Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 16 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By D.C. Ranatunga

Except for a casual reference in an interview with John Exter on the day he left Sri Lanka about his successor, ‘Central Bank Retrospect’ recording the bank’s history using newspaper clippings, has no mention of the new Governor.

It was considered a landmark event because a Sri Lankan (‘Ceylonese’) was being appointed to the high-ranking post for the first time. Deputy Governor Neville Ubesinghe Jayawardena (NUJ) succeeded Exter on 1 July 1953. After holding several posts in government departments, he was Controller of Exchange (1948) and Controller of Import and Exports (1949) prior to being appointed Deputy Governor in 1950 with the opening of the Central Bank.

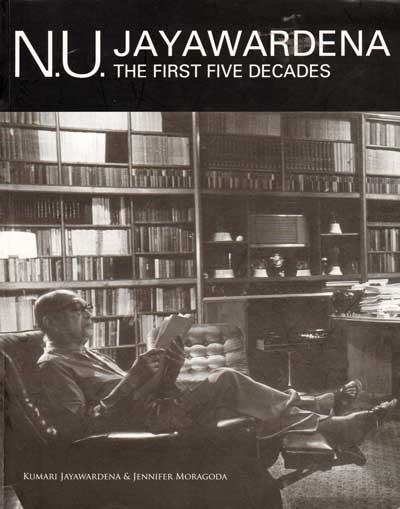

‘N U Jayawardena – The First Five Decades’ (Kumari Jayawardena and Jennifer Moragoda 2008) describes in detail his career in the Central Bank over the short by eventful period of around four years of which he was Governor for 16 months. His link to the bank started as a consultant during John Exter’s study on the setting up a central bank, when NUJ was Controller of Exchange. Exter had stated in his report that in studying Ceylon’s economic and financial problems, “I have drawn heavily upon Mr. N.U. Jayawardena’s unrivalled understanding of the operations of the Ceylon economy.”

When the Exter Report was debated in the House of Representatives, while MPs like Dr. N.M. Perera and Dr. Colvin R. de Silva argued that there were no Sri Lankans with proper qualifications to be Governor, Finance Minister J.R. Jayewardene and Trade and Commerce Minister C. Suntheralingam supported a Sri Lankan governor. In fact, Suntheralingam had gone to the extent of saying that one of the prime candidates should be NUJ. However, Exter was appointed governor and NUJ deputy.

After Exter departed, though there were many vying for the post of governor in “a heavily-charged atmosphere of speculation and suspense”, NUJ was appointed apparently on the recommendation of Exter. He was then 45 years old.

Hailing it as the crowning achievement of years of determination, hard work and sacrifice,” Kumari J and Jennifer M write: “His salary as Governor was Rs. 45,000 per annum, with an official house and car, and driver as well as an entertainment allowance. NU recalled that, when the first currency notes signed by him were issued, he sent a 50-rupee note, which bore his signature, to his father – the astonishing sequel many decades later to his childhood fantasy that one day he might achieve his ambition. Sadly, by this time NU’s parents were ailing, and both would die later that year.”

The biographers state that as Governor, NUJ proved to be a strict disciplinarian and a hard taskmaster. “He imposed on the staff all the office discipline and experience that he had absorbed in his years in government departments when he interacted with eminent British and local civil servants. But he also followed a harsh regime himself, working very long hours.”

While he was involved with many international meetings when he was Deputy Governor, he had a busy travel schedule after he became Governor negotiating a World Bank loan, attending the second and third annual International Monitory Fund (IMF) meetings in Washington DC in 1953 and 1054, negotiating a sterling loan in the UK, and attending the 1954 Commonwealth Finance Minister’s Conference in Australia with Oliver Goonetilleke (later Sir), who had succeeded JRJ as Finance Minister.

Allegations

It was not long after that newspaper headlines broke the news that NUJ was to face a Commission to inquire into his conduct as Governor. While the allegation was that he had taken loans for building his house from commercial banks and other sources while being Governor of the Central Bank, it was rumoured that it was an act of political victimisation on the part of Prime Minister Sir John Kotelawela.

It was reported that after the tussle to become prime minister after the death of D.S. Senanayake and Dudley Senanayake had become prime minister, Sir John (he was Minister of Transport and Works) had made an application to transfer a large sum of money to Britain for the purchase of property and that NUJ had not permitted it on the grounds that according to the Central Bank and Exchange Control regulations at that time the transfer of such a large sum was not allowed. Sir John had not taken kindly to NUJ’s rejection of his application to remit the money abroad.

The Commission of Inquiry comprising Justice A.R.H. Canakaratne, Justice H.A. de Silva and Sir Eric Jansz sat for 20 days when NUJ took up the position that, like any other citizen, he had the right to take loans from commercial banks, and that it did not compromise his position as Governor of the Central Bank nor jeopardise its interests. Lawyers D.S. Jayawickrema QC and G.T. Samarawickrema appeared for NUJ.

At the end of the sittings, the Commission held that NUJ’s actions were violations of the position he held. On the Commission’s verdict, NUJ was dismissed from the Central Bank on 15 October 1954. Sir Arthur Ranasinghe, Secretary to the Treasury, succeeded him.

The matter did not end there. At the general election that followed two years later, the UNP was defeated and Sir John was swept out of power. The Mahajana Eksath Peramuna won the election and its leader, S.W.R.D. Bandaranaike became prime minister.

A few months later, in January 1957, in a bid to clear his name, NUJ drafted a 17-page appeal to Governor-General Sir Oliver Goonetilleke protesting the “perverse” findings of the 1953 Commission of Inquiry. On 10 August 1957, the Governor-General’s office announced that NUJ has been exonerated. This followed an opinion sought from the Attorney-General, Noel Gratien QC who opined that an injustice had been done.

The announcement by N.W. Athukolare, the Secretary to the Governor-General stated: “I am directed by the Governor-General to inform you that the Prime Minister has carefully considered all the relevant material regarding this case, and is of the opinion that you, as Governor of the Central Bank, had not done any act or thing which was of a fraudulent or illegal character or was manifestly opposes to the objects and interest of the bank.”

In the meantime, six months after his dismissal, J H Vavasseur Trading Company, the British-owned company in Colombo handling the production of coconut products since 1864, appointed him as the joint managing director, the first Sri Lankan to get such a high post in a British company.

In 1956 NUJ formed Mercantile Credit Ltd. as a finance company, and also became Chairman of Wellawatte Spinning and Weaving Mills, the major shareholder of which was the Maharajah of Gwalior. He entered the political arena after his exoneration when Prime Minister Bandaranaike appointed him to the Senate in December 1957.

“This was just the beginning of a new life for N.U. Jayawardena, the pragmatist, man of action and visionary. He would soon dominate the private sector, providing the lead for its development. He was eager to create the institutions which would help stimulate the economy and take the country forward, For NU, this heralded a still newer phase in the world of business, a sector that had helped to develop during his many years in government service. He had, as one wag said, moved from ‘Resthouse to Bank House,’ and now became both the chief of a Financial House and a member of the ‘Upper House,’” the biographers wrote. (Reference to the ‘Resthouse’ was because NUJ’s father was resthouse keeper at Hambantota, his home town.)

NUJ’s crowing moment, in a way, was founding Sampath Bank in 1986, which has reached great heights in recent years.