Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 16 January 2019 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka is having three accountancy bodies, The Institute of Chartered Accountants of Sri Lanka (ICASL-www.casrilanka.com) which was founded in 1959 by Act of Parliament, Association of Accounting Technicians of Sri Lanka (AAT-www.aatsl.lk) which was incorporated in 1987 under the Companies Act and Institute of Certified Management Accountants of Sri Lanka (CMA-www.cma-srilanka.org) which was incorporated by Parliament Act in 2009.

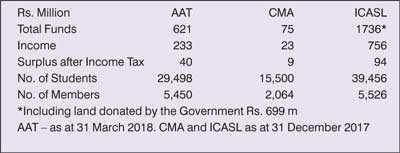

ICASL is the premier national accounting body in Sri Lanka and the authority in Sri Lanka for setting accounting and auditing standards in Sri Lanka. AAT focuses on producing middle level accountants and was incorporated to fill the gap in the market for them. CMA started its operations in 2000 under the name Society of Certified Management Accountants of Sri Lanka and was founded with the assistance of CMA-Canada in 2009 to meet the demand of management accountants created by the expansion of the industry. Considering the length of the operation of these institutes, all three are matured institutes and are member bodies of the International Federation of Accountants. Brief financial position of the three Institutes is given in the Table. In this short essay I would focus on governance and the education structure of these institutions.

Governance

Governing authorities are vested with the respective Councils of the Institutes. In ICASL, there are 16 members of the Council. Eight members are elected by the members of the Institute including the President and the Vice President and eight members are appointed by the Minister including the Auditor General and the immediate past president of the Institute. In CMA there are eight members of the Council. Five members are elected by the members of the Institute and three members are appointed ex-officio nominated by the President ICASL, Governor of the Central Bank and Head of the Department of Accounting at the University of Sri Jayewardenepura. In AAT there are 16 council members. Five members are elected by the members of the Institute, eight members are nominated by ICASL, one member each nominated by the Minister of Education and Minister of Finance. Immediate past President is also appointed to the Council. There are only two female members of these Councils at present and both are from AAT. CMA is having an advisory council as well as patrons. The operation of the Councils of all three institutions are in the same lines introduced by ICASL, which is the oldest among the three. Council is supported by various committees of which some are technical, and some are departmental. Members of the Councils as well as the members of the committees render an honorary service. Each committee is generally but not necessarily headed by a Council member. Committees are comprising of voluntary members of the institutes. The executives of the staff of the institutes of the related field of the committees also participate in these meetings and are acting as the respective secretaries of such committees in general.

The initial thinking of formation of these committees was to assist the respective Councils but over the time there may be a tendency of micro managing the Institutes by the committees. Moreover, most of the decisions whether those are strategic or operational are taken by the respective Councils since committees of the Councils have no formal authority to take decisions. They can forward their recommendations to the respective Councils. In the run there may be a tendency created that many operational level decisions are also taken by the respective Councils recommended by the respective committees. This eventually would take the times off form the respective Councils which are to be allocated for defining broad strategies of those Institutes.

These Institutes over a period evolved as educational institutions and surpassed their original mandates. Therefore, it may be necessary to have persons of different disciplines at very high levels to guide these institutes. If the Board of any listed company is comprising solely of accountants, for sure that company would end up in a disaster. CMA and AAT paved the way to appoint non-members to their Councils.

Over the time governing structures of other accounting bodies in many parts of the world were developed. Some of them have Boards of Directors operating under their Councils. The responsibilities of the respective Councils are mainly focused on formulating broad policy decisions and the respective Boards will have to implement those policies. For instance, The Institute of Chartered Accountants of England and Wales (ICAEW) defined the role of its Council as follows in three points. (www.icaew.com)

1.The Representative role – Ensuring the views across our profession are heard in helping to set the strategy;

2.The Holding to Account role – Upholding the public interest and holding the Board to account for the delivery of our strategic priorities;

3.The Approvals role – Approving annually the Operational Plan and Budget and satisfying itself that our Principal Risks are being addressed by the Board.

The council consists of up to 125 members that reflect the depth and breadth of the membership. The Board of ICAEW is responsible to council for planning and managing the affairs and business of the Institute. It does this in accordance with objectives, polices and budgets approved by the council. It is also responsible for resource management and coordinates the work of departments and committees. The Board of ICAEW is comprising of the president, the deputy president, the vice president, three chairmen of the technical boards appointed by the Council, three members who are elected from and by the Council, two independent non-executives and six members representing the management of the Institute including CEO and COO.

Therefore, the Board is represented by the Council, management and more importantly the two outsiders who can bring a wealth of experience in different disciplines.

American Institute of Certified Public Accountants (AICPA) and Institute of Chartered Accountants of Australia and New Zealand (CA-ANZ) are also having similar governance structures. CA-ANZ is in the process of redefining its governance structure.

In conclusion, local Institutes should focus on allocating more time of the respective Councils for defining broad policies, deviating from micro management and bringing in expertise in different disciplines. CMA and AAT have brought in the different disciplines, but it can be extended to various other important fields such as marketing. It is also important to focus on the independence criteria of the Council members where the Council should take decisions related to practical training of the students and provision of educational support to the students. Introduction of new governance structure altogether may be useful.

Education structure

The President of ICASL stated as follows in the Annual Report 2017 of the Institute: “Chartered accountants are considered leaders in the accountancy profession in Sri Lanka and also they are entrusted with the power to audit. In order to strengthen the profession we must bring management accountants of CMA and the accounting technicians of AAT into one fold. With this intention CA Sri Lanka will introduce the One Voice, One Profession initiative. Accordingly we plan to develop joint conferences, seminars and programmes in relation to professional development in the near future.”

The President of CMA stated as follows in the Annual Report 2017 of the Institute: “The diversification of the qualification to include the hospitality sector has added another dimension at the entry level and is anticipated to address the need of the hour for talent in the sector.”

There is a trend worldwide to have more affiliations among the professional accounting bodies. In most of the countries professional accountants will have to follow a general degree and then select to follow a professional accounting program. In Sri Lanka students can get enrolled in any accounting program conducted by any one of the Institutes without having a degree. The reason for this may have been the limited availability of university placements in Sri Lanka. As a result, there are several students who are unable to get enrolled at a university follow courses of either ICASL or CMA.

Some of them follow AAT course after their GCE ordinary level examinations. ICASL is presently conduct a degree programme of Applied Accounting approved by the University Grants Commission (UGC). It may be appropriate if all three Institutes get together and conduct a general degree program approved by UGC and it can be the entry qualification to ICASL and CMA. AAT course can be continued since the entry qualification is GCE O/L. At present there is a gap of the private sector requirements and the levels of the graduates produced by the universities.

This gap was wider sometime back and seems to be reduced based on various initiations taken by the universities. This suggested university degree program should be designed to cover not only accounting but also all the aspects required by the private sector organisations. Eventually this program can be the basic qualification to enter into various other disciplines such as marketing, human resource management and logistics. AAT can be given more responsibilities of this program and if necessary, the profits can be shared with other two institutions. The program should be affordable to average population.

One of the main problems of the education system of Sri Lanka is that the students are prepared mainly by the tuition masters for the exams and only for the exams. This approach prevents the students to be broad minded and have a broad knowledge base. In the private tuition classes approved by those three Institutes responsible for accounting education in the country, the same system of the schools is extended to a great extent. That is the demand from the students. Therefore, it will be an enormous task to break this pattern. Logistics would also be a great challenge. Campuses will have to be established in main cities. For this purpose, available infrastructure of technical colleges, government units such as vocational training centres can be used.

In conclusion by introducing a general management degree at an affordable rate the Institutes can secure the future of the students with an achievable final goal for all; direct the persons who need specialised knowledge to appropriate stream; secure a degree for all the future accountants; facilitate the requirements of the industry; and ease the burden of the Government in providing university education.

(The writer is a chartered accountant and holds an MBA from PIM of University of Sri Jayewardenepura. He was the director education, examinations and training at ICASL. He can be reached at [email protected].)