Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 27 April 2022 00:00 - - {{hitsCtrl.values.hits}}

By Arshad Ahamed and

Madusanka Prasad

Healthcare has been a sector where there has been little to no innovation in how its brands are taken to market, in the last two decades.

Yet there has been a significant increase in marketing budgets. Some industry experts estimate a circa 70% lift in marketing spending in the same period (Source: Journal of the American Medical Association, 2019).

Where is all this money going to? Pharmaceutical marketing has always been about the drugs and the prescriber first, and the patient second.

Marketing budgets are spent on presenting abstracts at large therapy-specific global conferences, on developing posters for display at said conferences, on elaborate stalls at conferences globally as well as locally, and of course on salaries paid to an army of medical representatives, also known as direct salespeople.

Some budgets are also allocated to the occasional sponsorship of an industry event, the newsletters of medical colleges, payments to doctors in exchange for their time and effort in speaking at industry events on behalf of pharmaceutical companies, and the occasional sponsorship of doctors to attend foreign seminars.

It’s all a bit old-school. Some might even say it’s outdated. Because it is.

Pharmaceuticals have been sold on a personal relationship backed by evidence that is delivered to the doctor at a one-to-one level. This is very effective, especially when delivered by med reps that have a good understanding of the therapy regime context that their drug sits in.

If they can articulate how the fundamental approach to treatment that they are promoting is better than the competition, half the battle is won. From there on it becomes less about competition from other molecules and more about the competition within. The latter is much more easily managed by commercial trade deals.

But it isn’t an ideal world, and the competition is high. 20 years ago, doctors gave med reps a good amount of their time, which allowed them to sell their story in its entirety, from therapy regime to drug efficacy.

Today it’s a different story. Doctors’ time is money and patients are impatient. A rep will have to spend hours in hospital waiting rooms to get a three-to-five-minute audience with them. It’s humanly impossible to sell the story in its entirety, face to face.

Even long before the pandemic, it was quite clear that the pharma sales force was experiencing a reduction of face time with healthcare providers. This was because of the expansion of the industry, with an increased number of reps per doctor, that medicines (molecules) in use are time tested and not driven by deep scientific conversations like how they used to be.

How do pharmaceutical companies put across why they believe in a path of treatment, explain the role their drug play in it, provide evidence of its efficacy, and finally explain why their particular brand is the best choice?

The short answer to this is by breaking the story up into pieces and delivering the right pieces through the right mediums to doctors and patients, at the right time, in the right places.

Easier said than done.

What is holding the pharmaceutical industry back?

Fundamentally, a lack of new-age marketing talent with the right mindset and skill set.

The reason is quite logical. The pharmaceutical industry attracts graduates of biosciences and pharmacology. Most stay within the industry and have gotten well-seasoned in the art and science of Med Rep delivered selling as described at the start of this article. Over time the marketing function is staffed with people whose skillset is firmly rooted in face-to-face selling.

The conventional model is so hardwired and the moment someone talks about digital innovation in pharma marketing, one of the biggest arguments put forward by pharma when attempting to take off on a digital journey is “what’s the ROI”? It is quite irrational that we worry about ROI at the conception of the digital journey, and we try to measure it through the same set of conventional KPIs we use for the Med Rep model.

No matter how hard we try to hold on to the conventional pharma model the world of mainstream marketing has changed beyond recognition. With digital devices becoming the way we live our lives, platforms such as social media, gaming, and over-the-top media becoming the new countries in which people live their lives, and the world’s increasing economic and time pressures, it is high time we evolved the way we market pharmaceuticals.

Doctors, just like everyone else, are people whose lives have permanently been altered by the digital revolution. They spend time browsing the web, reading blogs, watching cat videos, catching up on news in their friends’ circles, their communities, their countries, other countries, the world, and, most importantly, rely on their devices and the internet whenever they want to know something.

In short, that means doctors are no longer sitting around waiting for their Med Rep to come and tell them something new and/or answer questions that they have.

Patients, just like everyone else, are also people whose lives have permanently been altered by the digital revolution. They spend time browsing the web, reading blogs, watching cat videos, catching up on news in their friends’ circles, their communities, their countries, other countries, the world, and, most importantly, rely on their devices and the internet whenever they want to know something.

See where we are going with this?

As the sophistication of digital media and digitisation of life, in general, continues on, the needs of the HCPs become more complex. These needs range from remembering your brand to subscribing to your favoured form of treatment to trusting your manufacturing process to be armed with the correct arsenal of knowledge and awareness material to add value to the patient experience. To deliver on this need, the conventional one-size-fits-all med rep engagement is no longer sufficient. That is just one of many communication channels that HCPs are on. When a multi-channel engagement plan is required, delivering a sales rep experience is not enough to build HCP trust and loyalty.

Pharmaceutical companies in Asia have attempted to build a multi-channel marketing engine to serve relevant and timely content across multiple devices and platforms. Unfortunately, this has been marginally successful. Mostly because the ownership of delivery is placed on the Med Rep who has for decades relied on their instincts to build relationships with their HCPs.

It is unreasonable to expect them to master the intricacies of a multi-channel environment where the lines between offline and online and blurring at a rapid rate. It is an expectation that is completely unrealistic and borderline impossible to achieve with the complex matrix of channels, content, relevance, and frequency of interactions that must be managed.

There is also a general fear to risk disruption in the inflow of short-term sales, for long-term benefits and future sales.

What comes after is a sense of worry. The pharmaceutical industry lags other industries in Asia such as banking and FMCG in commercial transformation driven by digital technologies. Nobody is more aware of this than the pharmaceutical commercial engine itself. They fear lack of understanding, lack of talent, lack of processes, lack of data, and of course an actual lack of technology and infrastructure.

But the pharmaceutical industry has the right data in its possession. Sales data, HCP call cycle planning data, event participation data, etc.

So, what can the pharmaceutical industry learn from, say, banking?

Banking is an industry that is governed by strict regulatory frameworks similar to the pharmaceutical industry.

For day-to-day requirements, digital engagements are favoured over physical engagement.

Visits to branches first thing in the morning to arrange financial transactions for the day are a thing of the past. Now, digital banking products have taken over the daily transaction needs of consumers. The role of the branch now is to be more involved in transactions, financial planning, mid to long-term goal setting, relationship management, etc.

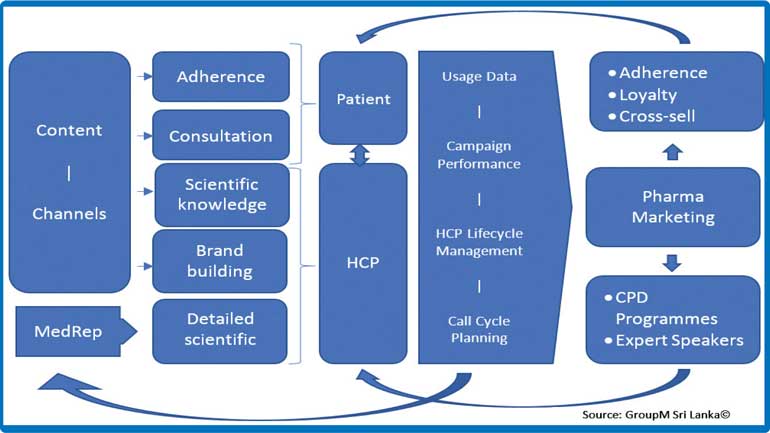

Similarly, for pharma, the Med Rep interaction should also be limited to a more high-level conversation. We are at no point undervaluing the contribution made by the Med Rep towards the commercial objectives of the pharmaceutical industry. We are elevating the role of the Med Rep, harnessing their true value and channelling it towards maximising their knowledge and time contributions. In other words, the Med Rep should be following up on multi-channel activities by picking up the thought-starter content and using it as fuel to create a richer 2-way conversation in line with both the HCP’s needs as well as the pharmaceutical company’s goals.

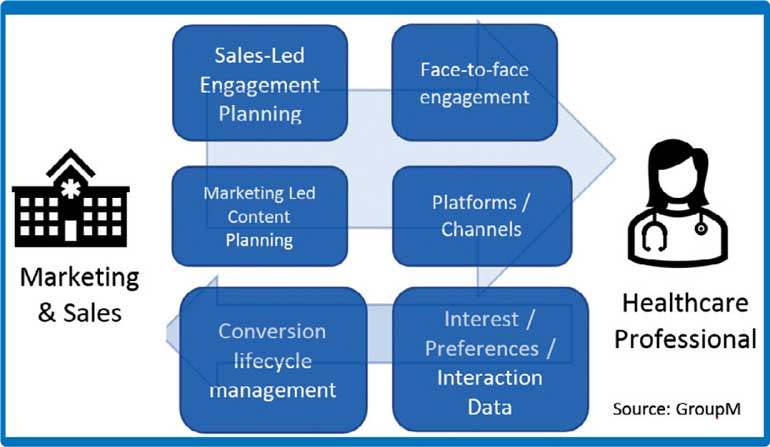

Sales and marketing: the interplay

The execution model should separate the ownership of content delivery from face-to-face relationship building. In Asia, where relationship building has a large personal element to it, the Med Rep needs to be allowed to harness their interpersonal skill set and instincts to build these relationships with their HCPs. Therefore, the responsibility to deliver the conversation-starting content, the fuel, at the right frequency through the right channels needs to be a back-end marketing function.

The quality of the engagement and ultimately its success of it can easily be measured using industry-standard metrics such as open rates, site visits, minutes viewed, completed views, event registrations, event participation, etc. This, coupled with a log of HCP sentiments recorded at the time of a physical visit to a pharmaceutical company a full picture of how well their content and engagements are being received by their customer.

All right, now what about the patient?

The patient, in this whole scenario, sits in a precarious position. The pharmaceutical company is not allowed to market to them directly. Even if they were, the patient may very easily misinterpret the information and cause harm to themselves. But there are still things that patients need to be made aware of. Some of these are not restricted by pharmaceutical marketing regulations.

These include how to use devices such as inhalers, and an understanding of a therapy area and/or symptoms and what they could potentially mean.

All of these can be considered as ways to identify and manage your conditions and seek professional medical advice. In other words, it is a business development exercise that pharmaceutical companies do on behalf of healthcare professionals be it doctors, nurses, hospitals, or pharmacies.

It’s not just that though, it is a genuine way of creating awareness for conditions that may be underdiagnosed and/or mismanaged.

In that sense, there is a great responsibility on the shoulder of pharmaceutical companies to ensure that their patient awareness campaigns are done in a way that maximises the reach of the campaign, and also maximises conversion from awareness to adherence and consultation.

Redefining the Med Rep

In the spirit of alleviating human suffering and prolonging healthy life, it is the pharmaceutical industry’s responsibility to operate in a way that makes the HCP-Patient relationship richer while achieving its own commercial goals.

By elevating Med Rep’s role to that of owning detailed scientific engagements with HCPs, they can focus on using their knowledge of pharmacology, interpersonal skills, intuition, and selling skills to build mutually respectful, well-managed relationships.

To ensure that the relationships are in fact well managed, the Med Rep is fed with a steady stream of data, delivered via simple dashboards and trend lines, showing them which subject matter is gaining the most traction amongst HCPs and patients. Together with central marketing teams, the pharmaceutical company’s Salesforce can create physical and virtual scientific engagement events that are carefully curated to ensure maximum relevance to the HCP, impact on the therapy area, and alignment to their commercial objectives.

Meanwhile, the pharmaceutical company is armed with the market insight to experiment with models like adherence-based sales promotions, loyalty programmes, e-commerce, and cross-selling with neutraceutical and other OTC products.