Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 6 January 2016 00:00 - - {{hitsCtrl.values.hits}}

Our stable outlook, in place since July 2014, reflects our expectations that the operating environment for banks in Sri Lanka will remain healthy and that asset quality and profitability will be stable over the next 12-18 months, offsetting some moderate deterioration in funding and liquidity.

The operating environment will remain healthy. While slowing somewhat compared to 2013-14, GDP growth rates in Sri Lanka will remain robust; we expect annual growth of 6.7% over 2015-16. An accommodative monetary policy supports the growth outlook. In addition, investments are likely to have more participation from the private sector, compared with the public-sector-led approach of the past few years, a shift which should provide an impetus to loan growth.

Asset quality will continue to stabilise. The gross nonperforming loan (NPL) ratio has improved over the past 18 months, coming down to 4.0% in September 2015 from 5.6% in December 2013. Problems in the pawning sector – the key reason for the pick-up in NPLs in the recent past -- have been addressed. At the same time, banks’ underwriting standards have been fairly tight over the past two years, as reflected in only moderate loan growth in 2013-14 even as the economy was growing rapidly.

Profitability will be stable overall. On the one hand, net interest margins (NIMs) will remain under pressure, primarily due to the low interest rate environment. On the other hand, have Sri Lankan banks have already made significant investments in their branch networks and personnel in recent years, so faster loan growth will lower their cost-to-income ratios. Some banks will also benefit as elevated credit costs associated with pawning NPLs are no longer required.

Funding and liquidity conditions will tighten. The current level of liquidity in the system is adequate with the statutory liquidity ratio in the domestic book at 36%. However, liquidity should tighten over the outlook horizon, as we expect annual loan growth of around 20%, faster than deposit growth of 16%. This should put pressure on the banks’ funding profiles as they will need increase their dependence on more expensive sources of borrowing, including foreign-currency borrowings.

Sri Lanka has a track record of providing systemic support to banks when needed.

We assume that such support would be forthcoming, if required. Sri Lankan banks need to comply with Basel III capital norms, as well as liquidity coverage ratio (LCR) norms, from January 2016 onwards.

Our stable outlook for the Sri Lankan banking system is consistent with our stable outlook on the Sri Lankan government’s B1 rating

See Exhibit 1 and 2

Rating universe

We rate two banks in Sri Lanka that accounted for about 29% of system assets as of June 2015 (see Exhibit 3). The 10 largest banks together represent 86% of banking system assets. The two rated banks have baseline credit assessments (BCA) of b1, which is in line with the sovereign long-term rating. Their foreign currency deposit ratings are capped at B2, the Sri Lanka’s foreign-currency deposit ceiling.

See Exhibit 3

Operating environment

The operating environment for Sri Lankan banks will remain healthy in the next 12-18 months. We expect real GDP growth of 6.8% in

2015 and 6.5% in 2016, which would be slower than the 7.4% growth seen in 2014 but still quite robust in absolute terms (see Exhibit 4).

See Exhibit 4

An accommodative monetary policy should further support the growth outlook. A significant moderation in inflation over the past two years provided scope for the central bank to cut policy rates by 50 basis points in April (see Exhibit 5). We do not expect further cuts as stabilisation on the external front receives policy priority, but interest rates will remain low.

See Exhibit 5

In terms of the composition of growth, especially in terms of investment, we expect greater participation from the private sector.

Under the previous government, the public sector played a key part in many of the newly initiated infrastructure projects, with most of them being financed through either the government’s own balance sheet or through bilateral financing. With the change in government this year, we expect a greater emphasis on private-sector participation. This should support loan growth.

External vulnerabilities represent the key risk to the operating environment. Sri Lanka has been running a persistent current account deficit for the past few years (see Exhibit 6). While the recent decline in oil prices is a positive factor for the country’s current account, we expect it to remain in deficit at around 3% of GDP in 2016. The capital flows needed to finance the current account deficit have been dominated by portfolio flows. A slowdown or a reversal of these portfolio flows represents a key risk to the operating environment, and would manifest in the banking system through a tightening of domestic liquidity.

See Exhibit 6

Moderate loan growth over the last two years should support asset quality.

Asset quality has been stabilising over the past year, with the gross NPL ratio as of September 2015 at 4.0%, much lower than the 5.6% at the end of 2013 (see Exhibit 7). The decline in the NPL ratio has been primarily on account of an improvement in the asset quality of the pawning portfolio. Pawning, or loans with gold taken as collateral, saw significant deterioration in asset quality over 2012-14, driven by a decline in gold prices as well as weak underwriting standards. Since then, however, banks have taken corrective action, including significantly reducing the pawning portfolio. These measures have led to an improvement in pawning asset quality, and consequently an improvement in the overall portfolio.

See Exhibit 7

While loan growth, which was fairly subdued in 2013 and 2014, has picked up in 2015 (see Exhibit 8), the faster growth has been driven to a large extent by increased leasing loans, which reflect recent favorable changes to the tax structure1 on car imports and not any particular loosening of underwriting standards by banks.

See Exhibit 8

In addition, the financial health of corporates has remained fairly stable. While the aggregate corporate debt-to-equity ratio has picked up a bit in FY15 after declining in the prior two years, it is still below the levels seen before FY13 (see Exhibit 9). This reflects the fact that a large part of the investment growth in the past few years has been from the public sector.

See Exhibit 9

On the other hand, economic growth is slowing at the margin, with GDP growth over 2015-16 expected to be around 6.7% compared to 7.5% in 2013-14. In particular, prices of some agricultural commodities like tea and coffee, which are key parts of the Sri Lankan economy, have been seeing some weakness. This could put some mild pressure on asset quality.

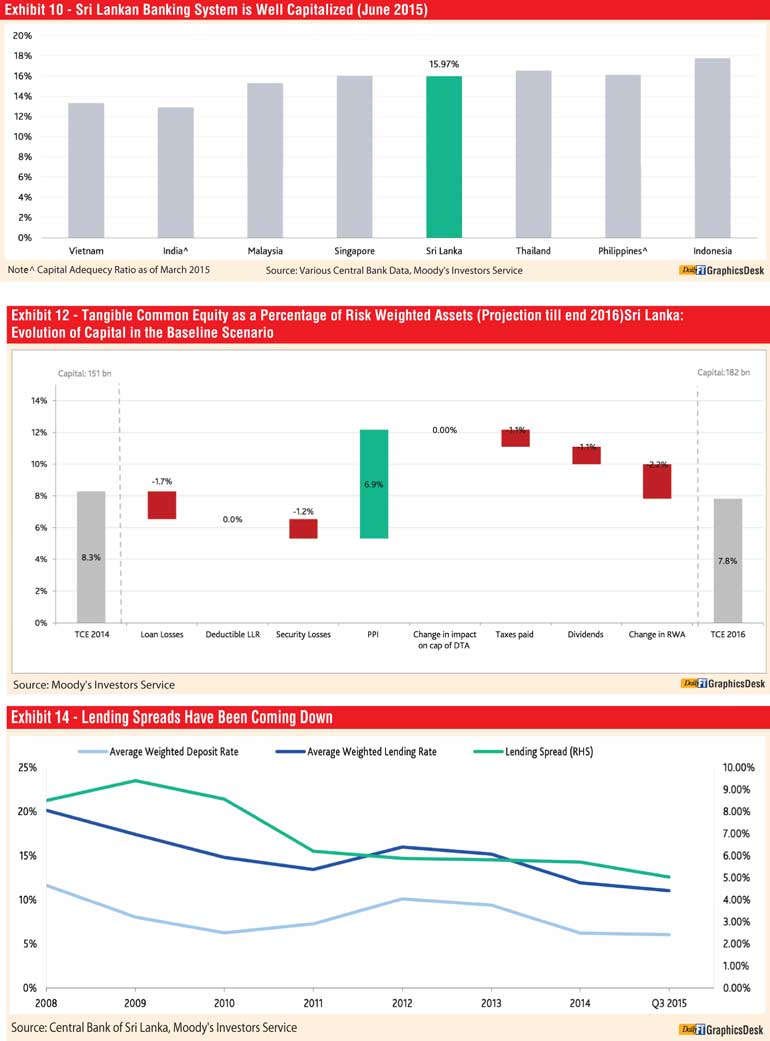

Sri Lankan banks have moderate buffers in place to withstand asset-quality stress; the system-wide capital adequacy ratio was 16% as of March 2015 (see Exhibit 10). In addition, profitability is strong enough to support higher credit costs, acting as a buffer as well (see Exhibit 11).

See Exhibit 10 and 11

Forward-looking solvency analysis

Base expectations: stable capital

Under our baseline (or most likely) scenario, we expect the system-wide capital ratio to remain fairly stable over a two-year horizon, i.e. up until end-2016 (see Exhibit 12). Pre-provision profitabililty is more than sufficient to absorb expected credit costs and assumed losses on securities (most of which are related to the sovereign and therefore driven by the expected loss rate equivalent to its B1 rating), though remaining profitability is absorbed by expected growth in risk-weighted assets.

See Exhibit 12

Stress scenario: severe impact under stressed conditions

We also consider an alternative “stress scenario”. This is not our baseline expectation but a measure of the capacity of banks to withstand such stressed conditions. They thus inform our opinion on the creditworthiness of the system as a whole. The results of our stress scenario on the Sri Lankan financial system show that the impact would be severe, leaving the system with negative capital at the end of the two-year horizon, compared to 8.3% of RWAs at end-2014 (see Exhibit 13). In addition to higher loan losses, the assumption of severe losses on banks’ holdings of government securities leads to this outcome.

See Exhibit 13

Profitability and efficiency

Profitability will remain stable over the next 12-18 months, as moderate pressure on NIMs will be compensated by higher operating leverage and lower credit costs.

Lending spreads have been narrowing (see Exhibit 14) as interest rates fall because the rates the banks pay on current and savings accounts (CASA) have remained sticky as lending rates decline and because high-yielding pawning loans have become a smaller portion of the overall loan book. As loan growth picks up, the share of term deposits in overall deposits should increase, putting further pressure on NIMs. On the other hand, we expect the share of pawning loans to stabilise at current levels, which is a positive for margins.

See Exhibit 14

At the same time, Sri Lankan banks have already made significant investments in their branch networks and personnel in recent years and are unlikely to increase such costs further over the outlook horizon. Hence, as loan growth picks up, banks can benefit from increased revenues without a corresponding increase in operating expenses as existing infrastructure can support the growth. This should lead cost-income ratios to decline (see Exhibit 15).

See Exhibit 15

In addition, some of the banks could lower credit costs as the elevated credit costs of the past few years related to pawning will not recur.

Funding and liquidity

At present, liquidity levels in the Sri Lankan banking system are adequate with the statutory liquidity ratio in the domestic book at 36% as of June 2015, above the minimum requirement of 20%. However, with loan growth picking up, we expect funding conditions to tighten because banks will need increase their dependence on more expensive sources of borrowing, including foreign-currency borrowings. There are already signs of this; the system-wide loan-to-deposit ratio (LDR) rose to 91% as of September 2015 compared with 84% a year earlier. (Exhibit 16)

Over the past decade, in most of the years, loan growth has outpaced deposit growth in Sri Lanka (see Exhibit 17), reflecting the gap between domestic savings and investment rates (see Exhibit 18). In the next 12-18 months, we expect this pattern to continue, with loan growth of around 20% and deposit growth of 16-17%, in line with the pace seen over the past five years.

See Exhibit 17 and 18

The gap between loan growth and deposit growth can be resolved in two ways: first, as seen in 2013, a period of very strong loan growth leading to rising LDR is likely to trigger macroprudential measures from the central bank aimed at slowing down credit expansion. However, this is not our base case in the next 12-18 months.

Second, banks in Sri Lanka have been increasing their use of foreign funding sources. Over the forecast horizon, we expect the share of foreign-currency borrowings to increase from around 12% as of June 2015 (see Exhibit 19), which is credit negative. Not only are these mostly wholesale sources of funding, which are vulnerable to changes in sentiment, but the hedging requirements on such borrowings are not as stringent in Sri Lanka as they are in most of the other Asian banking systems. However, we expect the increase in foreign funding to be relatively moderate.

See Exhibit 19

Government support

We expect that government support of individual banks would be forthcoming, if needed. The banking system is sizeable, with system assets at 68% of GDP and is considered by the government to be of high importance to support economic growth. We note, however, that the government’s capacity to support the banks with new capital is only moderate, as highlighted by the country’s fiscal constraints and budget deficit. In this context, liquidity support from the central bank will likely be the preferred support mechanism for the banks in case of need. Sri Lanka has a track record of providing systemic support to banks when needed. When privately owned Pramuka Savings and Development Bank failed in 2002, the government transferred both its assets and liabilities to a new state-owned bank. And when Seylan Bank (unrated), also privately owned, faced a run on its deposits in 2008 due to liquidity concerns at an affiliated corporation, the central bank asked Bank of Ceylon to provide liquidity support until Seylan raised fresh capital. The central bank has also had to deal with several instances of liquidity stress at non-bank financial institutions. In 2010, it introduced a deposit insurance scheme and currently around 90% of the rupee value of the systems’ deposits are insured.

Sri Lankan banks will be on Basel III capital norms from January 2016. In addition, banks have already begun to comply with liquidity coverage ratio norms since 1 April 2015.

Sri Lanka does not have any plans to adopt a statutory bail-in regime that would allow loss burden sharing among creditors.