Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 5 January 2016 00:01 - - {{hitsCtrl.values.hits}}

By Forbes and Walker Tea Brokers

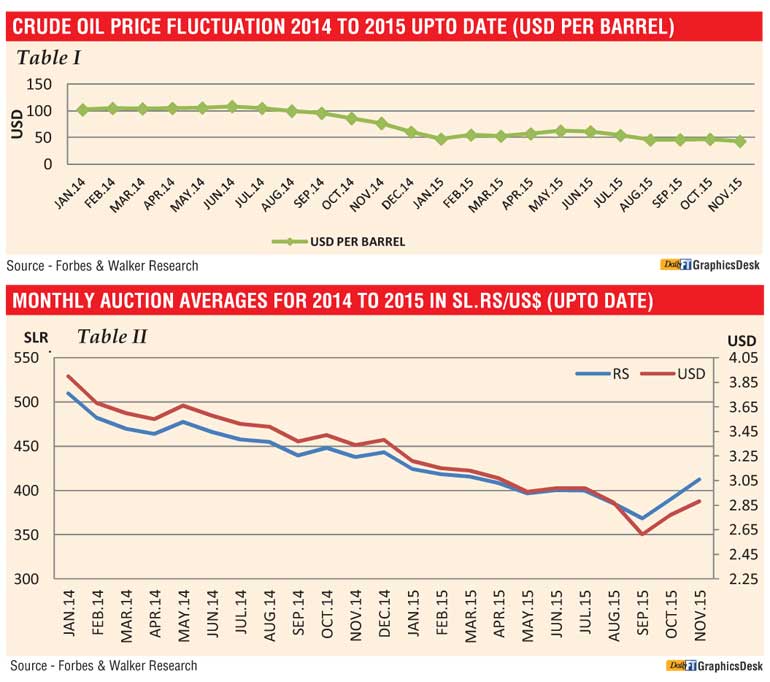

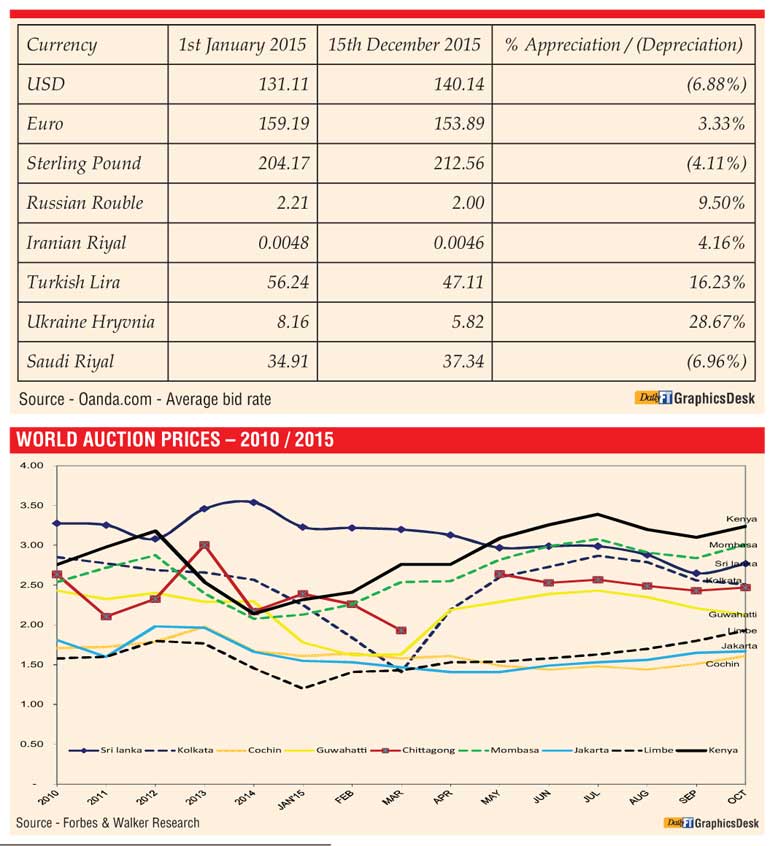

Year 2015 will go down in history as one of the most challenging years for the tea industry. On the one hand the Middle Eastern region where the bulk of our teas is exported never recovered from the socio economic unrest. In fact conditions deteriorated even further resulting in at times restricting exports to the region. On the other hand destinations such as Russia, Ukraine and Turkey were faced with many economic challenges which led to currencies being constantly devalued thus impacting prices at the Colombo auctions.

Hence the smooth run experienced by the tea industry since 2012 YOY where there was a growth in auction averages, earnings from exports and growth in production to a lesser extent etc., is unlikely to be achieved this year. By evaluating the current available statistics only production will get somewhat closer to the corresponding year’s level whilst revenue from exports and auction prices will fall well short of last year’s levels.

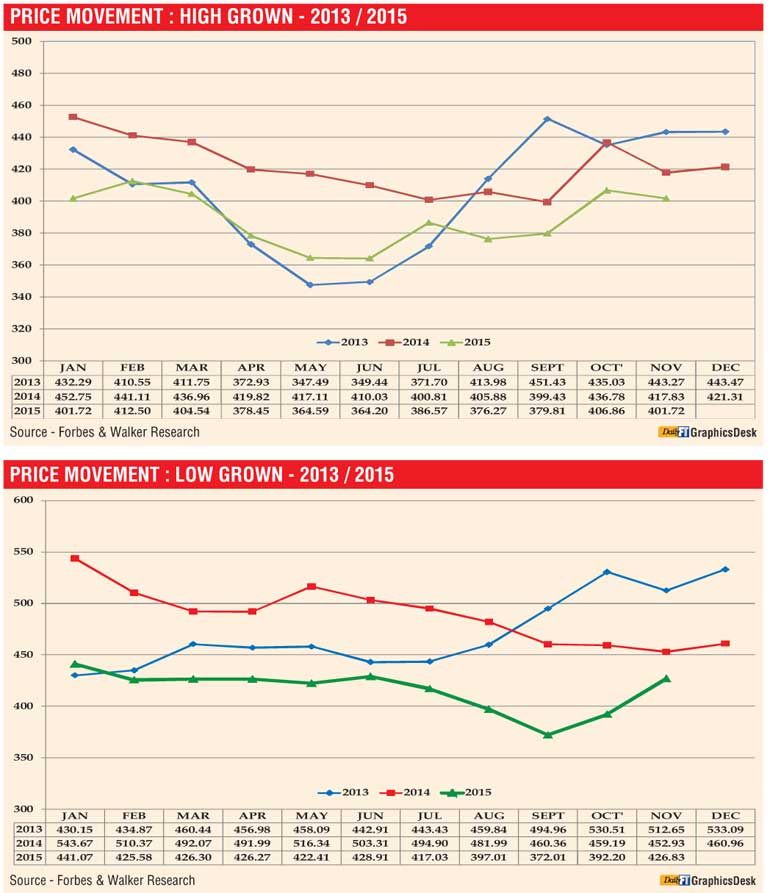

The First Quarter commenced with auction volumes reaching 7m/kg which showed a gradual increase to reach around 7.2-7.3m/kg by end January. Thereafter with dry weather being reported from most planting districts coupled with the onset of the quality season auction volumes showed a decline. Consequently quality from the High and Medium Grown areas showed an improvement particularly from Western and Nuwara Eliya districts. Seasonal quality teas from the Westerns were available by mid-February resulting in more activity at the auctions with a fair number of invoices attracting special/air mail inquiry. However the overall season was a disappointment as there was less activity towards mid-March following quality.

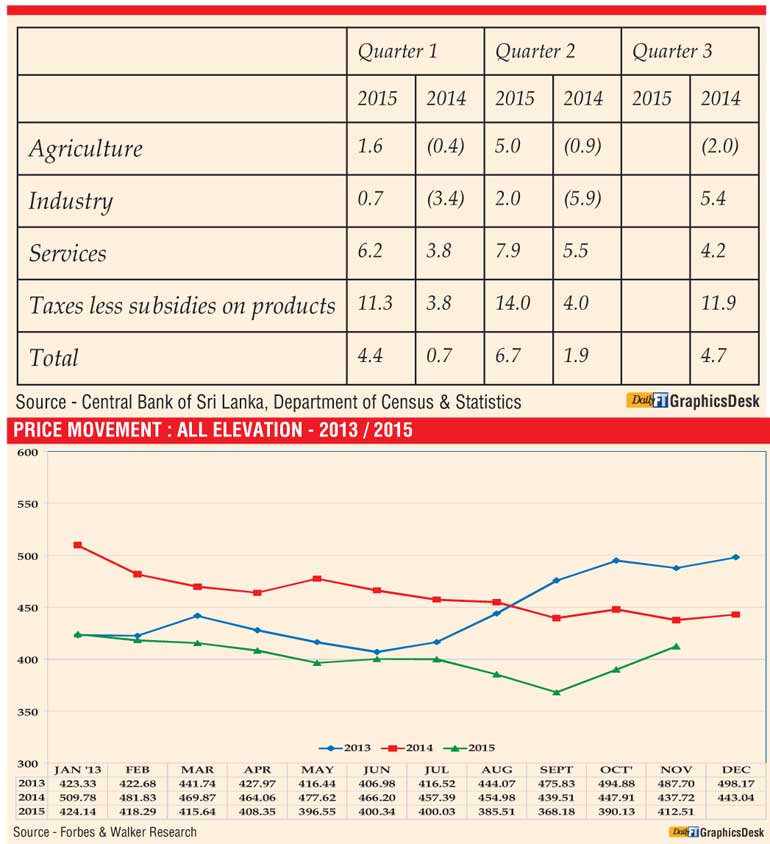

Meanwhile Nuwara Eliya together with a fair selection of liquoring Leafy teas attracted good demand and prices for these teas gained sharply. Uva/Udapussellawas too which gathered momentum by mid-February started to ease off towards the end of the quarter, consequent to the availability of high volumes of average teas. Low Grown prices which was a concern during the last quarter of 2014 continued to decline. Both Leafy and Tippy varieties kept on declining and by the end of the 1st quarter Low Grown prices were approx. Rs. 100 per kg below the corresponding levels. This trend pushed the auction averages down by the end of the quarter to Rs. 419.04 showing a decrease of Rs. 67.61 vis-à-vis Rs. 486.65 of January-March 2014.

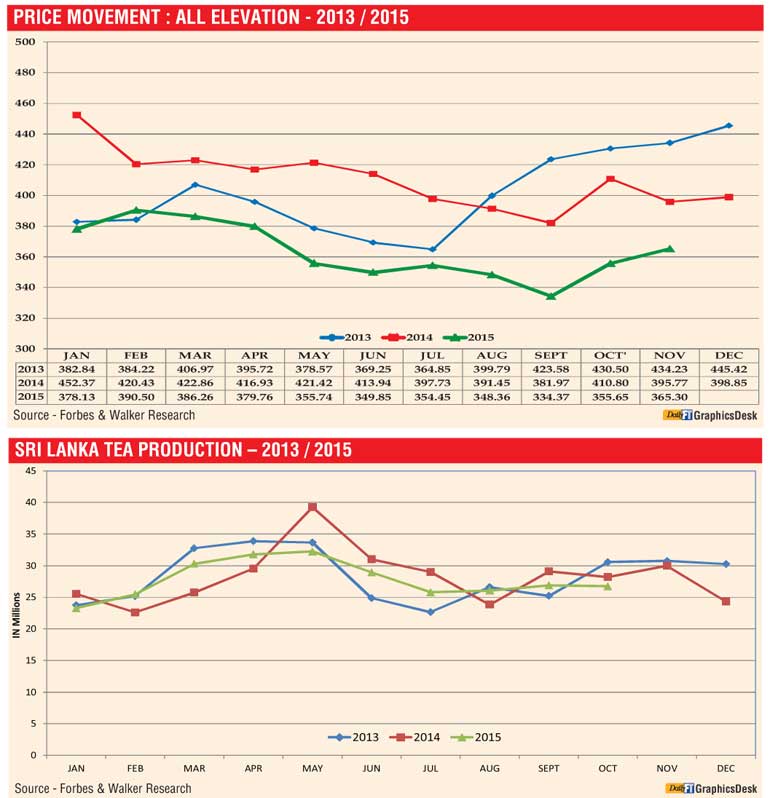

Meanwhile 1st quarter production for 2015 totalled 78.9 m/kg vis-à-vis 73.7 m/kg of 2014 showing an increase of 5.2 m/kg. All elevations recorded a growth YOY.

Exports, however, totalling 73.2 m/kg have shown a decrease of 2 m/kg vis-à-vis 75.2 m/kg YOY for the 1st quarter; in value terms too total revenue of Rs. 44.3 billion realised show a decrease of Rs. 6.2 billion vis-à-vis Rs. 50.5 billion of 2014.

The Second Quarter commenced with auction volumes maintaining over 7 m/kg with high volumes being harvested during this period. By May auction quantities showed a further increase with volumes reaching over 7.5 m/kg. Meanwhile quality on offer showed a decline resulting in large volumes of average teas being offered from the High and Medium grown elevations. Hence prices for BOP/BOPF continued to decline particularly for the poorer sorts. By mid-June with quality improving prices too commenced to strengthen. The availability of the better made BOP/BOPF from High and Medium elevation too saw prices improving. Liquoring Leafy types continued to attract premium prices although levels were slightly lower to the first quarter.

Low Growns continued its dismal run with prices decreasing from the inception of the second quarter. This was quite evident particularly for the small leaf varieties. By mid-June OP/OPAs together with PEK/PEK1s witnessed an increase in demand which saw the Low Grown average move up marginally. Other grades such as FBOP/FBOPF1s continued to decline. By the end of the second quarter auction averages for the period January-June 2015 declined to Rs. 409.68 showing a decrease of Rs. 67.87 vis-à-vis Rs. 477.55 of the corresponding period of 2014. Here again the steepest decrease was in the Low Grown category.

Second quarter production totalled 92.9 m/kg showing a decrease of 6.8 m/kg vis-à-vis 99.7 m/kg of the corresponding period of 2014. Low Grown production during this period showed a fairly significant decrease whilst High Grown and Medium Grown production showed only a marginal decrease. January-June cumulative production too of 172.6 m/kg for 2015 showed a decrease of only 1 m/kg vis-à-vis 173.6 m/kg of 2014. Here again Low Grown/ High Growns show a decrease whilst Mediums have shown a marginal gain.

Second quarter exports totalled 78.3 m/kg showing a decrease of 3.8 m/kg vis-à-vis 82.1 m/kg of 2014. In value terms too total value of Rs. 46.3 billion realised during the quarter showed a fairly substantial decline of Rs. 7.1 billion vis-à-vis Rs. 53.4 billion of 2014. On a cumulative basis too for the period of January-June total exports of 151.5 m/kg showed a decrease of 5.8 m/kg vis-à-vis 157.4 m/kg of 2014 and the total revenue realised of Rs. 90.7 billion showed a decrease of Rs. 13.2 billion vis-à-vis Rs. 104.07 billion of January-June 2014.

Third Quarter auction volumes which continued to be over 7 m/kg at the commencement declined in August and September. This was mainly due to trade union activities that disrupted the normal work particularly in the High and Medium grown regions. This also led to restricted volumes being offered at the auctions which in turn propelled the prices of BOP/ BOPF to attractive levels. By this time Uvas too brightened up and seasonal quality teas were on offer.

Although the season was a disappointment a range of teas attracted special inquiry and were able to secure attractive prices. Liquoring Leafy varieties which had a good run in the 1st and 2nd quarters met with less demand. Long prices realised for these teas declined and hence did not enjoy the premium over the other Leafy teas. Prices of Low Grown teas meanwhile did not show any change in trend. In fact 3rd quarter prices have been the lowest so far this year. By August Low Grown average declined to Rs. 397.01, the lowest since March 2012.

During this period a high percentage of teas remained unsold due to lack of demand. By end September total auction average was Rs. 401.08 showing a decrease of Rs. 66.60 vis-à-vis Rs. 467.68 of the corresponding period of 2014. Once again Low Grown prices showed the highest variance and were the main contributor to this substantial variance in average.

During the 3rd quarter of 2015 production totalled 78.7 m/kg showing a variance of 3.2 m/kg vis-à-vis 81.9 m/kg of 2014. Low Grown production during the period under review showed a decrease YOY whilst High Growns and Medium Growns showed a marginal increase. Analysing January-September production of 252.6 m/kg for 2015; shows a decrease of 2.9 m/kg vis-à-vis 255.5 m/kg of January-September 2014. By the end of the 3rd quarter only Low Growns have shown a decrease YOY, whilst, High Growns have remained static and Medium Growns have shown a growth.

Exports during the 3rd quarter totalled 74.5m/kg once again showing a fairly substantial decrease of 9.3m/kg vis-à-vis 83.9m/kg of 2014. A total revenue too of Rs. 43.9 billion realised showed a decrease of Rs. 10.6 billion vis-à-vis Rs. 54.6 billion of 2014. January-September exports totalling 226 m/kg, showed a substantial decrease of 15.2m/kg vis-à-vis 241.3 m/kg of 2014. In value terms too total revenue realised Rs. 134.7 billion showed a significant decrease of Rs. 23.9 billion vis-à-vis Rs. 158.7 billion of 2014.

The 4th Quarter auction quantities maintained over 6.5 m/kg. Quality on offer from High and Medium grown elevations showed an improvement during the early part of October. Demand for BOP/BOPF too improved resulting in prices gaining over the closing levels of the third quarter and BOPF enjoyed a premium over the corresponding BOPs. This trend could be attributed to “Ceylon’s” being good value consequent to the sharp increase in prices for African teas at the Mombasa Auction commencing around May 2015.

Prices for liquoring Leafy varieties too once again improved with a few teas from the Medium Grown areas gaining substantially. Uva/Udapussellawa BOP/BOPF particularly the cleaner sorts met with better demand and prices commenced to strengthen. From around early October Low Grown prices too strengthened. Small leaf varieties commenced to attract better demand and by mid-November prices for most grades gained significantly which resulted in the November average reaching Rs. 426.83 from Rs. 392.20 in October 2015. Leafy teas from High and Medium elevations followed a similar trend.

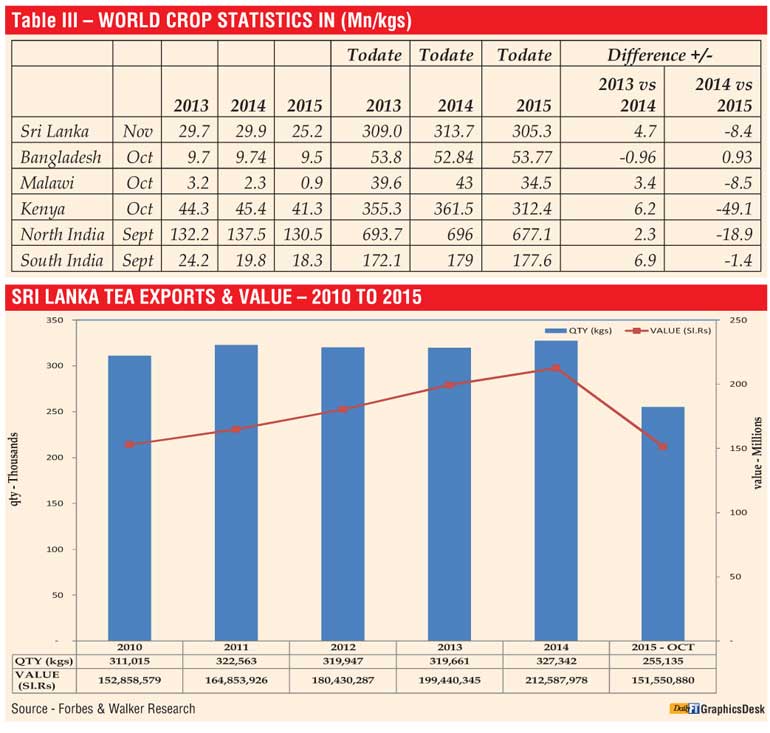

Due to this turn around in prices total auction average by end November reached Rs. 412.51 vis-à-vis Rs. 437.72 of November 2014 showing a negative growth of only Rs. 25.21. Low Grown YOY negative variance too by this time narrowed to approx. Rs. 26 which is a significant improvement compared to Rs. 100 recorded at the commencement of the year. According to the latest available figures January-November 2015 crop figure of 305.3 m/kg shows a decrease of 8.4 m/kg vis-à-vis 313.7 m/kg of 2014. Hence 2015 production too will fall short of 2014 levels.

Meanwhile total exports for the period of January-October 2015 of 255.1 m/kg, show a decrease of 13.5 m/kg vis-à-vis 268.6 m/kg of January-October 2014. It is relevant to note however that total revenue realised for the period of Rs. 151.1 billion show a significant decrease of Rs. 24.7 billion vis-à-vis Rs. 176.2 billion of January-October 2014. Therefore it is very unlikely that we would surpass last year’s total of Rs. 212 billion which is the highest ever.

Synopsis of the Tea Industry 2015 Prices

Exports

Revenue

Production

Sri Lanka Macro

Economic Update 2015

Sri Lanka ushered in 2015, with the election of a new President and Government on 8 January 2015. The new Government brought about some changes to the economy by their interim budget presented on 29 January 2015. However, the future direction was clearly spelt out only by October (by the Prime Minister) and November (by the Finance Minster) 2015. The impact of these will be seen only in 2016.

Economic growth

The economic growth as measured by the percentage increase in the gross domestic product (GDP) was around 5.3% for the first two quarters of 2015. This is in contrast to the growth of 4.5% for the entire 2014. What is significant is the quarter on quarter improvement over 2014 in each sector. It should be noted that the computation of the GDP figures were amended in January 2015 and therefore the 2014 figures we reported in our last report have been restated.

Inflation:

The inflation for the 12-month period ending October 2015 was recorded at 0.7% against 3.8% in October 2014. There has been a steady month on month decline in inflation in the country. From a high of 6.5% in January 2014 it came down to 3.2% by January 2015. Thereafter we have seen the rates decline further to the decimal point level of inflation for the past two months. Historically 2015 has been a year with one of the lowest levels of inflation in the country.

Interest rates

The prime lending rates and treasury bill rates have seen an upward movement in 2015. The one year treasury bill rate which was 6.05% in January 2015, increased to 7.06% by October 2015 (6.00% in October 2014) The average prime lending rates by banks too increased from 6.43% to 7.24% within the 10 months of this year.

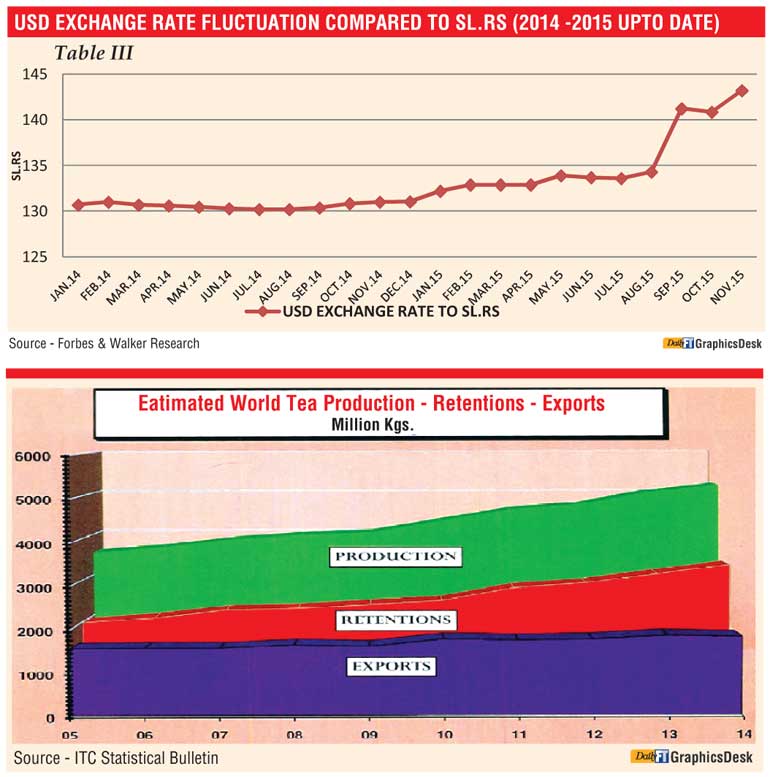

Exchange rates

The Sri Lankan Rupee (LKR) depreciated against the USD and the GBP during the year. However, it is noteworthy that the LKR appreciated against most of the currencies in the tea drinking world.

Outlook for 2016

Projecting a possible market outlook for the year ahead would no doubt have a strong element of ‘crystal ball gazing’ more so due to the turmoil in Sri Lanka’s main tea export markets and the drastic currency depreciation in these markets as well. On the supply side, global tea production up to end of the 3rd quarter and the forecast for the last quarter, estimate a global crop deficit of 80-100 m/kg with the dawn of the New Year. A significant feature would be the sharp decrease in production of approximately 50 m/kg from Kenya (primarily CTC teas) and India recording a shortfall of approximately 20 m/kg and to a lesser extent Indonesia, Malawi and Sri Lanka.

From a Sri Lankan perspective, an important factor in the supplier equation is that Orthodox tea which accounts for 90% of our total tea crop would record a decline of approximately 8 m/kg (2.3%) compared to 2014. However, tea production in 2016 is also unlikely to record any appreciable change in the back drop of the likely change in the fertiliser policy. From a global angle, rising concerns of an El-Nino impact would also warrant due consideration.

The global commodity crisis emanating from political issues between Russia/Ukraine, turmoil in the Middle Eastern markets (decline in oil and gas prices – which is the lowest since Jan/Feb 2009), drastic currency depreciation in key tea importing countries, economic sanctions etc. affected the Colombo tea market in particular and to a lesser extent demand for tea in general during the year 2015. Consequently, tea prices particularly in Colombo which reached a record high in 2014 ended the year substantially weaker. In fact, the Colombo Auction average for the calendar year 2015 is approximately Rs. 62 lower than the corresponding average in 2014.

The decline in US Dollar terms would record an even sharper decline compared with 2014 following the devaluation of the Sri Lankan Rupee against the US Dollar during 2015. This brings in to focus the sharp decline in Auction averages brought on essentially by economic and political issues in Sri Lanka’s key tea exporting markets which mostly impacted Sri Lanka’s Low Grown teas.

On a positive note, a turnaround in Auction averages is recorded particularly during the last quarter which could be correlated to the depreciation of the Sri Lankan Rupee. However, the full impact of the currency advantage is not reflective as we have seen in the past possibly due to the continued weakening of crude oil prices.

Under normal circumstances in the back drop of approximately 80 m/kg tea shortfall, the year 2016 would have commenced with buoyant prices. However, in this instance, the weak Russian Ruble, Regional turmoil in the Middle East, drastic currency depreciation, economic sanctions etc. continues to prevent the optimism. In this back drop, China becomes an important destination for growth. Currently, other than Japan, all other major tea importers among the top 10 importers rely on oil and gas for the stability of their economies. Therefore, with crude oil prices between $ 40-45 a barrel, a buoyant market forecast for 2016 may be optimistic. In this background, the following factors would be significant in projecting a market scenario for 2016:

2016 would begin with a shortfall of approximately 80-100 m/kg.

The steady growth in tea consumption in tea producing countries itself thus reducing the export availability.

The global tea production during the first quarter is generally the lowest during a calendar year on account of the dry weather conditions experienced in most producer countries.

A further important factor is that the quality of offerings during the first quarter from Sri Lanka, India and Kenya is fairly useful with Sri Lanka experiencing its Western ‘Quality’ season.

We also expect fair market activity from most importing countries as price levels are the lowest since 2012. Competitive prices, coupled with low quantities should stimulate additional demand in general during the first quarter.

Successful government to government negotiations with Iran could very well be a silver lining for Ceylon Tea during 2016.

With low crops worldwide, it is fairly conclusive that prices during the first quarter would continue to be satisfactory in most of the major Auction Centres and Colombo in particular, notwithstanding the current global issues that are adversely impacting on the tea industry. In fact, Colombo could record an appreciation on current levels particularly if the Sri Lankan Rupee would continue to depreciate against the US Dollar as the year progresses.