Friday Mar 13, 2026

Friday Mar 13, 2026

Saturday, 9 December 2017 00:00 - - {{hitsCtrl.values.hits}}

Sydney (Reuters): Asian shares rallied for a second session on Friday as economic news from China and Japan beat all expectations while bitcoin, the market’s new crypto-star, tumbled more than 10% after a meteoric ascent in recent weeks.

Sterling briefly rose after the head of the European Commission Jean-Claude Juncker said the EU and the UK have made a break-through in the negotiations on how to run their post-Brexit land border and that the two sides will move to the next step of negotiation.

Beijing reported exports surged 12.3% in November from a year earlier, more than double the forecast, while imports climbed almost 18%.

Iron ore and copper imports enjoyed a stellar rebound, which could help stem a recent pullback in commodity prices.

Japan’s Nikkei led the way as the yen eased on the dollar, rising 1.1% on top of Thursday’s 1.45% bounce to be almost back where it started the week.

Revised data showed Japan’s economy growing twice as fast as first thought as business spending jumped.

European stock futures were up, with euro stoxx 50 futures rising 0.6% in early trade.

Australian stocks put on 0.3% while MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.7%.

Bidders were encouraged by a steadier performance on Wall Street, where the Dow rose 0.29%. The S&P 500 gained 0.29% and the Nasdaq 0.54%.

Still to come was U.S. nonfarm payrolls, with investors looking for 200,000 new jobs in November and much talk wages might show some welcome strength.

Sterling which briefly rose as high as $1.3521 on the Brexit accord, two cents above its low of $1.3320 on Thursday, last traded at $1.3461, down 0.1% for the day.

It was one of only a few currencies to gain on the U.S. dollar, which was otherwise broadly firmer.

The U.S. currency cleared 113.00 yen to reach 113.34, while the euro touched a two-week low at $1.1763. Against a basket of currencies the dollar held firm at 93.848.

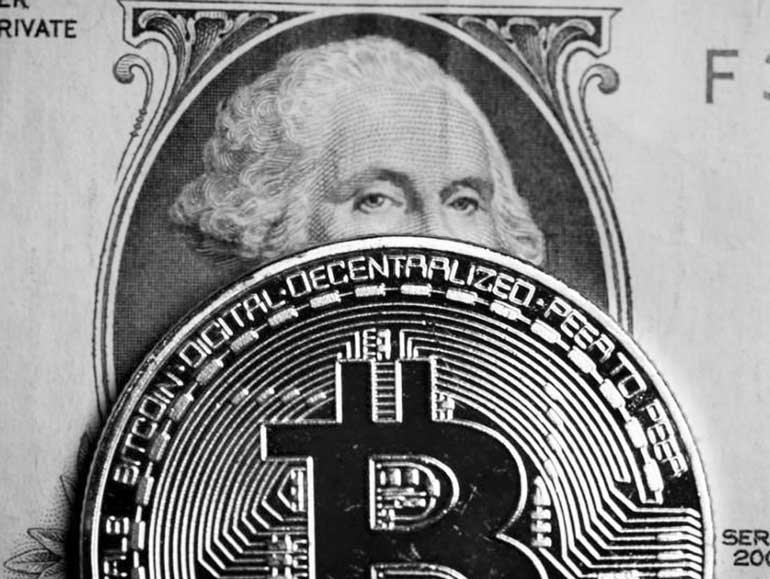

Digital darling

Bitcoin crested above $16,666 on the Bitstamp exchange having doubled in value in just two weeks.

But within a few hours it dropped almost 15% from that level to as low as 14,239 in volatile trade, intensifying the debate about whether it is a bubble about to burst. It last stood at $15,641, down 6% on the day.

The largest U.S. cryptocurrency exchange has been struggling to manage record traffic, with an imminent launch of the first bitcoin futures contract further fuelling investor interest.

Some, however, warned the coming of futures might prove to be the downfall of the digital darling.

“Dragging bitcoin into the futures market poses a risk of big players opening doors to short-selling hell,” said Naeem Aslam, chief market analyst at Think Markets UK.

“Futures markets make it possible to short in decent size with a lot of liquidity, thus affecting the price discovery in the underlying asset market.”

The spectacular rise of the cryptocurrency has stolen some thunder from gold bulls, providing an asset that is also seen as a hedge against inflation and government interference.

Gold steadied at $1,258.10, having finally breached its recent tight trading range to hit a four-month trough at $1,245.60.