Sunday Feb 22, 2026

Sunday Feb 22, 2026

Saturday, 18 August 2018 00:10 - - {{hitsCtrl.values.hits}}

TOKYO (Reuters): Asian shares won a modest reprieve on Friday after China and the United States agreed to hold their first trade talks since June next week and as the Turkish lira extended gains from its record low earlier this week.

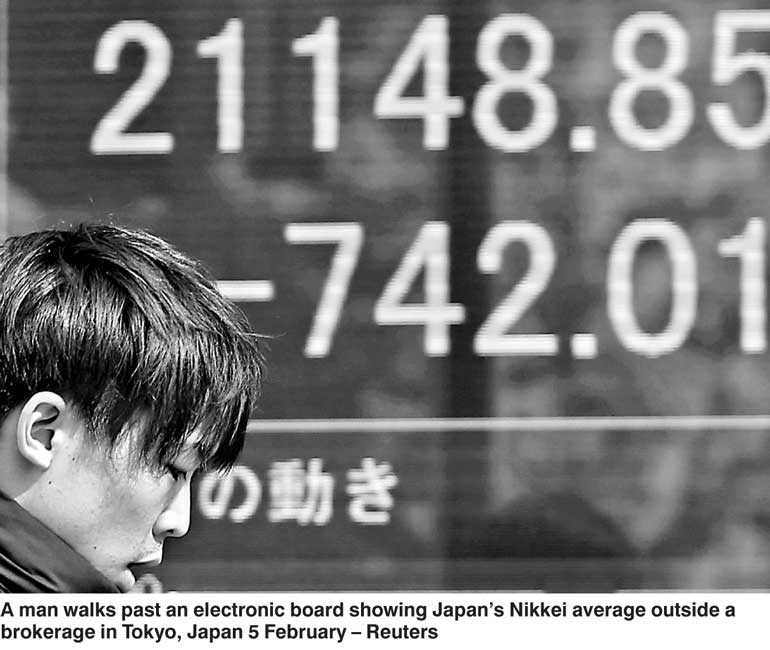

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.46%, a day after it hit its lowest level in a year. Japan’s Nikkei advanced 0.5%.

European shares are expected to be little changed, with financial spreadbetters looking at an almost flat opening in three major European bourses.

In US markets on Thursday, the Dow Jones Industrial Average rose 1.58% and the S&P 500 gained 0.79%.

MSCI’s index of world stocks rose 0.63% on Thursday, the biggest gain in a month.

News that a Chinese delegation led by Vice Minister of Commerce Wang Shouwen will meet US representatives helped to improve the mood.

The meeting is set to take place as the world’s two largest economies are due to slap tariffs on billions of dollars of each other’s goods on 23 August, in addition to levies that took effect on 6 July.

But there are doubts over whether lower-level talks can resolve the trade dispute given what is at stake. White House Economic adviser Larry Kudlow warned Beijing not to underestimate President Donald Trump’s resolve in pushing for changes in China’s economic policies.

Indeed, Chinese share markets were hardly impressed by the news.

The Shanghai composite index fell 0.5% by early afternoon for a weekly fall of 3.7%, risking a close below a 2-1/2 year low set on 6 August.

MSCI China, mostly made up of Chinese shares listed in Hong Kong and the United States, has fallen 5.9% so far this week. That weighed on MSCI emerging markets index, which closed at a 13-month low on Thursday.

That weakness also stemmed from falls in emerging market currencies after the Turkish lira plunged this month on concerns about diplomatic rifts between Ankara and Washington.

“Because of the currency crisis in Turkey, investors are shifting funds from emerging markets to developed markets,” said Shuji Shirota, head of macroeconomic strategy at HSBC Securities in Tokyo.

“But if you look at longer-term prospects, the US could be affected if the trade disputes linger. Given a US president tends to do badly in his first mid-term election, he might do more on trade issues after the election,” he added.

In the currency market, the lira slipped 0.8% to 5.84 per dollar but it retained much of its rebound this week and up almost 25% from its record low of 7.2400 hit early on Monday, despite threats of more sanctions from Washington.

It has gained some support from the announcement late on Wednesday of a Qatari pledge to invest $15 billion in Turkey.

The offshore Chinese yuan weakened slightly after a 1.2% climb on Thursday, the biggest daily gain since January 2017 following the trade talks news. The yuan last stood at 6.8770 per dollar, down 0.25% on the day but still off Wednesday’s 19-month low of 6.9587.

“We believe that the wave of RMB depreciation is probably over and that renewed fiscal stimulus (in China) will bring a halt to decelerating growth as well as higher interest rates supporting a stronger RMB,” Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis, said in a note.

The euro, which has been affected by concerns about European banks’ exposure to Turkey, traded at $1.1375, almost flat on the day and off a 13-1/2-month low of $1.1301 on Wednesday.

The yen changed hands at 110.97 per dollar, unchanged from Thursday. The pound rose 0.12% on Thursday after 10 straight days of falls though concerns about a hard Brexit continued to undermine the sterling. Oil prices were on the defensive, on a weakening outlook for crude demand despite their gains on Thursday thanks in part to a recovery in global shares.

Brent crude oil futures fetched $71.36 a barrel, down 0.1% in Asia on Friday after a 0.69% rise the previous day. They are on course to log the seventh straight week of losses.

US crude futures stood at $65.43 a barrel, down 0.05%.