Sunday Feb 22, 2026

Sunday Feb 22, 2026

Saturday, 24 November 2018 00:10 - - {{hitsCtrl.values.hits}}

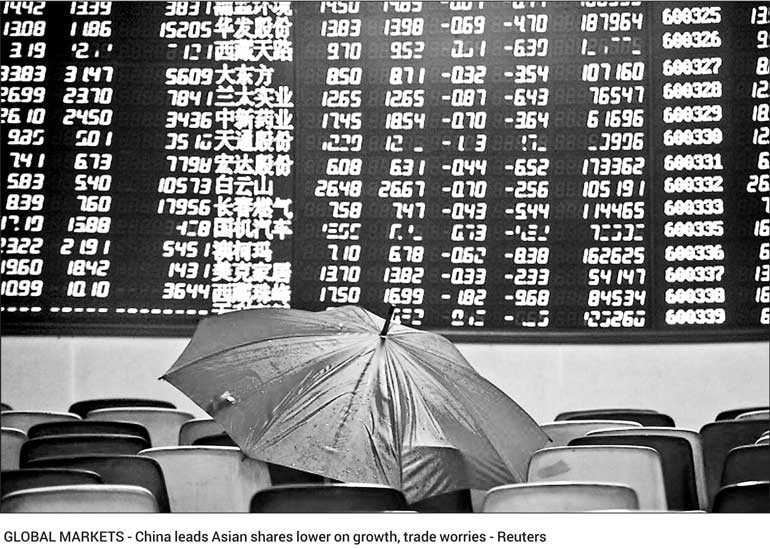

SHANGHAI (Reuters): Asian shares slipped on Friday as trade tensions continued to hurt sentiment, while weak corporate earnings in Europe added to worries about global growth and outweighed hopes for progress in Brexit negotiations.

With US markets closed overnight for Thanksgiving and Japan on holiday on Friday, trading activity was muted. Regional indicators turned lower after China’s markets opened.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.2%, giving up early, small gains as Chinese blue-chips dropped 1.4% and the Shanghai Composite index lost 1.6%.

China’s markets have been stuck in a slump as the country’s trade war with the US has exacerbated worries about slowing growth. Few analysts expect sustained improvement for Chinese shares even if US and Chinese leaders make progress in mending ties at a G20 meeting in Argentina at the end of the month.

At this stage, some economists doubt the G20 talks will bring progress.

Prakash Sakpal of ING in Singapore said there “haven’t been any promising developments” since the trade war started.

“There is a lot of rhetoric driving things farther from any sort of solid consensus that both countries could come around.”

Seoul’s Kospi was down 0.6%. Hong Kong’s Hang Seng was off 0.4%, as were Taiwan shares.

Australian shares held on to gains, rising 0.5%, but were on track for a second week of losses.

US equity futures were pointing to weakness on Wall Street when trading resumes Friday. S&P E-mini futures were down 0.27% at 2,641.75.

On Thursday, stock markets in Europe were hit by disappointing earnings on further signs that corporate profit growth is peaking globally.Those earnings underscored the lingering anxiety among equity investors as trade tensions, slowing global investment and growth kept stock markets on the back foot after a torrid October. A draft deal between Britain and the European Union on future relations reached late Thursday did little to lighten the mood.

In the currency market, the pound was flat, buying $1.2878 after rising more than 1% on Thursday on news of the draft agreement between Britain and the EU, which describes a close post-Brexit relationship. The agreement follows a draft treaty last week that set the terms for Britain’s departure from the EU in March.

But the deal faces a rocky ride once it reaches a deeply divided British Parliament containing hardline eurosceptic and staunch pro-EU factions, and various shades of grey in-between.

Indeed, analysts at National Australia Bank cautioned against early celebrations.

“After EU leaders are expected to rubber stamp this political declaration alongside the withdrawal agreement at a summit on Sunday, the ‘meaningful vote’ in the UK Parliament is likely in the second week in December. It would be far too optimistic to declare victory on a deal yet,” they said in a note to clients.

The euro edged up to $1.1414, despite statements by Italy’s leaders that they would press ahead with expanding the country’s deficit next year and resist pressure from EU authorities to trim its budget, as investors focus on conciliatory rather than confrontational comments.

The dollar was unchanged against the yen at 112.93.

In commodities markets, US crude oil prices extended their recent slump as US inventories hit their highest level since December, adding to concerns about a global crude glut.

US crude was trading down 2.4% to $53.33 a barrel, as of 0351 GMT, after hitting a low $53.82 a barrel earlier in the session. Brent crude gave up 1% to $62 a barrel.

Spot gold was 0.1% more precious at $1,228.02 per ounce.