Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 2 March 2018 00:00 - - {{hitsCtrl.values.hits}}

Hong Kong (Reuters): Manufacturing data painted a mixed picture of economic activity in Asia, with strong currencies hurting exporters in South Korea, Japan and Taiwan, while China surprisingly showed resilience amid fears tighter regulations may slow growth.

Hong Kong (Reuters): Manufacturing data painted a mixed picture of economic activity in Asia, with strong currencies hurting exporters in South Korea, Japan and Taiwan, while China surprisingly showed resilience amid fears tighter regulations may slow growth.

The Lunar New Year holidays disrupted activity, suggesting that the slowdown in some of the economies could be temporary.

There were worries remained that the dollar’s broad weakness could hinder the regions export-driven economies, though manufacturing surveys in the United States and Europe later on Thursday were expected to confirm the strong momentum in global trade.

Also, the full impact of China’s crackdown on risky financing is likely yet to be seen.

Japanese manufacturing expanded at a slightly slower pace in February as a stronger yen weighed on new export orders and Taiwan’s factory growth was the slowest in four months, although both economies still posted relatively solid numbers.

South Korea’s export growth slowed in February to its weakest in more than a year.

The Japanese yen JPY= is currently trading around its strongest in more than a year, the Korean won KRW= in more than three years and the Taiwanese dollar TWD= in more than five.

“For Asia, the strength of the currencies will have some impact but generally how growth in the G3 economies fares is more important,” said Khoon Goh, head of Asia research at ANZ.

“We should continue to see a strong momentum in exports going into the second half, when base effects come into play,” Goh said, cautioning against reading to much into the holiday-distorted numbers.

In the absence of any signs of an acceleration in growth, however, markets remain of the view that central banks in Asia will significantly lag the Federal Reserve in hiking rates this year.

Fed chief Jerome Powell, in his first public appearance since talking the helm at the U.S. central bank, said this week that he aimed to prevent the economy from overheating, cementing market expectations for three or four interest rate increases this year.

Chances for rate hikes in Asia are far fewer.

Bank of Japan board member Goushi Kataoka cautioned on Thursday against a premature exit from the BOJ’s ultra-loose monetary policy and called for a ramping up of the bank’s massive stimulus program.

In China, a private survey showed on Thursday factory growth at a six-month high, but the findings were largely at odds with downbeat official activity readings on Wednesday, which raised concerns that tighter regulations may lead to a sharper slowdown in the world’s second biggest economy.

The divergence might be explained by the fact that the private survey captures more of the activity of small and medium firms in the private sector, while the official survey focuses more on large state-owned enterprises, analysts say.

The state-owned firms service the domestic demand more and their weaker showing may point to weakness stemming from property-cooling measures, higher interest rates and tougher rules against risky financing, factors which are expected to weigh throughout the year.

Government measures to reduce pollution over the winter have also led to cuts in production, economists said.

“The big picture is that while the survey data have generally been strong during the past year, we don’t expect that strength to be sustained in coming quarters,” said Julian Evans-Pritchard, senior economist at Capital Economics.

ING analysts were more upbeat, however, pointing to the fact that even the weaker private survey showed manufacturers’ expectations of future activity were still solid.

“These numbers imply that the low reading is likely driven by holiday effects, rather than by any underlying slowdown in coming manufacturing activity,” said Iris Pang, Greater China economist at ING.

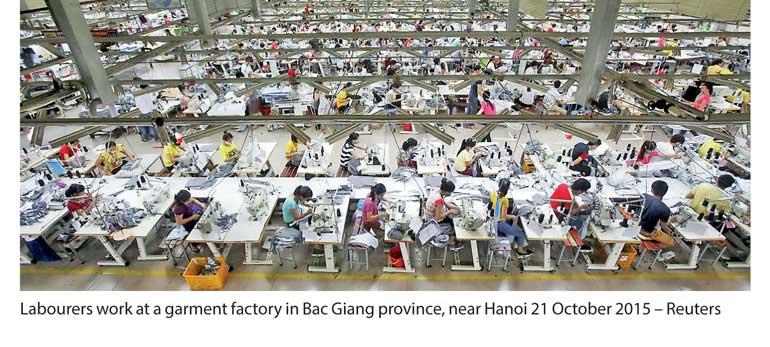

In smaller economies, Vietnam’s activity was at a 10-month high, Indonesia’s was at a 20-month high, while Malaysia’s contracted.