Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 10 May 2018 00:00 - - {{hitsCtrl.values.hits}}

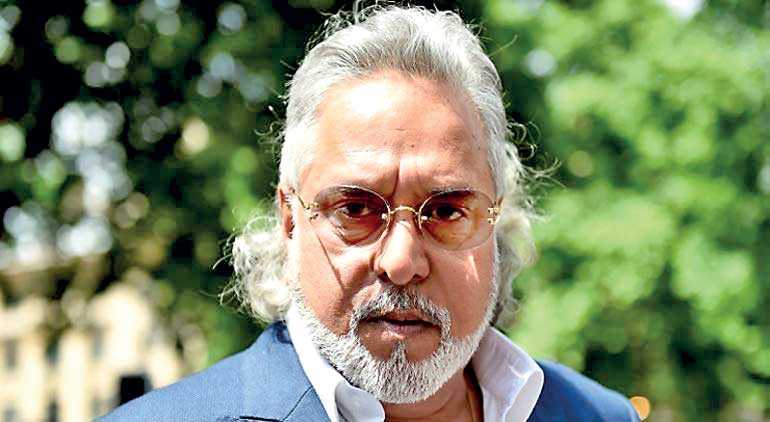

LONDON: Vijay Mallya’s efforts to challenge the registration of a ruling by India’s Debt Recovery Tribunal in the UK, and the freezing of international assets failed on Tuesday, as a court in London ruled against him, in what will be seen as a legal victory for a consortium of Indian banks seeking to recover £1.145 billion worth of assets.

The applications — in the Commercial Court Queens Bench division in London — had been running separately to the Indian government’s efforts to extradite him to India to face allegations of fraud and money laundering.

Mallya had sought to challenge the registration of the Debt Recovery Tribunal’s judgment from January 2017, and a worldwide freezing order that prevented him from removing — or diminishing — his assets in England and Wales.

“In dismissing Mallya’s application, the High Court has demonstrated its willingness to recognise judgments granted by courts in other jurisdictions, giving parties opportunities to enforce their judgments against any assets held here,” said Paul Gair, partner at TLT, a UK-based law firm that represented the 13 Indian banks, including in securing the registration and freezing order on November 23 last year.

“This case also sets a strong precedent for parties to secure a worldwide freezing order when enforcing judgments against wilful defaulters…. Today’s judgment is a very important decision not just for our clients, who want to proceed in this jurisdiction with enforcing the judgment they secured against Mallya in India, but also for Indian and international banks more generally.”

In January 2017, the Debt Recovery Tribunal’s Bengaluru Bench allowed recovery proceedings against Kingfisher Airlines Ltd and Mallya, directing them to repay ₹6,203 crore to the banking consortium. The initial asset freeze order in London from November gave Mallya a £5,000 a week allowance to live on, which was increased to just below £20,000 following an application by Mallya’s lawyers.

Mallya was arrested by British authorities in April last year and remains on bail, as the separate extradition proceedings against him continue at Westminster Magistrates Court, following several delays and the provision of further information, including details of the conspiracy charges he potentially faces in India.

While the extradition efforts focus specifically on an alleged fraud centring around loans provided by IDBI Bank, the debt-recovery and asset freezing efforts — related to the ruling on Tuesday — are being pursued by 13 banks led by the State Bank of India and include Bank of Baroda, Corporation Bank, Federation Bank, IDBI Bank, Indian Overseas Bank, Jammu & Kashmir Bank Ltd, Punjab and Sind Bank, Punjab National Bank, State Bank of Mysore, UCO Bank, United Bank of India and JM Financial Asset Reconstruction.

Meanwhile, in India, PTI reports that a Delhi court has issued fresh directions to attach the properties of Mallya for evading summons in a money laundering case. (The Hindu Business Line)