Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 2 February 2018 00:00 - - {{hitsCtrl.values.hits}}

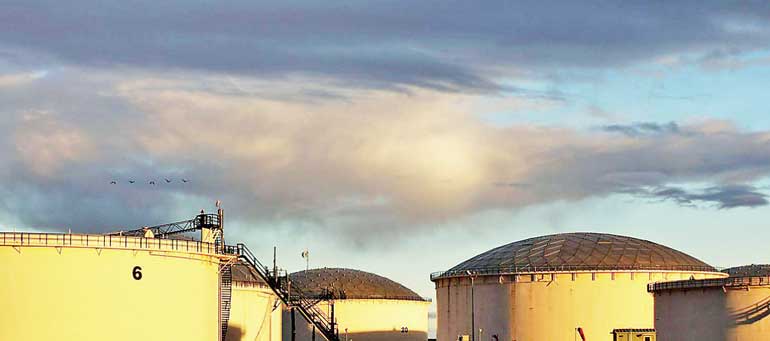

London (Reuters): Oil prices rose on Thursday after a survey showed OPEC’s commitment to its supply cuts remains in place, even as US production topped 10 million barrels per day for the first time since 1970.

London (Reuters): Oil prices rose on Thursday after a survey showed OPEC’s commitment to its supply cuts remains in place, even as US production topped 10 million barrels per day for the first time since 1970.

Brent April crude futures were up 53 cents on the day at $ 69.42 a barrel by 1150 GMT, while NYMEX crude for March delivery rose 42 cents to $ 65.15 a barrel.

Brent crude rose by 3.3% in January, its strongest start to the year for five years, in line with a broad rise in other risk-linked assets such as US equities, which hit record highs last month and marked their biggest January increase since 1997.

With investors now pondering which of oil’s current key driving forces will prove to be the dominant one - rising US crude output, or OPEC’s adherence to its supply cuts, the relationship with equities and even the dollar is likely to erode. Goldman Sachs raised its three-month forecast for Brent to $ 75 from $ 62 and its six-month forecast to $ 82.50 from $ 75.

Oil prices are unlikely to advance much above $ 70 a barrel in 2018, given the tug of war between OPEC and the US shale industry, a Reuters poll showed on Wednesday.

US crude oil production in November surpassed 10 million bpd for the first time since 1970, and neared the all-time output record, the Energy Information Administration said on Wednesday.

The EIA also reported the biggest increase in crude oil stocks since March last year, a rise of 6.8 million barrels.

Output by the Organization of the Petroleum Exporting Countries (OPEC) also rose in January from an eight-month low as higher output from Nigeria and Saudi Arabia offset a further decline in Venezuela, a Reuters survey found.

However, adherence by producers included in the deal to curb supply rose to 138% from 137% in December, suggesting commitment is not wavering even as oil prices hit their highest since 2014.