Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 2 January 2018 00:00 - - {{hitsCtrl.values.hits}}

AFP: Saudi Arabia and the United Arab Emirates introduced value-added tax from Monday, a first for the Gulf which has long prided itself on its tax-free, cradle-to-grave welfare system.

Saudi Arabia compounded the New Year blow for motorists with an unannounced hike of up to 127% in petrol prices with immediate effect from midnight.

They are the latest in series of measures introduced by Gulf oil producers over the past two years to boost revenues and cut spending as a persistent slump in world prices has led to ballooning budget deficits.

The five% sales tax applies to most goods and services and analysts project that the two governments could raise as much as $21 billion in 2018, equivalent to 2.0% of GDP.

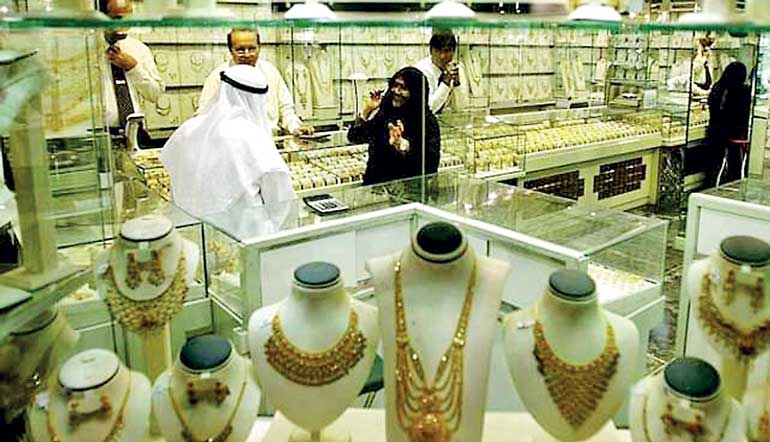

But it marks a major change for two super-rich countries where the mall is king. Dubai has long held an annual shopping festival to draw bargain hunters from around the world to its glitzy retail palaces.

Saudi Arabia has deposited billions of dollars in special accounts to help needy citizens face the resulting rise in retail prices. The other four Gulf states -- Bahrain, Kuwait, Oman and Qatar -- are also committed to introducing VAT but have decided to delay the move until early in 2019.

The hike in fuel duty in Saudi Arabia was the second in two years.

But it still leaves petrol prices as some of the lowest in the world.

High-grade petrol rose 127% from 24 cents a litre ($1.09 a gallon) to 54 ($2.46), while low-grade petrol rose 83% from 20 cents a litre (91 cents a gallon) to 36.5 ($1.66).

Duty on diesel and kerosene remained unchanged.

Saudi Arabia has introduced a raft of measures to raise revenue and cut spending as it bids to balance its books.

Last month, it slashed the government subsidy on electricity supply, leading to a sharp rise in bills.

Riyadh posted budget deficits totalling $260 billion over the past four fiscal years and does not expect to balance its books before 2023.

To finance its mounting public debt, the kingdom has withdrawn around $250 billion from its reserves over the past four years, reducing them to $490 billion.

It has also borrowed around $100 billion from the international and domestic markets.