Thursday Feb 19, 2026

Thursday Feb 19, 2026

Saturday, 20 June 2020 00:00 - - {{hitsCtrl.values.hits}}

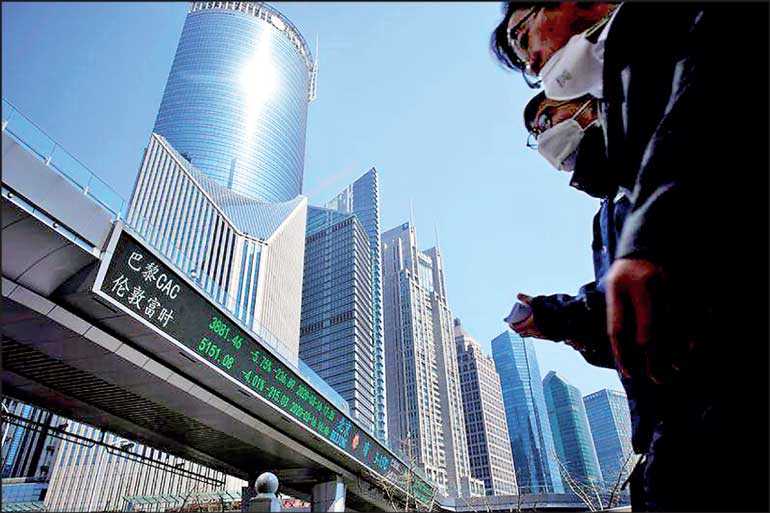

Pedestrians wearing face masks walk near an overpass with an electronic board showing stock information, following an outbreak of the coronavirus disease, at Lujiazui financial district in Shanghai, China, 17 March – Reuters/File Photo

TOKYO/WASHINGTON (Reuters): Asian shares and US stock futures wobbled in choppy trade on Friday as lingering concerns about a fresh spike in coronavirus cases offset growing hopes for a quick economic recovery.

MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.06%. US S&P 500 e-minis moved in and out of the red, and were last up 0.23%.

Shares in China rose 0.61%, led by gains in financials and the health care sector, but South Korean stocks fell 0.81% due to concern about diplomatic tension with North Korea.

Australia’s S&P/ASX 200 jumped 1.0%, with the energy sector leading the charge, as oil futures rose in Asia on hopes that output cuts will put a floor under prices.

On the whole, markets have been sideswiped this week on fresh contagion concerns, prompting some investors to temper their optimism about how quickly the global economy can recover for the pandemic.

On Thursday around 400 workers at a slaughterhouse in northern Germany tested positive for the virus. At the same time, investors are nervously following a cluster of cases in Beijing and rising cases in several US states.

All three major US stock indexes were range-bound and oscillated through much of the day as investors struggled to interpret the impact of US employment data without any guidance from corporations on their earnings.

Data on Thursday showed the number of US unemployed remains stubbornly high amid signs of a second wave of corporate layoffs as companies grappled with large declines in revenue because of the coronavirus outbreak.

“The market is looking for its next big impulse,” said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana.

“There are a lot of impulses in the market for investors to weigh, sift through and take into account to figure out the next direction.”

The Dow Jones Industrial Average fell 0.15% on Thursday, but the S&P 500 added 0.06%.

The Nasdaq Composite rose 0.33% after spending much of the session lower.

Cleveland Federal Reserve Bank President Loretta Mester said it could take a year or two for the US economy to return to pre-pandemic levels, with the gross domestic product declining by 6% in 2020 and the unemployment rate still around 9% by year’s end.

Oil futures extended gains from the previous session after OPEC producers and allies promised to meet their supply cut commitments and two major oil traders said demand is recovering.

US crude ticked up 0.57% to $ 39.06 a barrel, while Brent crude rose 0.43% to $ 41.69 per barrel.

In foreign exchange markets, the dollar headed for its best week in a month against a basket of major currencies as a resurgence in coronavirus cases knocked confidence in a rapid economic recovery and drove investors to the safety of the world’s reserve currency.

The British pound was mired near a two-week low at $ 1.2403 due to concerns that the Bank of England’s bond purchases may not be enough to support an economic revival.

Sterling could stage a mild recovery if retail sales data due later on Friday point to a rebound in consumer spending.

Benchmark 10-year US Treasury notes edged up to 0.7035%, but further gains could be capped due to worries about the US labour market.