Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 24 February 2017 00:00 - - {{hitsCtrl.values.hits}}

AFP: Asian markets mostly struggled Thursday as investors put the brakes on a Trump rally that has inflated global stocks, while Japanese car giant Nissan fell after Carlos Ghosn, the man considered its saviour, stepped down as CEO.

AFP: Asian markets mostly struggled Thursday as investors put the brakes on a Trump rally that has inflated global stocks, while Japanese car giant Nissan fell after Carlos Ghosn, the man considered its saviour, stepped down as CEO.

While New York’s Dow index racked up a ninth successive all-time high, its longest record streak in 30 years, analysts said there was a sense that the advance may have gone too far.

The dollar picked up slightly but was unable to fully bounce back from Wednesday’s sell-off after minutes from the Federal Reserve’s latest board meeting showed policymakers expect a rate hike “fairly soon” but also see increases being gradual.

While they cited “heightened uncertainty” about possible US policies that could lift inflation, hastening the need for rate hikes, that was not enough for dealers who had hoped for a firmer guidance.

Apart from taking a breather in January, world markets and the dollar have been on an upward trajectory since Donald Trump’s November US election win on bets his big-spending, tax-cutting plans would fire the US and global economy.

But Greg McKenna, chief market strategist at CFD and FX provider AxiTrader, said in a note there appears to be some scepticism of the likely effectiveness of Trumponomics as well as worries from some hedge funds that any big news has been priced in.

He added that there were an increasing number of investors betting on a retreat.

‘Subtle shift’

“When folks are starting to think and talk like this, it tells me that there could be a subtle shift in market thinking. This is because the Trump rally has now exceeded most US equity market strategists’ guesstimates of where US stocks would end 2017,” he said.

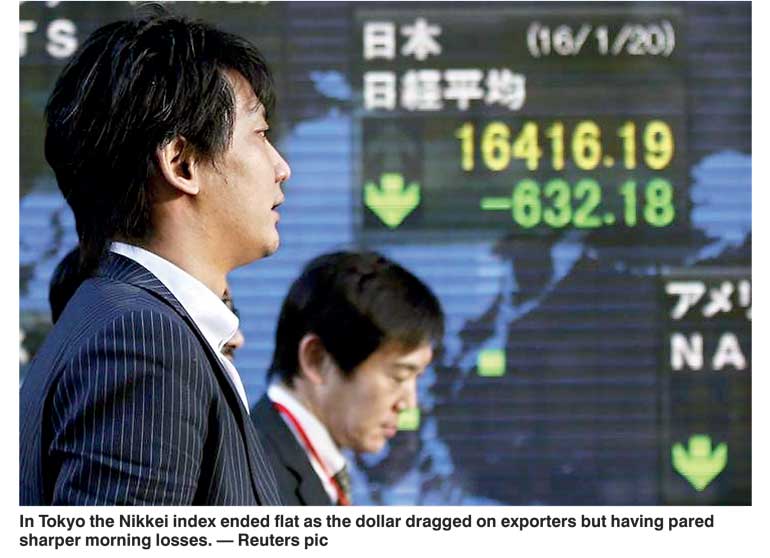

In Tokyo the Nikkei index ended flat as the dollar dragged on exporters but having pared sharper morning losses.

Hong Kong shed 0.4% in the afternoon, Shanghai closed 0.3% down and Sydney shed 0.4%, while Taipei and Bangkok also retreated.

However, Seoul rebounded from morning selling to end slightly higher while Singapore was up 0.2%.

News that Nissan chief executive Ghosn would resign his post weighed on the carmaker, sending it down 0.6% in Tokyo.

The man credited with reinventing the once nearly bankrupt Japanese firm said he would focus on overhauling rival Mitsubishi Motors, but will stay on as chairman, while co-CEO Hiroto Saikawa will take over.

Nissan, Japan’s number two automaker that has a 40% stake in France’s Renault, threw Mitsubishi a lifeline in May when it bought a one-third stake in for about $2.2 billion, as it wrestled with a mileage-cheating scandal that hammered sales. Mitsubishi ended up 0.4%.