Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 14 May 2015 01:10 - - {{hitsCtrl.values.hits}}

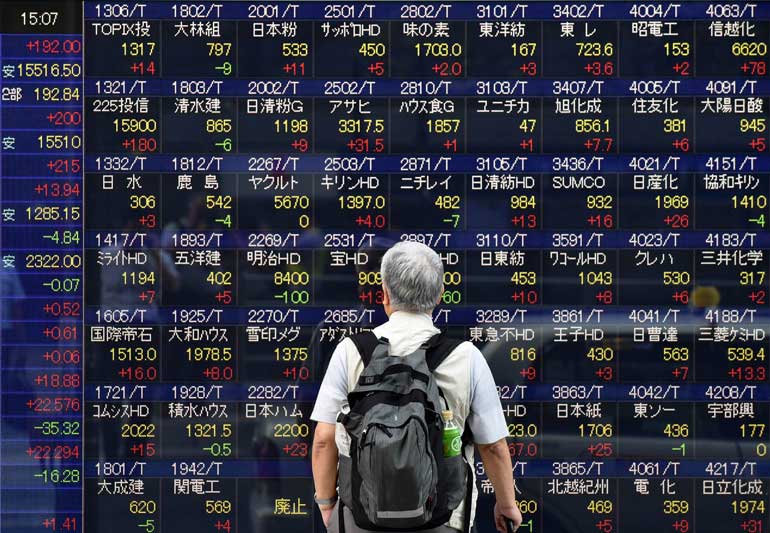

Tokyo (Reuters): Asian shares advanced on Wednesday despite another set of disappointing Chinese economic reports, as investors instead focused on hopes of further stimulus from Beijing to prevent a sharper slowdown in the world’s second-largest economy.

European shares were expected to get the day off to a bright start, with financial spreadbetters predicting Britain’s FTSE 100 would open up as much as 0.2% up, Germany’s DAX 0.4% higher, and France’s CAC 40 was seen up 0.3%.

MSCI’s broadest index of Asia-Pacific shares outside Japan was off session highs but still up 0.3%.

China’s factory output rose a less-than-expected 5.9% in April compared with the same period last year, boosting bets the government will have to step up its efforts to shore up the sputtering economy in order to meet its gross domestic product target.

Fixed-asset investment and retail sales also fell short of expectations.

“Expect the pace of easing to be increased, or at least maintained, by the authorities through the year, in order for the GDP target of 7% to be attained,” said Chester Liaw, economist at Forecast Pte in Singapore.

On Sunday, the People’s Bank of China announced it was cutting its benchmark one-year lending and deposit rates by 25 basis points, the third cut in six months. Economists expect more easing steps from Beijing to help support an economy headed for its slowest growth in a quarter of a century.

Japan’s Nikkei stock index erased early losses and ended up 0.7%, shrugging off a weak cue from Wall Street.

US stocks finished lower on Tuesday after a recent run-up in global bond yields unsettled investors, though stocks recovered from steeper losses after Treasury yields pulled back slightly from six-month highs.

The yield on benchmark 10-year notes was last at 2.250%, down from its US close of 2.262%, and taking away some of the greenback’s appeal.

The dollar marked modest losses against a basket of major currencies, dragged down by a stronger euro. The pound also firmed, moving back toward a five-month high touched in the previous session after upbeat UK data.

The dollar index edged down 0.1% on the day to 94.489 . Against the yen, the US currency stuck to its recent ranges and was nearly flat on the day at 119.89 yen, while the euro added about 0.2% to $ 1.1230.

Underpinning the euro, German bond yields climbed on Tuesday on optimism that inflation may have bottomed in the euro zone, though investors remained cautious about developments in debt-strapped Greece.

Greek Prime Minister Alexis Tsipras on Tuesday called on lenders to break an impasse in cash-for-reform talks after Athens had to resort to a temporary expedient to make a crucial payment to the IMF.

Investors await data later on Wednesday on the euro zone’s first-quarter gross domestic product as well as US retail sales. The latter are expected to rise just 0.2% in April, slowing from March’s 0.9%. “With the Fed so intensely focused on the data at present, these matter,” said Emma Lawson, senior currency strategist at NAB.

Sterling edged up about 0.1% on the day to $ 1.5683 as investors awaited the Bank of England’s quarterly inflation report later on Wednesday. It rose as high as $ 1.5710 overnight, its loftiest peak since mid-December.

|