Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 12 November 2015 00:00 - - {{hitsCtrl.values.hits}}

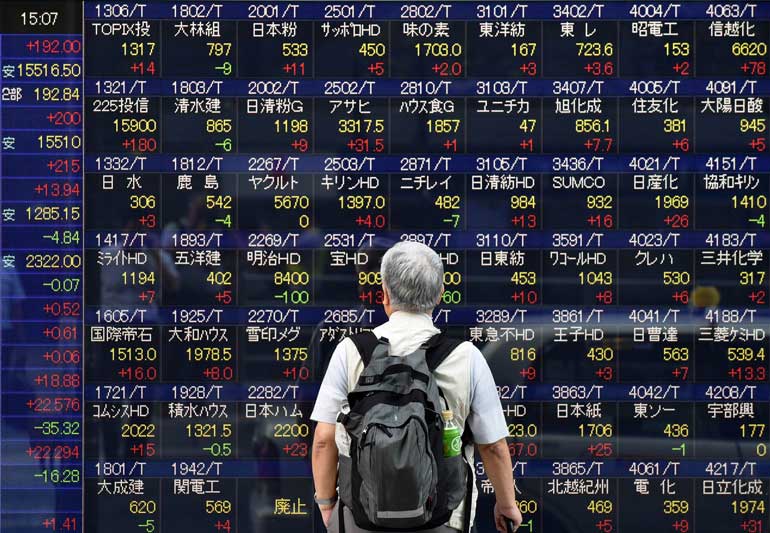

Reuters: Asian stock markets pulled back slightly on Wednesday after a mixed batch of Chinese data showed growth in the world’s second-biggest economy was still in low gear.

China’s October industrial production growth cooled to 5.6% last month from a year ago, slightly lower than the 5.8% gain seen by economists in a Reuters poll. Retail sales jumped 11% from a year ago, just ahead of expectations of a 10.9% increase.

Chinese shares extended losses, with the CSI300 index .CSI300 of the largest listed companies in Shanghai and Shenzhen falling 1.3%, while the Shanghai Composite Index eased 0.9%.

MSCI’s broadest index of Asia-Pacific shares outside Japan gave up earlier gains to trade little changed. Taiwan shares recorded a 1.4% decline.

Japan’s Nikkei and South Korean shares were little changed.

A Reuters survey showed confidence among Japanese manufacturers fell in November for a third straight month to levels unseen in about 2-1/2 years, evidence that concerns about Chinese demand linger.

European markets look set for a rosier open, with financial spreadbetters expecting Britain’s FTSE 100 and France’s CAC 40 to start the day up 0.4% and Germany’s DAX to climb 0.3% on the open.

Wall Street had offered no direction as the Dow .DJI ended Tuesday with a slight gain of 0.16%. The S&P 500 added 0.15% and the Nasdaq eased 0.24%.

Weighing on the Nasdaq, Apple shares fell 3% after Credit Suisse said the iPhone maker had lowered component orders by as much as 10%.

In currency markets, the euro struggled as political uncertainty in Portugal provided an excuse to sell in a market already bracing for further monetary policy easing from the European Central Bank.

The common currency last stood at $1.0759, having hit a six-month trough of $1.0673 on Tuesday.

The dollar index eased back form a seven-month peak to slip 0.4% to 98.883. The dollar ran into a little profit-taking against the yen, nudging it down 0.3% to 122.86, from an early 123.15.

Yields on sovereign bonds were generally lower as soft Chinese inflation continued to point to global deflationary pressures.

Benchmark 10-year Treasury yields dipped a couple of basis points to 2.32%, but remain hostage to the chance of a Fed rate hike next month. Indeed, concerns are growing that another strong payrolls report could lead to rates rising at a faster pace than was currently priced in.

The Treasury market is closed on Wednesday for Veterans Day, but Wall Street will be open.