Friday Feb 20, 2026

Friday Feb 20, 2026

Saturday, 30 January 2016 00:00 - - {{hitsCtrl.values.hits}}

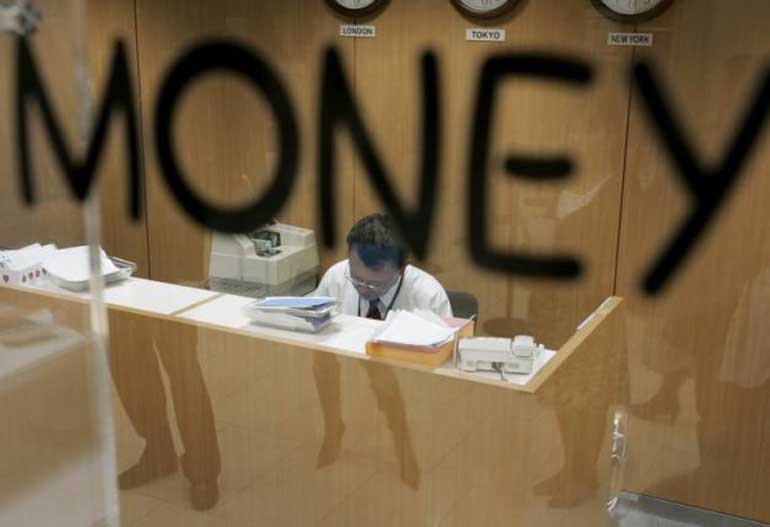

Reuters: The Bank of Japan unexpectedly cut a benchmark interest rate below zero on Friday, stunning investors with a move aimed at shielding the country’s sluggish economy from volatile markets and slowing global growth.

Asian shares jumped, the yen fell and sovereign bonds rallied after the BOJ said it would charge for excess reserves parked with the institution, an aggressive policy pioneered by the European Central Bank (ECB).

“The BOJ will cut the interest rate further into negative territory if judged as necessary,” the bank said in a statement announcing the decision.

BOJ Governor Haruhiko Kuroda had said as recently as last week that the bank was not thinking of adopting a negative interest rate policy for now, telling the Japanese parliament that further easing would likely take the form of an expansion of its massive asset-buying program.

But in a 5-4 vote, the BOJ’s policy board decided to charge a 0.1% interest on current accounts that financial institutions hold with it.

The central bank said the move was aimed at forestalling the risk of global financial turbulence hurting business confidence and reviving the ‘deflationary mindset’ it is striving to wipe out with aggressive money printing.

“Kuroda had been saying that he didn’t think something like this would help so it is a bit surprising and it’s clear the market has been surprised by it,” said Nicholas Smith, a strategist at CLSA based in Tokyo.

“The banking sector is getting smoked right now, though everything else seems to be doing just fine. This has obviously had a big effect on inflation and on inflation expectations.”

Several European central banks have cut key rates below zero, and the European Central Bank became the first major central bank to venture into negative territory in June 2014.

The BOJ maintained its pledge to expand base money at an annual pace of 80 trillion yen ($ 675 billion) via aggressive purchases of Japanese government bonds (JGBs) and risky assets conducted under its quantitative and qualitative easing (QQE) program.

Markets have been split on whether the central bank would ease policy as slumping oil costs and soft consumer spending have ground inflation to a halt, knocking price growth further away from the BOJ’s ambitious 2% target.

In a quarterly review of its forecasts released on Friday, the BOJ cut its core consumer inflation forecast for the coming fiscal year beginning in April to 0.8% from 1.4% projected three months ago.

However, it expects consumer inflation to accelerate to 1.8% in the fiscal year ending in March 2018, taking into account the effect of Friday’s measures.

Friday’s surprise interest rate decision came in the wake of data that showed household spending and output slumped in December, underscoring the fragile nature of Japan’s recovery.

Analysts point out that the bank’s room for further manoeuvre with its QQE program was limited because it was quite simply running out of assets to buy.

“I think this is a regime change and the BOJ’s main policy tool is now negative interest rates,” said Daiju Aoki, an economist at UBS Securities in Tokyo. “This shows that the ability to buy more JGBs is limited.” Consumer inflation was just 0.1% in the year to December, invigorating expectations that the BOJ would eventually have to deliver further stimulus.

Many BOJ policymakers have been wary of using their diminishing policy tools to counter what they see as factors beyond their control, such as volatile financial markets and China’s economic slowdown.

But pessimists on the BOJ board have worried that slumping Tokyo stocks may discourage firms from boosting capital expenditure, threatening the positive momentum the BOJ is trying to create with its heavy money printing.