Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 10 July 2015 00:00 - - {{hitsCtrl.values.hits}}

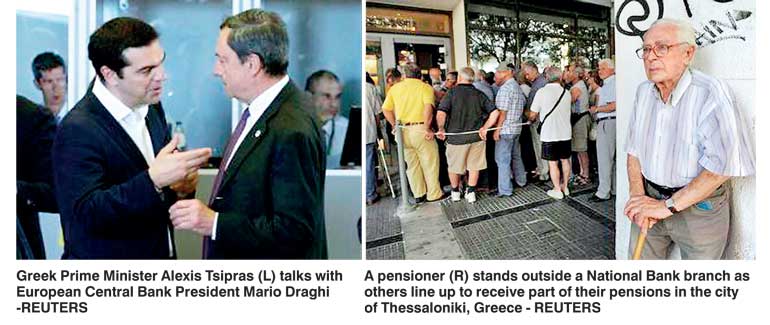

European Central Bank President Mario Draghi has voiced unprecedented doubts about the chances of rescuing Greece from bankruptcy as Greek Prime Minister Alexis Tsipras was due to put forward last-ditch reform proposals on Thursday.

Italian daily Il Sole 24 Ore quoted the ECB chief, under growing fire in Germany for keeping Greek banks afloat, as saying he was not sure a solution would be found for Greece and he did not believe Russia would come to Athens’ rescue.

Asked if a deal to save Greece could be wrapped up, Draghi told the paper as he was boarding a plane in Brussels on Wednesday: “I don’t know, this time it’s really difficult.”

The ECB is keeping shuttered Greek banks afloat with emergency liquidity capped until the weekend as leaders of the 19-nation euro zone race to find a last-minute third bailout for Athens.

Asked if he expected Russian President Vladimir Putin to help Greece, Draghi said: “I don’t believe so, I don’t see it as a real risk ... and then, they don’t have money themselves.”

The usually discreet central banker was speaking after an emergency euro zone summit on Tuesday gave Greece five days to come up with a credible plan to repair its public finances and reform its economy or face an economic meltdown and possible exit from Europe’s common currency.

Under that timetable, the leftist Greek government, which formally applied on Wednesday for a three-year loan from the European Stability Mechanism bailout fund, has until midnight to present convincing, detailed reform proposals.

International Monetary Fund chief Christine Lagarde added a potential complication by insisting that any deal must include a restructuring to make Greece’s massive debt pile sustainable.

Speaking in Washington on Wednesday, Lagarde said that to address Greece’s acute crisis any deal needed to have two legs. One was structural reforms and fiscal consolidation.

“The other leg is debt restructuring, which we believe is needed in the case of Greece for it to have debt sustainability,” she said.

Germany, Athens’ biggest creditor, has said any debt write-off would be illegal under the EU treaty and has also taken a restrictive approach to reprofiling Athens’ official borrowings to ease the short-term pressure of debt service.

Even France, Greece’s strongest support in the euro zone, acknowledged on Thursday it was working on scenarios for a Greek exit from the currency area if weekend efforts to clinch a deal fail.