Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 22 May 2015 00:00 - - {{hitsCtrl.values.hits}}

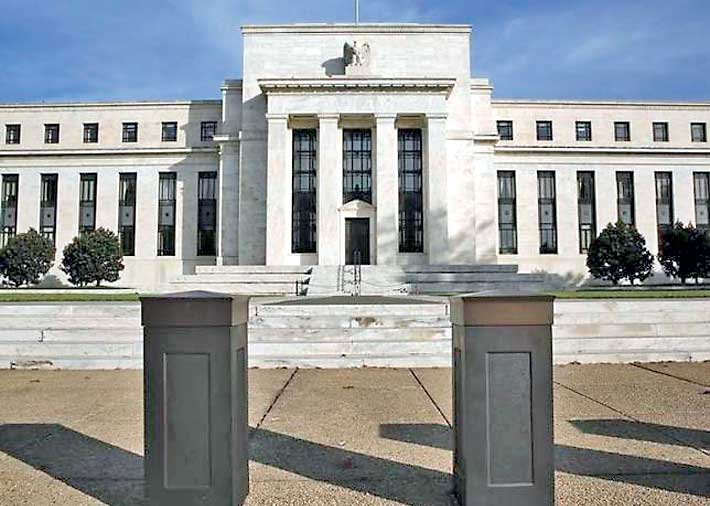

Federal Reserve officials believed it would be premature to hike interest rates in June even though most felt the US economy was set to rebound from a dismal start to the year, according to minutes from their April policy meeting released on Wednesday.

The central bank debated whether a slew of disappointing data, including weak consumer spending, signalled a temporary slump or evidence of a longer-lasting slowdown, with most participants agreeing economic growth would climb to a healthier pace and the labour market would strengthen.

The US economy grew an anaemic 0.1% in the first quarter, according to the most recent government data.

The minutes from the 28-29 April policy-setting committee meeting also highlighted the quandary the Fed faces in trying to avoid the market volatility tied to a rate hike while sticking to its meeting-by-meeting guidance on when that move will come.

With an increased amount of uncertainty and signs of softness across the economy, the minutes showed Fed officials pushing the prospect of a rate hike later into the year.

“Many participants, however, thought it unlikely that the data available in June would provide sufficient confirmation that the conditions for raising (interest rates) had been satisfied ...,” the minutes said.

US Treasury prices were largely unchanged after the release of the minutes, while short-term interest rate futures and TIPS inflation break-even rates held firm, as did stocks.

Fed officials flagged a number of concerns including disappointment that falling oil prices did not spur consumer spending as much as had been hoped. They also cited economic worries in China and Greece.

They also were troubled by the behaviour of the bond market, which Fed Chair Janet Yellen spoke about earlier this month. The minutes show central bank officials believe bond market volatility was higher now because of high-frequency traders, decreased inventories of bonds held by broker-dealers, and elevated assets of bond funds.

To avoid a disruptive spike in long-term bond rates, Fed officials discussed whether the central bank should better telegraph a rate hike in post-meeting communications. But most said keeping to the meeting-by-meeting policy was best for now.

The ‘taper tantrum’ of 2013, when emerging-market currencies and stocks plunged en masse on the suggestion that Fed bond-buying could be reduced, has loomed over the central bank as it nears its so-called rate lift-off.