Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 5 October 2015 00:00 - - {{hitsCtrl.values.hits}}

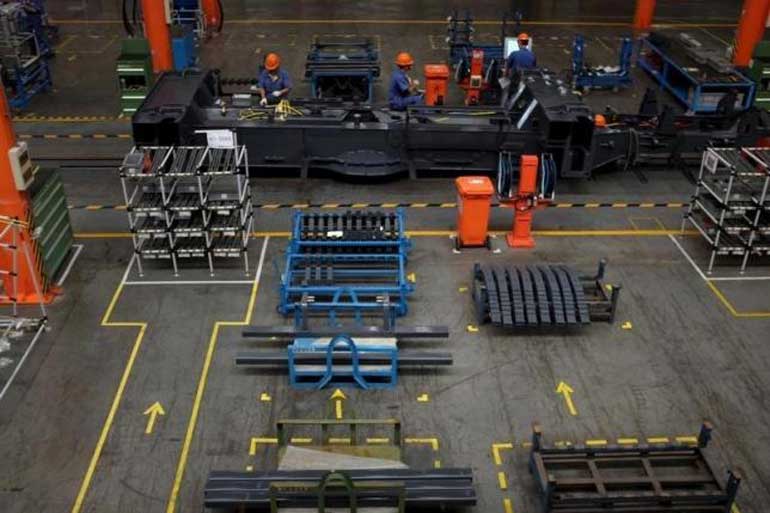

Employees work at a factory of XCMG Group, in Xuzhou, Jiangsu province

Employees work at a factory of XCMG Group, in Xuzhou, Jiangsu province

Factories in Asia cut more jobs and throttled back output in September as domestic and export demand shrivelled, adding to fears that cooling growth in China and emerging markets will jeopardise an increasingly fragile global recovery.

At the heart of Thursday’s flurry of releases were official and private surveys on China’s factory and services sectors that largely pointed to a further deterioration in the world’s second-largest economy despite a flurry of stimulus measures.

Another month of contraction in China’s vast manufacturing sector came as no surprise, but worryingly one private survey showed that growth in the services sector nearly stalled in September and was no longer strong enough to fully offset the broader economic downdraft from weak factories.

While the China surveys suggested a further loss of steam, they did not contain any signs of a hard landing which many global investors have begun to fear.

Still, the steady loss of momentum in developing and emerging countries in recent months leaves the United States as the lone bright spot in the global economy and will raise questions about whether its central bank should risk raising interest rates this year for the first time in nearly a decade.

Similar surveys in Europe and the United States due later in the day will be closely watched for any similar signs of weakness and any spillover effects from Asia.

“The big picture is that we’re going to see weaker Chinese growth for this quarter and an even slower growth rate for next year,” said Wei Li, China and Asia economist at Commonwealth Bank of Australia in Sydney.

“But if the labour market can be kept stable, then clearly Beijing would continue to focus on structural reforms, which will benefit long-term growth. There is no quick fix.”

The U.S. Federal Reserve held off from raising rates last month, citing in part worries about the extent of China’s slowdown, while members of the European Central Bank have warned euro zone growth is at risk from cooling emerging markets, adding to expectations that it may step up its stimulus efforts.

China, too, is expected to ease policy further in coming months in its biggest stimulus campaign since the global financial crisis.

Equally wary, the head of the International Monetary Fund, Christine Lagarde warned on Wednesday that a relentless deceleration in developing economies will curb global growth.

She said China needed to keep trying to rebalance its economy away from commodity-intensive investment but must also safeguard “demand and financial stability.”

Indeed, a summer stock market crash and China’s surprise devaluation of its currency in August sent shockwaves through global markets, raising concerns both inside and outside of China about Beijing’s ability to manage its economy.

In July, the IMF predicted a marginal slowdown in global growth this year to 3.3% from 3.4% in 2014, with a rebound to 3.8% in 2016. It could downgrade forecasts next week in its World Economic Outlook report.

Similar activity surveys and data from other trade-reliant Asian economies made for equally grim reading, with Japanese manufacturers seeing a tumble in new export orders, South Korean exports falling for a ninth consecutive month and Taiwan warning that its economy shrank in the third quarter.

Indonesian factory owners cut payrolls at the second-fastest rate in at least four years, while activity in Vietnam fell for the first time in two years.

Even Indian factories, which are more insulated from global trends, posted their slowest expansion in seven months. The drop in activity will have added to worries over the country’s sputtering growth and reinforced the rationale behind the central bank’s larger than expected interest rate cut this week.

Long and grinding road

Despite a stream of stimulus over the last year, including five interest rate cuts since November, there are worries that China’s third-quarter GDP data on Oct 19 will show growth fell below 7% for the first time since the global crisis.

Some China watchers believe current growth levels are already much weaker than official data suggests.

“China’s weak survey data suggest that additional policy easing is quite likely before year-end,” said Bill Adams, senior international economist at PNC Financial Services Group.