Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 1 February 2016 00:00 - - {{hitsCtrl.values.hits}}

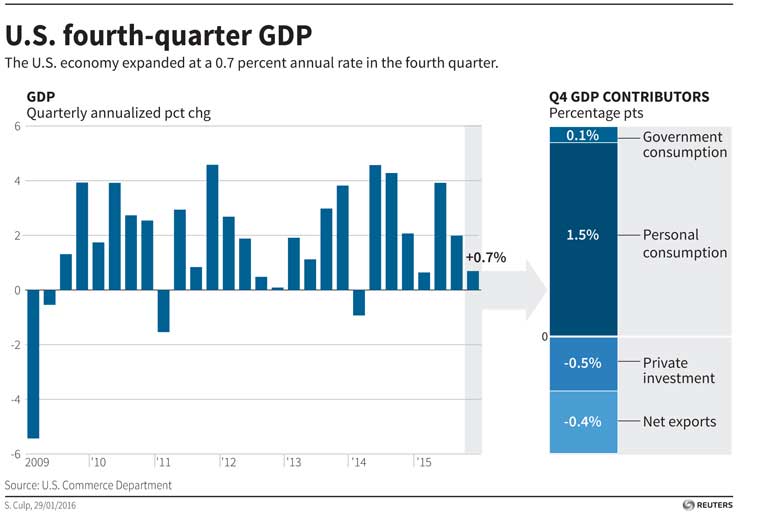

(Reuters) - U.S. economic growth braked sharply in the fourth quarter as businesses stepped up efforts to reduce an inventory glut and a strong dollar and tepid global demand weighed on exports.

(Reuters) - U.S. economic growth braked sharply in the fourth quarter as businesses stepped up efforts to reduce an inventory glut and a strong dollar and tepid global demand weighed on exports.

Gross domestic product increased at a 0.7% annual rate, the Commerce Department said on Friday in a report that showed a further cutback in investment by energy firms grappling with lower oil prices. Growth in consumer spending also slowed as unseasonably mild weather cut into spending on utilities.

But with the labor market strengthening and some of the impediments to growth largely temporary, economists expect output to pick up in the first quarter of 2016. First-quarter growth estimates are for now mostly above a 2% rate.

“The economy took its lumps late last year. It’s not going to be smooth sailing in 2016, but we don’t see the ship sinking either, and the rising concern about a recession later on this year triggered by China, those fears need a reality check,” said Chris Rupkey, chief economist at MUFG Union Bank in New York.

The Federal Reserve on Wednesday acknowledged that growth “slowed late last year,” but also noted that “labor market conditions improved further.” The U.S. central bank raised interest rates in December for the first time since June 2006.

Though the Fed has not ruled out another hike in March, weaker growth and financial markets volatility could see that delayed until June. Excluding inventories and trade, the economy grew at a 1.6% pace in the fourth quarter.

The fourth-quarter growth pace was in line with economists’ expectations and followed a 2% rate in the third quarter. The economy grew 2.4% in 2015 after a similar expansion in 2014.

The GDP data, together with a surprise decision by the Bank of Japan to cut a benchmark interest rate below zero in a bold move to stimulate the Japanese economy, buoyed the dollar against a basket of currencies. Prices for U.S. Treasuries rose and U.S. stocks were trading higher.

In the fourth quarter, businesses accumulated $68.6 billion worth of inventory. While that was down from $85.5 billion in the third quarter, it was a bit more than economists had expected, suggesting inventories could remain a drag on growth in the first quarter.

The small inventory build subtracted 0.45%age point from the first estimate of fourth-quarter GDP growth.

Consumer spending, which accounts for more than two thirds of U.S. economic activity, increased at a 2.2% rate. Though that was a step-down from the 3.0% pace notched in the third quarter, the gain was above economists’ expectations.

Unusually mild weather hurt sales of winter apparel in December and undermined demand for heating through the quarter.

With gasoline prices around $2 per gallon, a tightening labor market gradually lifting wages and house prices boosting household wealth, economists believe the slowdown in consumer spending will be short-lived.

“The consumer will continue to power ahead, as spillovers from the weak mining and manufacturing sector to services industries remain limited,” said Harm Bandholz, chief U.S. economist at UniCredit Research in New York.

Income at the disposal of households after accounting for taxes and inflation increased 3.2% in the fourth quarter after rising 3.8% in the prior period. Savings rose to a lofty $739.3 billion from $700.6 billion in the third quarter.

While a separate report from the University of Michigan showed a dip in its consumer sentiment index in January because of the recent stock market sell-off, consumer optimism remained at levels consistent with steady economic growth.

The dollar, which has gained 11% against the currencies of the United States’ trading partners since last January, remained a drag on exports, leading to a trade deficit that subtracted 0.47%age point from GDP growth in the fourth quarter.

The downturn in energy sector investment put more pressure on business spending on nonresidential structures. Spending on mining exploration, wells and shafts dropped at a 38.7% rate after plunging at a 47.0% pace in the third quarter.

Investment in mining exploration, wells and shafts fell 35% in 2015, the largest drop since 1986.

As oil prices appear to level off, the energy sector drag on the economy is expected to ease in the coming quarters. Oil prices have plummeted more than 60% since mid-2014, forcing oil field companies such as Schlumberger and Halliburton to slash their capital spending budgets.

Business spending on equipment contracted at a 2.5% rate last quarter after rising at a 9.9% pace in the third quarter. Investment in residential construction remained a bright spot, rising at a 8.1% rate.

With consumer spending softening, inflation retreated in the fourth quarter. A price index in the GDP report that strips out food and energy costs increased at a 1.2% rate, slowing from a 1.4% pace in the third quarter.