Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 10 August 2015 00:00 - - {{hitsCtrl.values.hits}}

Reuters: Top Wall Street banks still expect the Federal Reserve to raise interest rates in September, but a growing number now believe the central bank is likely to only hike once this year, a Reuters poll found on Friday.

13 of 19 primary dealers or the banks that deal directly with the Fed, polled said they expect the Fed to raise rates by September but just nine now believe the Fed will hike rates twice in 2015, compared with 15 of 20 in the July Reuters poll.

The median expectation for where the federal funds rate will end the year was 0.5% and 1.5% for 2016. For a table, click here:

The central bank has kept rates at a near-zero level since December 2008 as part of its effort to spur the recovery from the 2007-2009 financial crisis.

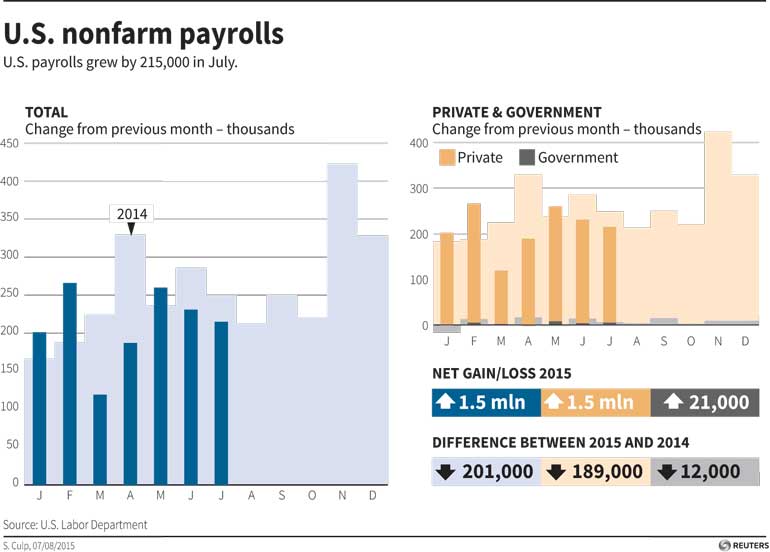

Friday’s jobs report, which showed US nonfarm payrolls increased by 215,000 in July, pointed to an improving economy and bolstered the case for a September hike.

“If we continue to get this type of trend-like data, we will get a hike next month,” said Joe LaVorgna, chief US economist at Deutsche Bank.

While most of the primary dealers continued to expect a September hike, some with increased conviction, BNP Paribas and Nomura pushed their rate hike expectations to December from September.

Five of the participants who in July said they expected two rate hikes this year now see only one. Currently less than half those surveyed expect two hikes this year.

In early July, Credit Suisse scaled back its rate hike expectation for 2015 to one from two, citing challenges to its previously held views on quickening labour income growth and a second-half rebound in global manufacturing.

“While things have turned the turns have not been conclusive enough for us to revert back to the previous call,” said Dana Saporta, economist at Credit Suisse. The Fed has long emphasised that it expects to raise interest rates only gradually, unlike the last rate-hike cycle, when policymakers raised borrowing costs slightly at successive meetings.

Federal Reserve officials are still undecided on whether to raise interest rates next month, but they are growing more comfortable with the idea, as an improving labour market makes it harder to justify historically low rates.

JAKARTA (Reuters): Indonesia wants the US Federal Reserve to hurry up and raise interest rates because uncertainty over when it will tighten has created downward pressure on the rupiah, the country’s chief economics minister said.

Sofyan Djalil, coordinating minister for economics, told Reuters that he did not see the rupiah dropping when the US tightening does come because the move has been built into market expectations, and in fact the currency is now undervalued.

The Federal Reserve has kept rates at a near-zero level since December 2008 as part of its effort to spur the recovery from the 2007-2009 financial crisis.

Fed officials are still undecided on whether to raise rates next month. However, data released on Friday showed US non-farm payrolls increased by 215,000 in July, pointing to an improving economy and bolstering the case for a September hike.

The rupiah has been emerging Asia’s second-worst performing currency so far this year, falling by more than 8% against the dollar. It hit its lowest level since the Asian financial crisis in 1998 multiple times this year, with Friday being the latest when it touched 13,542 per dollar.

“I wish the Fed will decide and the sooner is the better for Indonesia because the uncertainty gives ... the financial market a good legitimacy to play around,” Djalil said in an interview late on Friday.

Due to its sizeable current account deficit, Southeast Asia’s largest economy was one of the worst hit by outflows when the Fed first announced a plan to taper off its monetary stimulus in 2013.

The rupiah fell by more than 20% against the dollar that year and the country was dubbed one of the ‘fragile five’.

Indonesia’s current account gap has shrunk since then and is predicted to fall to a level the central bank, Bank Indonesia, considers healthy at below 2.5% of gross domestic product (GDP) in 2015.

Djalil said Indonesia’s fundamentals are good but the current weakness of the rupiah is because markets have priced in a 25-50 basis point increase in the Fed’s rate.

“Our rupiah is undervalued,” he said.

Bank Indonesia expects capital inflows after the US rate increase and that the financial market will see Indonesia’s positive side again, Senior Deputy Governor Mirza Adityaswara said on Friday.