Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 18 August 2021 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka’s startup ecosystem has grown significantly over the past 15 years, benefitting greatly from a fast-growing ICT sector, high rates of literacy, the brain gain of highly qualified ICT professionals returning home, etc. As a result, the Government of Sri Lanka (GoSL) is today well-positioned to take advantage of the major opportunities presented by the local startup sector, helping forge a clear path for this nation to become Asia’s next startup and innovation hub.

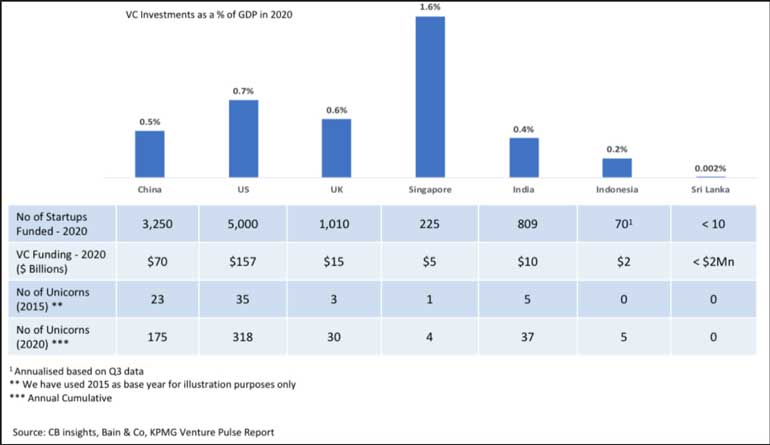

However, the biggest stumbling block to these future aspirations for Sri Lanka is a shortage of much-needed funding. Over the past 10 years, Sri Lanka has on average shown venture funding of only $ 2.5 million per year, whereas startup hubs in Asia, and beyond, have recorded funding levels close to 0.5% of GDP per annum. So, as a first step, Sri Lanka should aim to gradually increase its funding environment to target 0.1% of GDP, or approximately $ 80 million, during the 2022/2023 financial year.

To attract investors and growth capital, Sri Lanka also needs to greatly improve its startup infrastructure, for example by ensuring internet for every citizen, by promoting a higher level of digitisation across all services that aid in the growth of startups, and by improving venture funding structures aimed at attracting more FDIs to come in. These initiatives, along with the country’s largely untapped potential as a test market for startups gearing up for international growth, will put in place a winning strategy that will prove invaluable to investors looking for new markets.

Another way to attract investment is the setting up of several venture funds, possibly regulated by the Ministry of Finance, to make investments within the startup sector. Targeting growth stage funding for startups, these funds could potentially feature a minimum size of Rs. 200 million, as well as at least 10 investors, with a three-year lock-in period for investments. Investments made by these funds would ideally be made in startups at the Impact, Incubation, Angel or Venture Capital stages, so the best outcomes may be achieved.It would also be a big plus for potential investors if they were awarded tax exempt status such as in other leading countries that attract FDIs for startups. In these countries, the investors are given tax exempt status provided they invest for the life of the fund. The fund’s structure in these countries does not allow double taxation, i.e. at the fund level and at the investor level. These exemptions for investors, as well as the easing of foreign exchange restrictions on them, could greatly contribute towards boosting Sri Lanka’s overall investment climate.

Ultimately, when venture funds exit their foreign investments, capital and profits will be returned to Sri Lanka. So, the value of investments, in addition to the overall pool of investable capital, available to locally-based funds will increase accordingly. GoSL could nominate the Board of Investments (BOI) of Sri Lanka, or a likeminded institution, as the governing body to manage compliance of venture funds that are set up in Sri Lanka. Since many venture funds will want to invest in startups hoping to expand internationally, these investees could use their BOI accreditation as a mark of credibility when entering foreign markets.

The private sector, also encompassing programs such as Venture Engine, is committed to continuing its role in providing support to the government by shining a spotlight on Sri Lanka’s many successes in the startup sector. Some successful startups to come out of this program are Roar, InsureMe, Zigzag.lk, Stripes & Checks, and Skrumptious. This will, in turn, widen and broaden the scope of investors and growth capital attracted to the country. According to BOV Capital Co-Founder Prajeeth Balasubramanian, “A startup acceleration program like Venture Engine, Sri Lanka’s pioneering investor conclave, plays a central role in creating a vibrant and diverse local ecosystem, by inviting local industry leaders as well as High Net-worth Individuals (HNIs) from across the region and even the world to participate in investor days and pitching sessions.”

An initiative like Venture Engine has not just helped in attracting investors and raising capital, it has also provided access to international networks and mentorships, all of which has proven essential to startups taking their first few steps in the field.

Scheduled to launch its newest edition at the beginning of September 2021, and organized by BOV Capital, Venture Engine has to date hosted marquee investors from a number of international VCs. Past attendees have represented Avendus Capital, Accel, Sequoia Capital, Aavishkaar, Khazanah, Temasek, Crescent Group, 500startups, Lightbox Ventures, Jungle Ventures, Waterbridge Ventures, Unicorn India Ventures, Omidyar Network, TVS Capital, Gulf Islamic Investments, Morph Ventures and Striders Capital. Heavyweights like Google, Microsoft and Uber, as well as associations like the Indian Angel Network and the Singapore Angel Network, have also participated.