Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 12 October 2015 00:00 - - {{hitsCtrl.values.hits}}

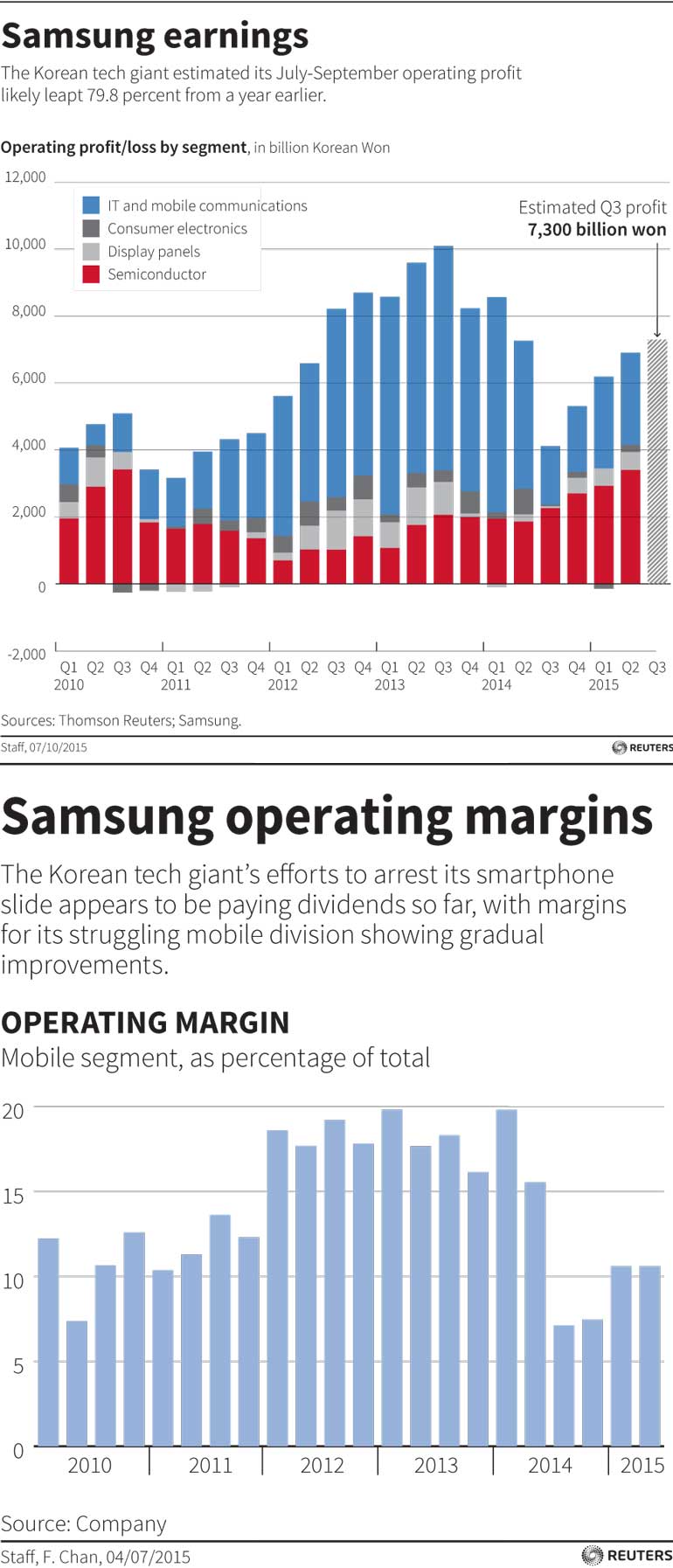

Reuters: Samsung Electronics Co Ltd forecast a sharp jump in quarterly profit, trumping expectations and sending its shares surging as favourable currency rates and robust component sales appeared have to offset weakness in smartphones.

The extent of the expected quarterly profit gain, its first in two years, will do much to allay concerns that the South Korean tech giant’s earnings would not be able shake off the loss of smartphone market share to Apple Inc in the premium segment and to Chinese rivals at the lower end.

Samsung Electronics estimated July-September operating profit would leap 80% from a year earlier to 7.3 trillion won ($ 6.3 billion), higher than a 6.7 trillion won profit Thomson Reuters Smart Estimate derived from 30 analysts.

“There were worries that overall earnings will continue falling as mobile profits declined, but now the numbers make the case that Samsung has the capacity to withstand weakness from the mobile business,” said IBK Securities analyst Lee Seung-woo.

Its stock jumped 8.7%, the biggest daily percentage gain in nearly seven years. But it remains down 5.7% so far this year, underperforming a 4.7% advance for South Korea’s benchmark index due to the long-standing worries about its earnings outlook.

The world’s No.1 maker of smartphones and memory chips guided for a 7.5% revenue increase for the third quarter, in line with expectations. It gave no further details about its performance, and will disclose full results in late October.

A 12% depreciation of the average won exchange rate against the dollar in the third quarter was widely cited as a key factor behind the bullish earnings forecast. Dongbu Securities analyst Yoo Eui-hyung estimated the favourable currency rate added about 300 billion won to operating profit.

Analysts also said Samsung’s chip division likely remained its top profit contributor for a fifth straight quarter due to new smartphone launches from a range of manufacturers, while display profits were probably helped by rising sales to clients such as Huawei Technologies Co Ltd.

And while Samsung has yet to regain lost market share, smartphone earnings likely improved from a year earlier on the back of new lower-end models and the August launch of the Galaxy Note 5 – a premium large screen phone.

South Korea’s top two mobile carriers, SK Telecom Co Ltd and KT Corp, also said Samsung will cut prices for Galaxy S6 models by as much as 124,300 won starting Thursday – a move that could boost sales volume but also hurt margins. Samsung declined to comment on the price cuts.

HDC Asset Management fund manager Park Jung-hoon said fourth-quarter operating profit would probably ease from the third quarter due to higher smartphone marketing bills ahead of the year-end holidays.

Reuters: Tech giant Samsung Electronics Co Ltd said its Samsung Pay user data is safe after a hacking attack against a US-based subsidiary that developed a key technology for its newly-launched mobile payments system.

Disclosure of the attack, first reported by the New York Times on Wednesday, comes less than two weeks after Samsung Pay’s launch in the United States. The world’s top smartphone maker hopes the convenience provided by the payments system can help it defend shrinking market share and margins.

“The LoopPay corporate network issue was resolved immediately and had nothing to do with Samsung Pay,” Samsung said in a statement.

Chinese hackers gained access to LoopPay’s office network around March and the breach was discovered in August, Samsung said. LoopPay developed the technology enabling Samsung Pay to work with magnetic-stripe card readers prevalent at retail stores, seen as a key advantage over similar services from Apple Inc and Google Inc.

The South Korean firm said Samsung Pay was operated by its own mobile division and was on a physically separate network to LoopPay’s, giving the hackers no access to user data or other core information.

The three compromised LoopPay servers did not store sensitive information including technologies developed by the firm. Yuanta Securities analyst Lee Jae-yun said the hack could nevertheless trigger security concerns and slow user adoption of Samsung Pay.