Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 6 March 2017 00:02 - - {{hitsCtrl.values.hits}}

BARCELONA (Reuters): Once famous mobile phones such as Nokia’s classic 3310 from the turn of the century have been given a new lease of life as  Chinese manufacturers revive Western brands to get an edge in an increasingly cut-throat handset market.

Chinese manufacturers revive Western brands to get an edge in an increasingly cut-throat handset market.

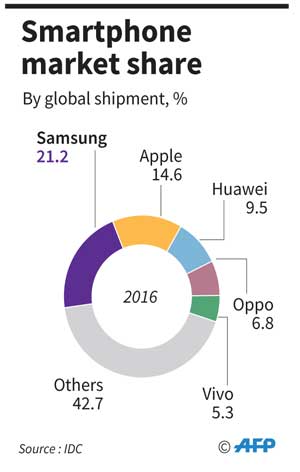

Apple and Samsung lead the smartphone pack worldwide but impressive growth in the Chinese market has left room for a host of home-grown manufacturers to come to the fore, with China’s Huawei now third in the world.

Within China, Oppo surged to become market leader last year and it is expanding rapidly in Asia to stand fourth in the world rankings, even if its brand is little known in developed and increasingly stagnant Western markets. A closely related Chinese brand, Vivo, has muscled its way into fifth place globally.

What this means, though, is that former Chinese market leaders, such as Lenovo and TCL Communications, are losing ground, and some are counting on retro Western brands to revive their fortunes at home and abroad.

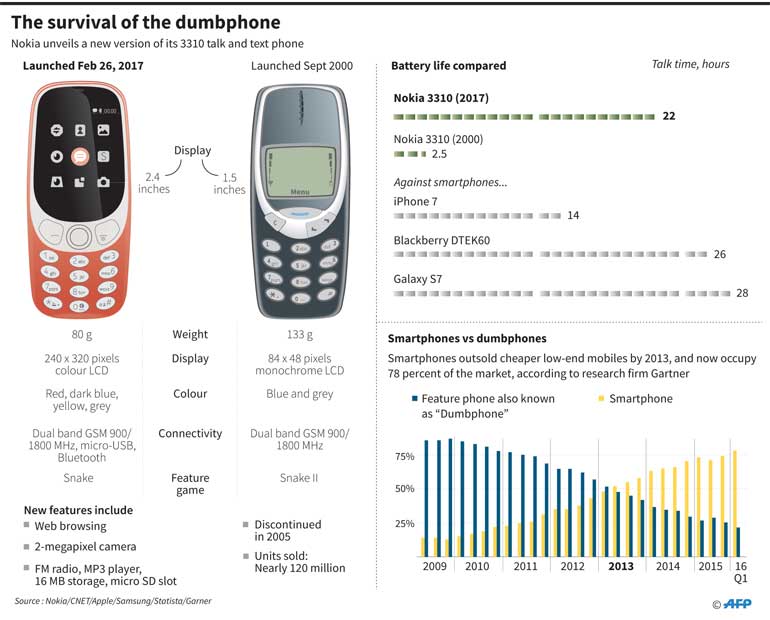

Emerging from a sea of indistinguishable smartphones, the showstopper at this year’s main European technology trade fair was a revival of the Nokia 3310, its brightly coloured cases and month-long battery life tugging at the heartstrings of erstwhile fans in search of a digital detox.

The new phone was launched by Finnish firm HMD Global, led by former Nokia executives and backed financially by Chinese electronics giant Foxconn, which makes devices for Apple and Sony, among others.

Priced at 49 euros, the 3310 is meant to appeal to old fans in the West as well as finding a new generation of younger users in emerging markets looking for a good-looking reliable phone.

The BlackBerry made a splash at the Barcelona trade fair too thanks to China’s TCL Communication, which unveiled a BlackBerry-licensed handset with the physical keyboard many professionals clung onto even as Apple’s iPhone revolutionised the smartphone market. BlackBerry Ltd supplies the phone’s security software.

TCL, which is part of a group that makes appliances ranging from TVs to washing machines, has kept France’s Alcatel brand alive for a decade. TCL-Alcatel is now the world’s 10th biggest smartphone maker, according to research firm Strategy Analytics.

International expansion

Lenovo, the world’s third largest mobile phone supplier in 2014 when it acquired US cellphone pioneer Motorola, has subsequently sunk to ninth globally but is counting on Motorola as its premium smartphone brand to battle back.

The Chinese firm is even open to following in Nokia’s footsteps and reviving the retro, flip-top Motorola Razr, which was the second best selling phone in the world in 2004 and 2005.

Lenovo Chief Executive Yang Yuanqing told CNBC this week that launching a revamped Razr could be a way of bringing customers back to the Motorola brand as it tries to drive into developed markets such as the United States.

The Philips handset brand also lives on in India and China after the Dutch firm licensed its brand to Sang Fei, a subsidiary of TPV Technology, which also makes Philips television sets.

For now, though, the top Chinese phone makers such as Huawei, Oppo and Vivo, look set on developing their own brands in a domestic market that is still growing even as demand in developed economies plateaus.

China accounted for more than a third of the world’s mobile phones shipped last year and domestic firms still had 90% of sales, according to a government report.

But as the market becomes overrun with me-too smartphones and margins evaporate, rivals may spot more opportunities to leapfrog rivals by capitalising on familiar Western brands, said Strategy Analytics analyst Neil Mawston.

“As the Chinese market peaks and organic growth becomes harder, these brands may consider takeovers as the fastest way to speed up their expansion,” he said, referring to moves overseas.

“At some point, either Huawei, Vivo or Oppo may come to the point where buying an existing international brand is their best way to expand,” Mawston said.

Analyst say possible targets could include famous phone brands fallen on hard times including Japan’s Sony or Taiwan’s HTC.

“It could well be that we see more brands of yesteryear picked up by Chinese brands,” said phone industry analyst Ben Wood of CCS Insight. (Additional reporting by Georgina Prodhan; editing by David Clarke)