Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 22 October 2015 00:00 - - {{hitsCtrl.values.hits}}

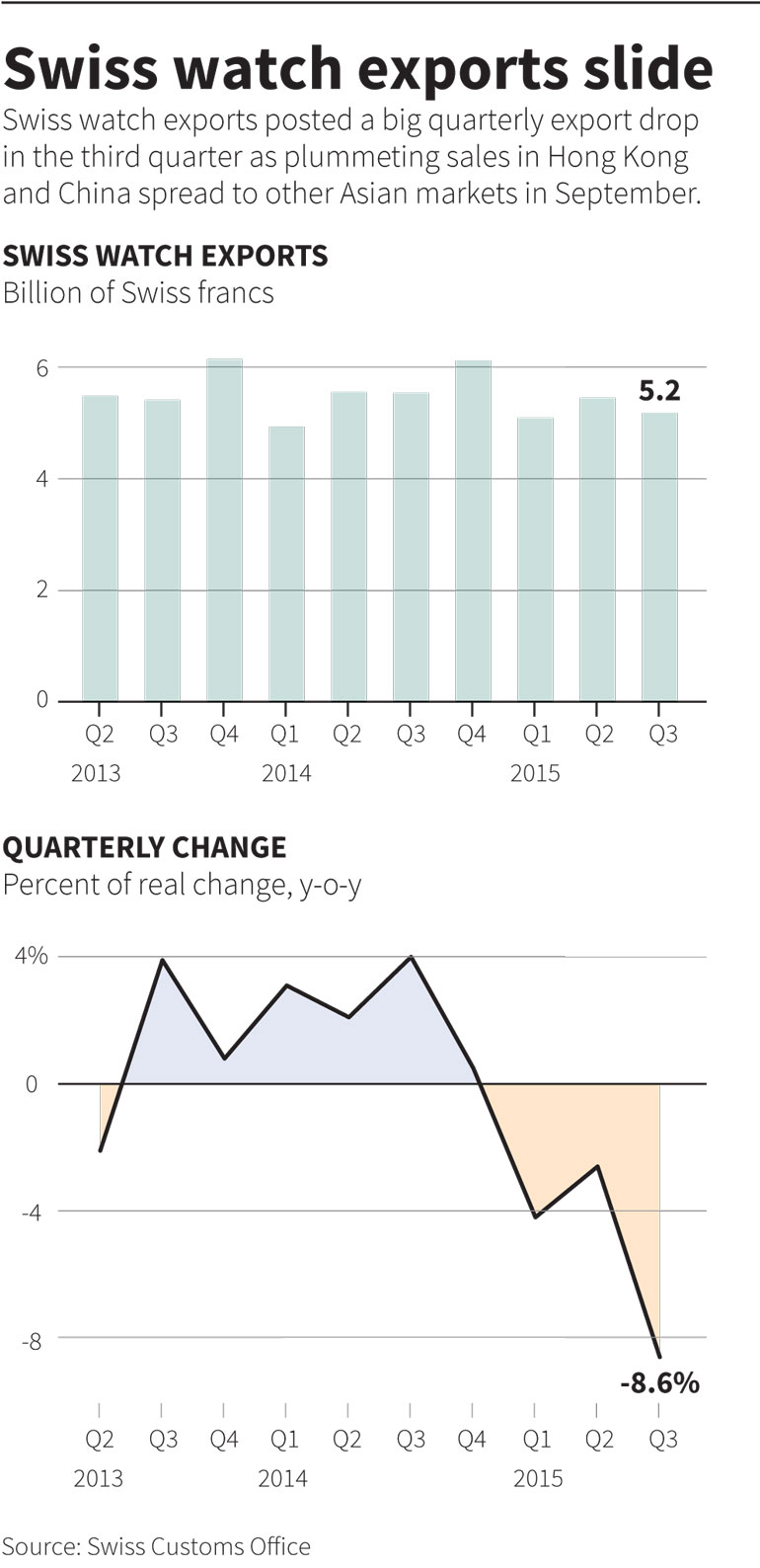

ZURICH (Reuters): Swiss watch exports posted the biggest quarterly export drop since 2009 in the third quarter as plummeting sales in Hong Kong and China spread to other Asian markets in September.

“After May and July, September is the third month to show a marked decline in Swiss watch exports,” the Federation of the Swiss Watch Industry (FH) said on Tuesday. “This negative change has spread to other, hitherto more robust Asian markets, and casts something of a shadow over prospects for the year 2015.”

Watch exports were down a real 8.5% for the third quarter after falling 9.9% in September and 10% in July, the Federal Customs Office said on Tuesday.

Sales in Asia declined 12.7% in September, as continued drops in Hong Kong, China and Singapore were compounded by sharp turnarounds in Taiwanese and Emirati sales and a dive in South Korean sales from negative 3.7% in August to negative 35% in September.

Analysts at Kepler Cheuvreux said the poor performance could be pegged to tough comparables in the previous year and continuing effects of a deadly SARS virus outbreak earlier this year.

Apple watch

At 1.814 billion Swiss francs ($ 1.91 billion), September watch sales abroad significantly undershot analysts’ expectations, posting declines that were double to triple what analysts had forecast.

Timepieces in all price segments were impacted, but watches in the low to mid-segment took the biggest hit. The 200-500 franc export category slipped 14.5%, igniting concerns that the Apple Watch could finally be taking a bite out of the Swiss industry’s stake.

On Friday, Bank Vontobel released a sector report highlighting Swatch Group’s particular smartwatch exposure, with its mid-range brand Tissot and lower range own label, Swatch.

“Swatch Group is the only (Swiss) player which also has a strong position in low to mid-end segments,” Vontobel said. “Swatch Group has a market share of 60-65% in the low to mid-end (accounting for 25% of sales).”

But Vontobel analysts remained optimistic that, due to the group’s technology know-how, it would offer its own smartwatch offerings to compete with the Apple Watch and its likes.

Last week, Swatch launched its first payment watch in China, beating Apple to the plate. Earlier this year, it launched a beach volleyball-themed smartwatch, but CEO Nick Hayek has said the group doesn’t intend to produce smart phones for the wrist.