Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 5 October 2021 01:51 - - {{hitsCtrl.values.hits}}

Prateek Roongta

Natarajan Sankar

Chilman Jain

Kanika Sanghi

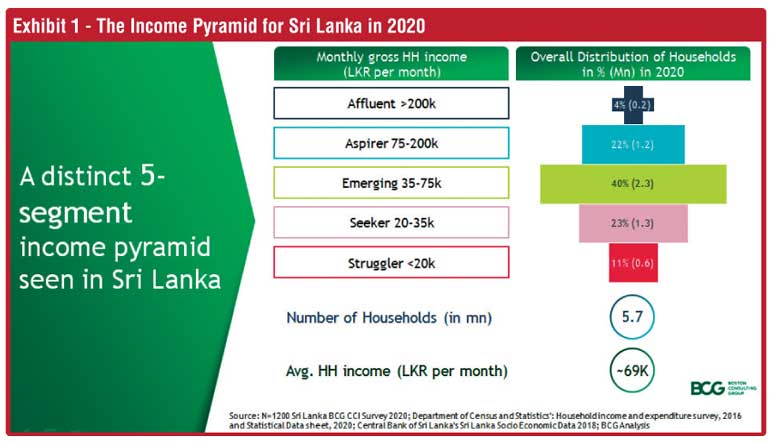

Boston Consulting Group’s Center for Customer Insight (CCI) administered a consumer survey in November 2020 in Sri Lanka. BCG Managing Director and Partner Prateek Roongta, BCG Managing Director and Partner Natarajan Sankar, BCG Principal Chilman Jain, and BCG Center for Customer Insight Partner and Associate Director Kanika Sanghi, share key insights in a series of curated articles centred on four themes: Sri Lanka’s income pyramid, consumer choices specific to brands and channels, digitisation and digital banking. In the first part, the authors take the readers through nuances of Sri Lanka’s income segments, consumption patterns and the rural-urban divide.

Our sampling framework ensures that the study is truly representative of the country’s population. Over 1,200 Sri Lankans were interviewed in-person, with respondents spanning across four districts and diverse demographics (SECs, gender, and age). Consumers from urban as well as rural regions were part of the sample set.

The Sri Lankan population can be segregated into distinct income segments, with differing preferences for consumption, location, spending, etc. To better elucidate these income segments, we draw a picture of two Sri Lankan households.

Dinesh is a 27-year-old mechanic at a large auto-workshop in Colombo. His wife is a homemaker and their monthly income is about Rs. 30 k. The couple stays in a rented one-bedroom accommodation and owns a bicycle. Their savings are negligible as they can barely make ends meet. They are trying to start a family but are constrained by their income. On the other hand, Sulochana is a 30-year-old restaurant owner in Colombo. She inherited the business from her father and is married to a doctor. The couple’s collective monthly income is over Rs. 400 k and they own several assets — cars, laptops, smartphones, appliances, and a house. They are saving to move into a bigger house.

While both Dinesh and Sulochana are in the same age bracket, and were born and raised in Colombo, their stories are contrasting, given the vast income differential between them. To truly harness the Sri Lankan market’s potential, it is imperative to understand the nuances of these distinct income segments and their discrete consumption behaviours.

We saw that asset ownership and consumption habits were closely related to household (HH) income in Sri Lanka. We observed a step jump in durables ownership and service penetration across four HH income points – Rs. 20k, 35k, 75k and 200k per month. We refer to these income segments as Struggler (HH income

Three key insights emerge from our findings:

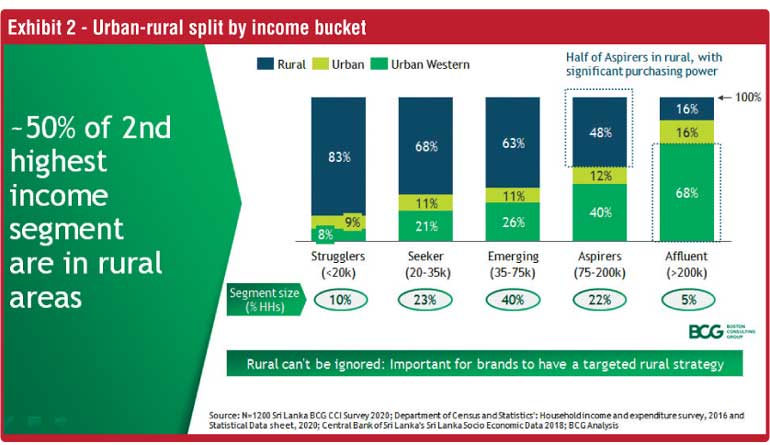

50% of the ‘Aspirers’ are in rural areas, with significant purchasing power

First, the income trend across urban-western (Colombo city), urban (municipal council and town council areas) and rural (all other areas) is telling. While 70% of the Affluent are in the Urban-Western, 50% of the second highest income segment reside in rural Sri Lanka (see Exhibit 2). This underscores a key imperative — rural population cannot be ignored. A distinct urban-rural divide necessitates a differentiated go-to-market strategy, to drive sales among consumers belonging to the rural section.

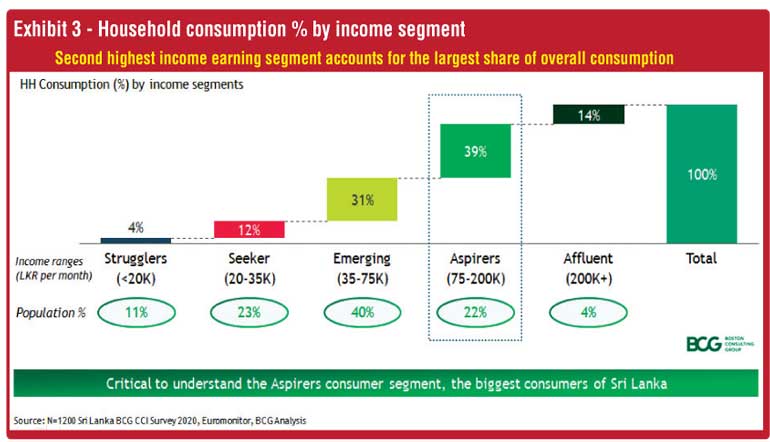

Aspirers lead the overall consumption race with ~40% share, while Affluent section significant for urban consumption

Second, analysis of each segment’s overall household spend reveals that Aspirers contribute the highest to national consumption. Nearly 40% of Sri Lanka’s consumption expenditure comes from this segment (see Exhibit 3). On the contrary, less than 15% of the spending on goods and services comes from the Affluent. Nevertheless, it accounts for one-fourth of the urban consumption. Targeted marketing campaigns and products are potential approaches for brands to prosper in both these segments.

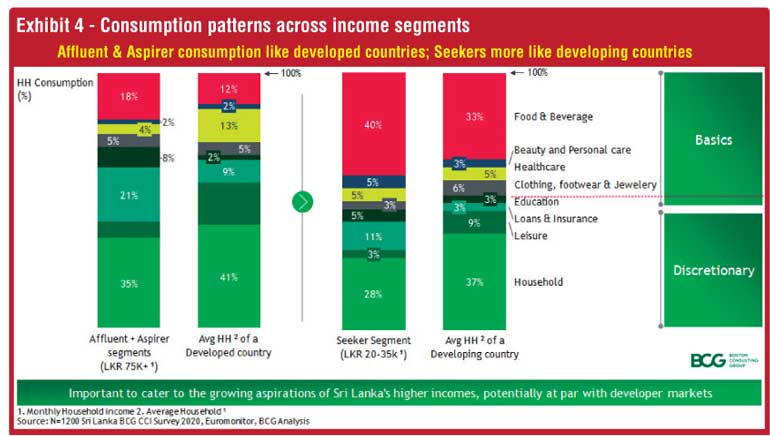

Behaviour of Affluent and Aspirers akin to developed countries

Thirdly, studying the consumption patterns of the different income segments reveals that the higher income segments, i.e. Affluent and Aspirers, have a similar split across basic and discretionary spending as that of an average household in a developed country. Conversely, the Seekers demonstrate behaviour similar to consumers in developing countries (see Exhibit 4). Wealthy consumers have growing aspirations and strive for a better standard of living. To tap into this segment, it is pivotal that brands cater to their changing demands, potentially at par with the developed markets.

We highlight three key takeaways for brands from the detailed study, below:

(Boston Consulting Group is a premier global management consulting firm founded in 1963. BCG partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities.)

(This one is the first article of the four-part series.)