Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 28 October 2021 00:57 - - {{hitsCtrl.values.hits}}

|

| BCG Center for Customer Insight Partner and Associate Director Kanika Sanghi |

|

| BCG Principal Chilman Jain |

|

| BCG Managing Director and Partner Natarajan Sankar |

|

| BCG Managing Director and Partner Prateek Roongta

|

Brand consciousness and loyalty is contingent on a host of factors. Simultaneously, consumer behaviour is intrinsic to any purchase and plays a pivotal role in shaping the “buying” decision. Understanding the nuances of consumer behaviour is, therefore, crucial for brands and retailers.

From this perspective, the Sri Lankan consumer mindset is unique. Consumers in Sri Lanka exhibit different buying behaviours when compared to other geographies. Heterogeneous patterns of shopping across regions and distinct channel perception are some peculiar traits of consumers in Sri Lanka. In this article, we highlight the key imperatives for brands to craft the right brand and channel strategy for the Sri Lankan consumers.

The survey, taking hundreds of variables into account, revealed several insights. We share three select insights, which we perceive as most relevant to Sri Lankan retailers today.

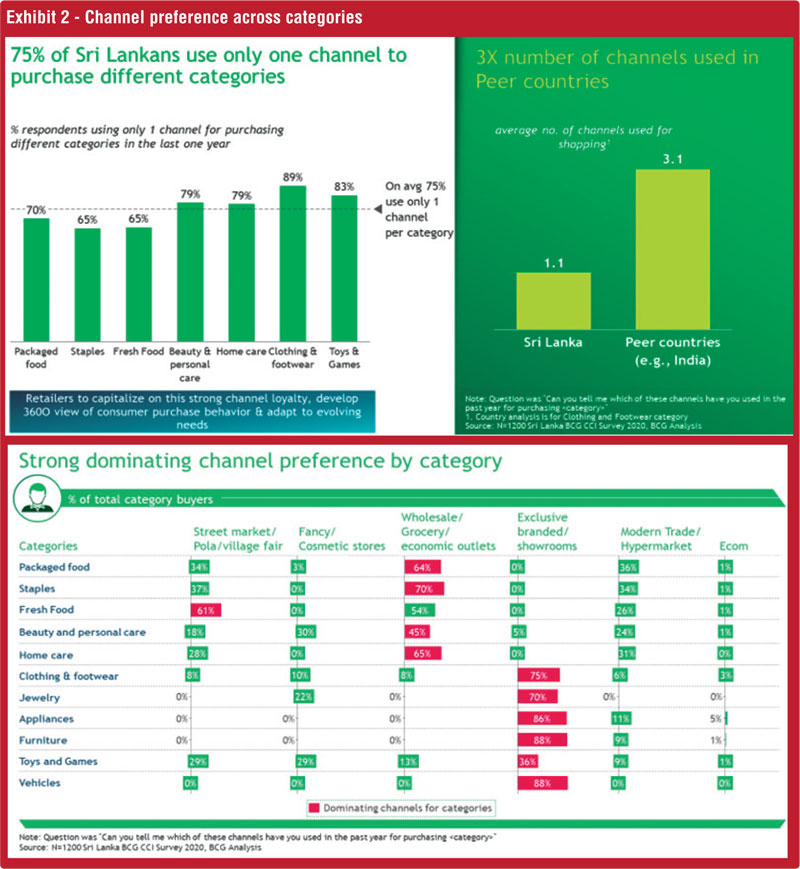

Brand loyalty varies widely by product category; brand consciousness is predominantly similar across categories

Before we deep dive into the details, understanding certain terminologies is important. While brand loyalty refers to a consumer relying exclusively on one brand to fulfil their requirements, brand consciousness denotes a consumer exhibiting preference for two to three brands.

We see a wide variance in brand loyalty across product categories. For instance, there is a significant brand loyalty for electronics, with over 50% respondents saying they stick to one brand. Apparels on the other hand, exhibit low single-brand preference with only 7-9% respondents showing affinity towards a particular make.

“Brand consciousness” is similar across categories, implying that factors such as product quality and brand affinity are crucial to Sri Lankan consumers, despite an indifference between brands themselves.

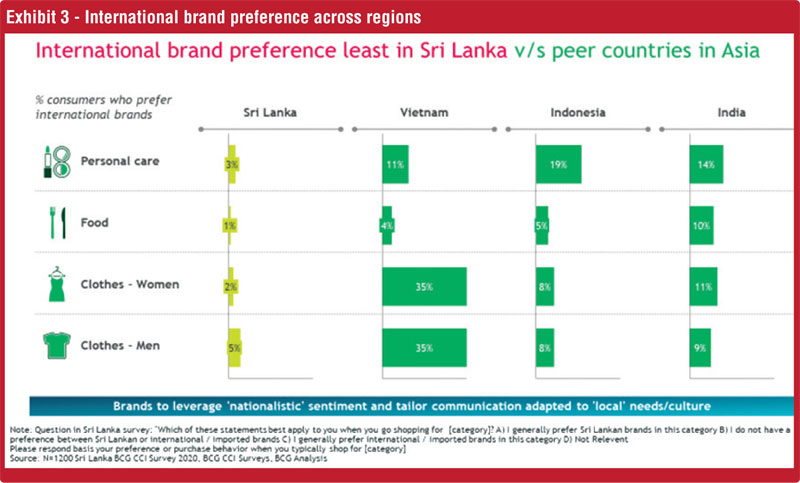

Majority of Sri Lankan buyers use only one channel per product category

Consumers today, have a host of channels at their disposal to make a purchase – street markets, modern trade, exclusive brand stores, wholesale outlets and e-commerce, etc. We see channel loyalty emerging as a key attribute specific to Sri Lankans, with ~75% consumers using only one channel to purchase for a given product category. This trend is evident across many categories such as food, personal care, home care, clothing, and games.

Within each category, there is a strong inclination towards a specific channel. For instance, over 70% consumers prefer exclusive branded outlets for clothing and footwear, jewellery, appliances, furniture, and vehicles, and over 65% prefer wholesale/grocery/economic outlets for packaged foods, staples and homecare goods.

Additionally, there is a clear penchant for street fairs/“polas” for fresh food, and cosmetic stores for beauty and personal care products. On the contrary, consumers in peer countries such as India, on an average, shop on three channels per category.

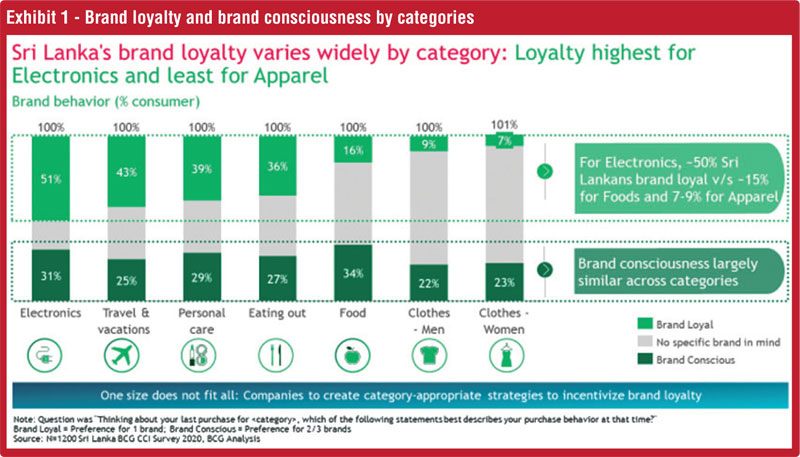

Low appeal of international brands

Majority of Sri Lankan buyers either do not fancy international brands or perceive them as irrelevant, whether the brand is Sri Lankan or foreign. This is in stark contrast to other emerging Asian economies such as Vietnam and India where preference for global brands is much higher. In case of everyday products, such as those in the personal care and food segments, nearly 50% Sri Lankans prefer local brands.

However, it remains to be seen whether the nationalistic response is premised on perceived benefits (price, quality, etc.) or patriotism.

In view of these insights, three key implications emerge for retailers in Sri Lanka

It is imperative for brands and retailers to recognise these behaviours and build a robust positioning in different categories, in accordance with the brand/channel behaviour demonstrated by consumers.

[Our sampling framework ensures that the study is truly representative of the country’s population. Over 1,200 Sri Lankans were interviewed in-person, with respondents spanning across four districts and diverse demographics (SECs, gender, and age). Consumers from urban as well as rural regions were part of the sample set.]

(Boston Consulting Group is a premier global management consulting firm founded in 1963. BCG partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities.)