Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 19 June 2018 00:00 - - {{hitsCtrl.values.hits}}

For many organisations the brand is an invisible asset that is often not a part of discussions at board meetings. Since the brand is not reflected on the balance sheet, management and owners entirely overlook it and the responsibility of managing it devolves by default, to the marketing department.

The brand is wrongly viewed as a solely marketing tool requiring significant investment in advertising and promotions to build. Because of this, businesses are missing out on the use of an important value creating asset, which can be deployed to create greater business value.

What is a brand?

In Brand Finance’s definition brand is an intangible asset which creates a distinctive image and associations in the minds of all of stakeholders of a business, thereby generating economic value.

The operative words are the “creation” of a distinctive image and associations, which are the “perceptions” associated with that brand. These are not familiar terms for numbers based financial analysts, but is key to understanding the power of brand value creation.

The way brand value is created is by building close relationships across all of the stakeholders of a business. Such as employees (who prefer to work in companies with strong brands -often at lower salaries), suppliers (who often provide favourable financial terms to secure and retain that well branded businesses), bankers and lenders (who would lend at lower rates, secure that their investments will be paid back) and consumers who are more likely to purchase and would be willing to pay a slightly higher price premium relative to lesser branded competitors.

Brand strength translates to shareholder value

Brand Finance Lanka has been annually publishing Sri Lanka’s most valuable brands for 15 years, which has relevant historic data. In order to prove the point of the value creating potential of the brand, we have taken a retrospective look at the movement of share price of the brands we have assessed over a five-year period. From which a compelling link emerges between strong brands and share price performance on the Colombo Stock Exchange.

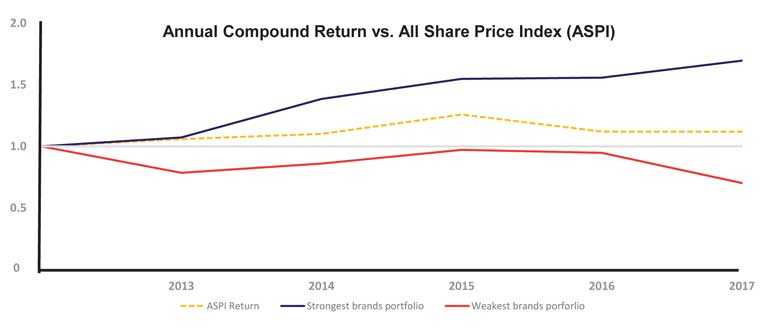

In order to determine the strength of a brand we use the Brand Strength Index (BSI) which analyses marketing investment, brand equity (the goodwill accumulated with customers, staff and other stakeholders) and the impact of business performance. Following this analysis, each brand is assigned a BSI score out of 100, which is fed into the brand value calculation. Based on the score, each brand in the league table is assigned a rating between a high of AAA+ and a low of D in a format similar to a credit rating. Brands from the Sri Lanka league table were selected to create the strongest and weakest brand portfolio weighted by market capitalisation. The weighted annual compounding return of these two portfolios were then compared against the All Share Price Index (ASPI) annual compounding return to identify the performance year over year.

The finding from our analysis clearly establishes that the strongest branded businesses on the Brand Finance Sri Lanka league table (those which have a AAA and AA+ brand rating) outperformed the weaker brands(BBB brand rating)and the All Share Price Index (ASPI).Between 2013 and 2017, the average return across the ASPI was 12%. However by using Brand Finance’s data, an active investor would have generated a return of up to 70% for the strongest brands whilst an investment in the weakest brands would have generated a negative return of -30%.

It has long been acknowledged that powerful brands drive consumer or customer choice, improving business performance and ultimately increasing shareholder value. We have now been able to quantify this effect in Sri Lankan brands, through the data we have collated over the years.

How perceptions drive value

The power of the brand is in its multiplier effect across the business, where it impacts and influences many facets and not just limited to consumers. Having a holistic view of the brand is therefore critically important with an outlook to total business value creation.

It is no longer sustainable for a business to create an external perception solely focused around customers, with little heed to the internal systems and culture. Aligning the promise with the service delivery, through employees who are “living the brand”, ensures a good customer experience. Strong brands are built around this powerful nexus of employees and customers. The Human Resource department is therefore as important as the Marketing department to ensure alignment in the brand building process.

Businesses which have understood this ensure consistency in the way they engage with employees and in the systems and management processes that are in place.

Entering the boardroom

Our analysis is compelling evidence that shows the link between brand and business value creation, with strong brands significantly out-performing the weaker ones. Therefore brand value as a long term measure of business value creation is an indicator that Boards should be cognisant of, and should embrace in their pursuit of shareholder value creation.

The method employed by Brand Finance is the Royalty Relief Methodology, which is an established ISO standard. This is based on how much the brand owner would have to pay to use its brand if it licenced the brand from a third party. It uses discounted cash flow analysis (DCF) to capitalise future branded cashflows.

In determining the brand value, three main elements are looked at; which is the relative brand strength index against its competitors, the appropriate royalty rate to be charged and the forecast brand specific revenues.

The brand strength index is a balanced scorecard and composed of sector specific attributes which are broken to investment, equity and performance of the brand.

Next, we determine the most appropriate royalty rate range by reviewing comparable licencing agreements sourced from Brand Finance’s extensive database of past similar clients and other online databases.

In order to compute the forecast revenues, we review the annual reports of listed companies on the CSE or those state owned enterprises that publish their annual reports. We also look at external factors such as the long-term growth rate, tax rate amongst others.

Finally, the royalty rate is applied to the forecasted revenues to derive a brand revenue which is discounted post-tax to present the value of the brand.