Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 15 December 2015 00:29 - - {{hitsCtrl.values.hits}}

It has long been acknowledged that powerful brands drive stakeholder preference, improving business performance and ultimately increasing shareholder value. However, for the first time the extent of this effect has been quantified.

Valuation and strategy agency Brand Finance has been tracking the brand values of hundreds and thousands of the world’s top brands for nearly 10 years. For the first time it has taken a retrospective look at the share price of the brands it has analysed and their subsequent stock market performance, revealing a compelling link between strong brands and stock market performance.

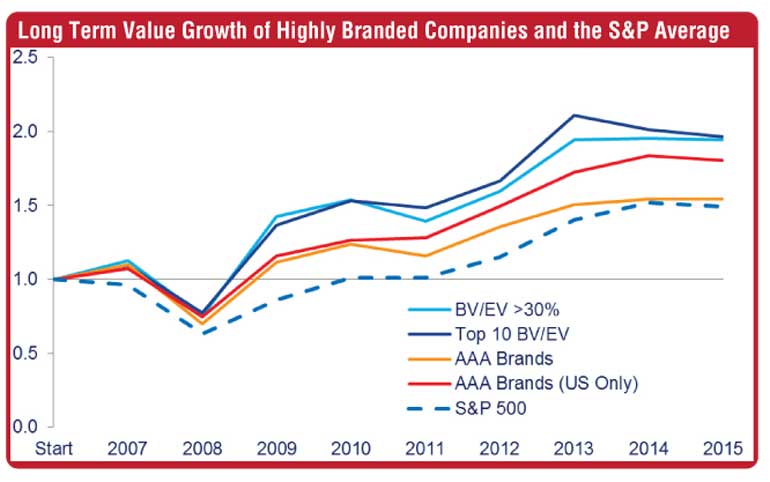

The most striking finding is that an investment strategy based on the most highly branded companies (those where brand value makes up a high proportion of overall enterprise value) would have led to a return almost double that of the average for the S&P 500 as a whole.

Between 2007 and 2015, the average return across the S&P was 49%. However by using Brand Finance’s data, investors could have generated returns of up to 97%. Investing in companies with a brand value to enterprise value (BV/EV) ratio of greater than 30% would have generated returns of 94%. Investing exclusively in the 10 companies with the highest BV/EV ratios would have resulted in a 96% return.

There was a similar effect for brands rated as AAA or AAA+ according to Brand Finance’s Brand Strength Index (BSI). This is the rating system Brand Finance uses to determine key variables in its valuation model, including the growth rate, discount rate and royalty rate applied to a brand’s revenue information as part of a brand value calculation.

A letter grade or ‘brand rating’, analogous to a credit rating, is awarded to each brand based on the results of Brand Finance’s BSI assessment. A strategy based on investment in all AAA and AAA+ rated brands would have led to a return of 54% over the eight years from 2007. However if only top-rated US brands were targeted, the return would have been 87%.

Brand Finance Chief Executive David Haigh comments, “These findings demonstrate the powerful effect brands can have on the long term financial performance and enterprise value of businesses. Anyone tasked with reporting to shareholders should have brand strength and brand value front of mind. In 2016 we intend to develop a range of investment products and indices based on this important insight.”

Brand Finance is the world’s leading brand valuation and strategy consultancy, with offices in over 20 countries. We provide clarity to marketers, brand owners and investors by quantifying the financial value of brands. Drawing on expertise in strategy, branding, market research, visual identity, finance, tax and intellectual property, Brand Finance helps clients make the right decisions to maximise brand and business value and bridges the gap between marketing and finance.