Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 14 June 2016 00:01 - - {{hitsCtrl.values.hits}}

London (Reuters): A third of investors in WPP refused to back a 70 million-pound ($102 million) pay package for Chief Executive Martin Sorrell last week, rebelling over one of the biggest payouts in British history at a fractious annual meeting.

One of the best known businessmen in Britain, Sorrell built the advertising group WPP from a two-man operation in a London office in 1985 to one that now dominates the industry with around 194,000 staff in 112 countries.

He says that during his 30 years in charge he has invested his own money in the firm and reinvested nearly all his income to buy WPP stock, meaning all his wealth and interests are tied up in the future of the company.

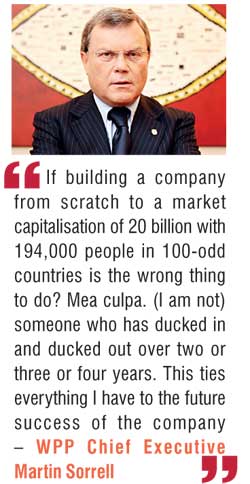

“If building a company from scratch to a market capitalisation of 20 billion with 194,000 people in 100-odd countries is the wrong thing to do? Mea culpa,” he told reporters after the meeting, held in a London theatre.

“(I am not) someone who has ducked in and ducked out over two or three or four years. This ties everything I have to the future success of the company.”

WPP is the biggest advertising firm in the world, offering branding, media planning, market research and consultancy from Canada to China and Belgium to Brazil, with clients including Ford, Unilever, L’Oreal and Tesco .

Sorrell has also become one of the most prominent businessmen in Britain, regularly appearing on television to comment on everything from political developments in emerging markets to national politics and the EU referendum.

Living between New York and London, he travels constantly, flying on commercial services and rarely spending more than a week in one location. He owns 21 million WPP shares or 1.6% of the firm.

WPP’s shares closed up 0.1% at 1,600 pence on Wednesday, valuing the company at 20.65 billion pounds.

While Sorrell received plaudits at the meeting for steering WPP ahead of rivals, several investors said they were “highly uncomfortable” or “uneasy” with the amount he was paid. The UK’s Railways Pension Scheme said it risked “reputational damage”.

Investors also had questions over the firm’s succession planning. WPP has recently said it is working to identify candidates to replace Sorrell for whenever he leaves and Chairman Roberto Quarta said the board routinely discussed potential internal and external execs should anything happen to the firm’s founder.

The WPP vote comes amid a resurgence in investor activism, with BP shareholders voting in April against Chief Executive Bob Dudley’s $20 million pay deal for 2015 after the company made a record annual loss.

At 70 million pounds, Sorrell’s 2015 pay package is one of the biggest ever payouts for the head of a FTSE 100 index company. The average pay for CEOs of a company in the blue-chip index was 5.23 million pounds last year.

Excluding abstentions 33.5% of investors voted against Sorrell’s remuneration deal in the non-binding vote.

The bulk of Sorrell’s pay package for 2015 came from a long-term scheme called Leap which was approved by more than 80% of shareholders at the time. Since its introduction the firm’s shareprice has doubled.

It has since been modified and will face a binding vote next year. Under the firm’s new scheme Sorrell’s pay is set to fall.

“We acknowledge Sir Martin’s talent but this year’s leap is a step too far,” one shareholder said.

Asset manager Hermes, a WPP shareholder, said it voted against the remuneration package in part because of “historic concerns about board composition and the remuneration committee’s apparent lack of vigour and stress-testing.”

“We are highly uncomfortable with the 2015 quantum,” a representative told the meeting.

WPP said ahead of the meeting on Wednesday that during the first four months of 2016 its net sales, profits and revenues were “well above budget” and up on last year.