Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 9 November 2017 00:00 - - {{hitsCtrl.values.hits}}

Reuters: The Coalition Government will seek to stoke exports and employment through support for the small business sector in its 2018 budget, a move that is likely keep the island nation’s fragile public finances under pressure.

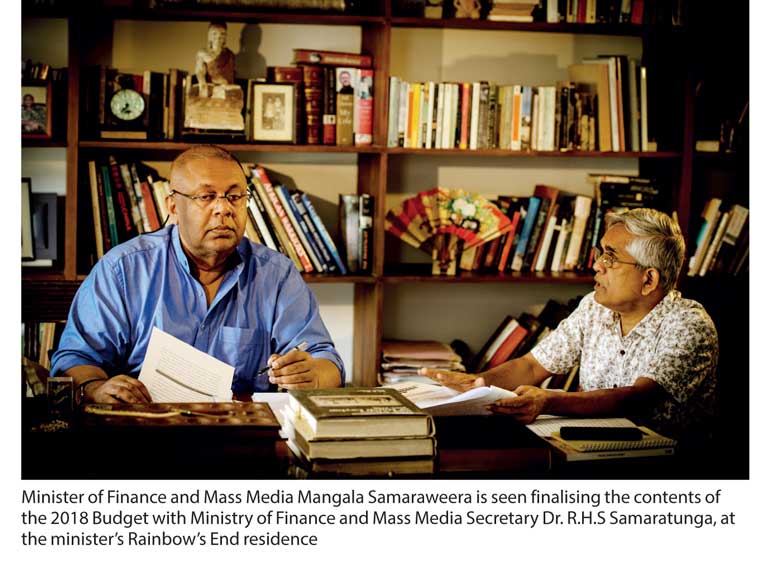

Analysts say Finance Minister Mangala Samaraweera will struggle to strike the balance between populist policies and fiscal consolidation as President Maithripala Sirisena’s coalition government prepares for local elections expected next year.

Samaraweera, in his first budget since taking the finance portfolio early this year, is expected to bring down the budget deficit to 4.3% of gross domestic product (GDP) from this year’s 4.6% target, a condition of a $ 1.5 billion loan from the International Monetary Fund. He delivers the budget on Thursday.

Since coming to power in 2015, the Government has boosted revenue, rationalised spending and cut the fiscal deficit, in line with the IMF targets. But the tightening of fiscal and monetary policies has weighed on economic growth, which has also been hit by bad weather this year.

“In our first two years of Government, we focused on stabilising the economy following a period of macroeconomic imbalance,” Samaraweera told a forum last week.

“Now we are poised for growth – growth that is led by exports, facilitated by technology, and driven by small and medium enterprises, entrepreneurs, and startups.”

The Central Bank expects economic growth of between 4% and 4.5% this year, after the $ 81 billion economy grew at 4.4% last year.

Prime Minister Ranil Wickremesinghe is targeting a fiscal deficit of 3.5% of GDP by 2020, which compares with last year’s 5.4%.

The Government has already passed some tough tax reforms, most of which take effect in April next year.

It faced a debt and balance-of-payments crisis early last year before the IMF came to the rescue with the loan.

“If it is going to come up with populist policy measures, then the whole process of increasing the tax revenue is gone and we will be back to square one,” Sirimal Abeyratne, a professor in economics at University of Colombo told Reuters. “The budget policies should target incentives structures to get investments and improve business confidence. We need more investment for export growth.”

External debt was about $ 47 billion, or 57% of GDP as of 2016, of which approximately 68% was public sector debt, Moody’s said.

Total debt, which includes domestic and foreign loans, rose to 79.3% of GDP last year from 71.3% in 2014. The government is aiming to cut it to 70% by 2020.

Despite the populist pressures, analysts expect Samaraweera not to deviate from the Government’s medium-term macroeconomic framework and for policies to remain consistent with the IMF’s loan conditions including tough reforms for state-owned enterprises.

The Coalition Government of President Sirisena’s centre-left party and Prime Minister Wickremesinghe’s centre-right party has had some success in implementing key 2017 budget proposals. It is in the process of signing trade pacts with India, China, and Singapore to expand its export market.