Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 15 September 2023 00:35 - - {{hitsCtrl.values.hits}}

The Employees’ Provident Fund (EPF/the Fund) wishes to inform its members that as an eligible participant and with the approval of the Monetary Board of the Central Bank of Sri Lanka, it has submitted an offer to exchange the portfolio of Treasury Bonds of the EPF under the Domestic Debt Optimisation (DDO) program as per the invitation made by the Ministry of Finance, Economic Stabilisation and National Policies (MOF) following a Resolution adopted by Parliament.

Accordingly, the following are brought to the notice of the members:

a. On 4 July 2023, the MOF announced the Government’s policy on domestic public debt optimisation strategy, approved by Parliament by a Resolution on 1 July 2023.

b. As per the announcement, the MOF has identified, inter-alia, the conversion/exchange of existing Treasury bonds of superannuation funds into new Treasury bonds to constitute the DDO, to avoid superannuation funds incurring a substantially higher tax of 30% on taxable income from Treasury bond investments. This tax will be applied from 1 October 2023, as per the Inland Revenue (Amendment) Act, No. 14 of 2023. At present, the tax rate applicable to the income of the EPF including the income from Treasury bonds is 14% and the continuation of a concessionary tax rate of 14% beyond 30 September 2023 is contingent upon the effective participation of the EPF in the DDO as defined in the Act.

c. The Exchange Memorandum dated 4 July 2023 and subsequent amendments issued by the MOF contained comprehensive details of the debt conversion/exchange. Further, the MOF held an investor presentation on 7 July 2023, outlining the proposed terms of the debt exchange and its implications, and subsequently issued clarifications to questions raised following this presentation. As per the Exchange Memorandum, eligible holders were required to analyse the implications of making or not making an offer by reference to the legal, tax, financial, regulatory, accounting and related aspects of the DDO. All communications in this regard can be accessed through https://treasury.gov.lk/web/ddo.

d. In this regard, a presentation was made to the Cabinet of Ministers on 28 June 2023, titled “Debt Restructuring in Sri Lanka” prepared by the MOF in consultation with the CBSL. On 29 and 30 June 2023, the Committee on Public Finance (COPF) has been informed regarding the expected impact of the DDO on the EPF through a presentation, followed by extensive discussions. Further, the COPF at its meeting held on 7 September 2023 discussed the impact of the proposed amendments to the Inland Revenue Act on the superannuation funds.

e. As per the Exchange Memorandum, the following two options were available for the EPF under the DDO program.

i i. Exchange Option: EPF can exchange a minimum required amount of existing Treasury bonds with 12 new Treasury bond series that mature from 2027 to 2038. These new bonds are offered with a coupon rate of 12% per annum until 2026 and 9% per annum thereafter. The EPF will continue to pay income tax at 14% per annum on its taxable income attributable from its Treasury bond portfolio.

ii ii. Non-Exchange Option: If the EPF decides not to exchange the existing Treasury bonds a 30% tax rate would apply to the taxable income of Treasury bond portfolio of the EPF.

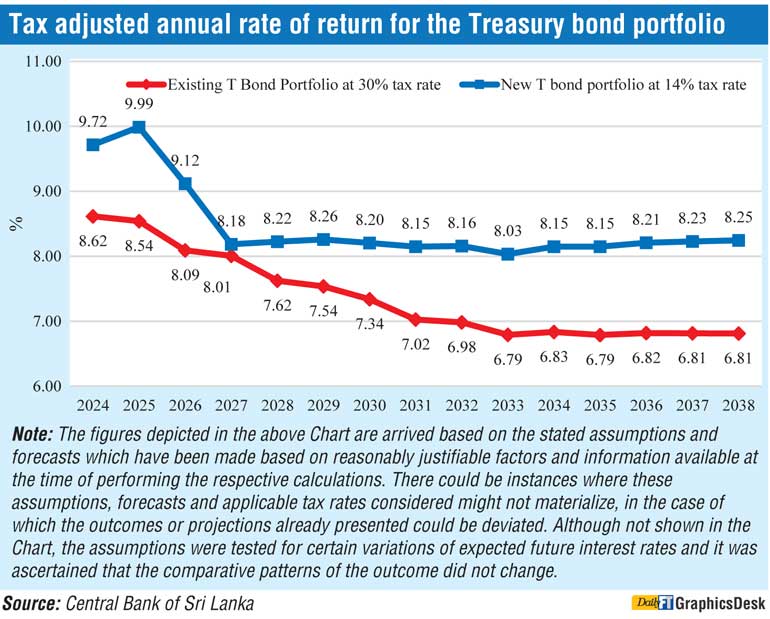

f. The Monetary Board has carefully examined how the DDO could affect the Fund under the above two scenarios. Accordingly, to assist the Monetary Board to ascertain the possible impact of the DDO on the Fund, the internal staff of CBSL has conducted relevant analyses. Such assessments have been carried out on the basis of several prudent and realistic assumptions and further taking into consideration the legal, tax, financial, regulatory, accounting and related aspects of the DDO. The summary of the expected returns of the EPF Treasury bond portfolio under the two scenarios is given in the chart below.

At present Treasury bond portfolio consists of 88% of the total Fund while a larger portion of the remainder is in Treasury bills. Treasury bills portfolio and new funds can be invested at prevailing market rates so that the total return of the Fund portfolio would be higher than the likely returns of the Treasury bond portfolio under both scenarios shown in the Chart below.

g. The main factors and assumptions taken into due consideration in arriving at the above annual rate of return of the Treasury bond portfolio are given below.

i i. The face value of the Treasury bond portfolio of EPF is Rs. 3,220 bn. To fulfil the minimum participation requirement, 78% of the face value of the Treasury bond portfolio on face value basis had to be exchanged.

ii ii. The Government will service all obligations relating to Treasury bonds including the new Treasury bonds issued under the Debt Exchange as they fall due in a timely manner.

iii iii. Cash receipts due from the above mentioned maturities and coupons will be reinvested in six-year Treasury Bonds at rates of 13.50% for 2023, 12.00% for 2024, 10.50% for 2025 and 10% for 2026 and onwards. (Expected returns are also computed under different reinvestment rate scenarios of which the pattern of the returns remains the same).

iv. If the EPF participated in the Exchange Option, the current tax rate of 14% will be applied. However, if the EPF did not participate in the Debt Exchange, the tax rate applicable on the taxable income of Treasury bonds will be increased to 30% which is more than double the applicable post exchange tax rate. It was further assumed that these tax rates would remain unchanged until 2038.

h. Upon a thorough analysis and in consideration of the persuasive factors given above, the Monetary Board is satisfied that arising from the exchange of Treasury bonds, the EPF would not face liquidity constraints in the foreseeable future and will not result in any reduction to the already announced current balances in the accounts of members. Further, the Cabinet of Ministers at its meeting held on 7 August 2023 has approved an amendment to Section 14 of the Employees’ Provident Fund Act, No. 15 of 1958, to present to Parliament the enactment of statutory provisions to guarantee a minimum 9% annual interest from 2023 to 2026 (including the said 2 years) on the contributions of the members of the EPF.

i. A meeting was convened with the Minister of Labour and Foreign Employment, the Secretary to the Labour Ministry and Foreign Employment, the Commissioner General of Labour, and a Deputy Secretary to the Treasury to apprise them on the impact of the DDO to EPF. Pursuant to the deliberations at the said meeting, there was complete consensus among the participants that opting for the Debt Exchange holds greater advantages compared to the non-exchange alternative.

j. A discussion chaired by the Governor along with the senior management of CBSL was held with representatives of several Trade Unions to express their concerns on the EPF’s participation in DDO, and an opportunity was provided to them to present their views.

iv The above information is published and disseminated to inform members of the EPF on the factors/considerations that were taken into account when making the decision regarding EPF's participation in the Treasury bond exchange under DDO.

The Monetary Board envisaged that of the two options, Debt Exchange is distinctly the better option considering the assessments that have been carried out on the basis of several prudent and realistic assumptions. Further, the Monetary Board is of the view that with the proposed Debt Exchange and the other reforms being implemented by the Government, the sustainability of public finance will be restored with its ability to service its debt. The Monetary Board was also cognizant that unless debt sustainability is restored without undue delay, there is a high risk of the Government not being in a position to fully service the obligations on the pre-exchange bonds held by the EPF leading to very serious adverse consequences to the EPF. Hence, opting for the DDO was in the best interest of the members of the EPF based on the two options available, given that a large share of the EPF’s assets is invested in Treasury bonds. It is also important to note that after the participation in DDO current balances of EPF members will not be reduced and the Fund will be able to distribute at a minimum 9% per annum return to members in the foreseeable future.

In conclusion, the Monetary Board of the CBSL as the custodian of the EPF, having considered the two options available decided to opt for the Debt Exchange offer with a long-term view in the best interest of the members of the Fund. Accordingly, the EPF tendered Rs. 2,667,512,169,237 face value of Treasury Bonds for Debt Exchange, including an additional Rs. 149,890,740,000 in excess of the minimum participation requirement considering its comparative benefits to the Fund. The Government has accepted the same and issued new Treasury Bonds to the EPF with an equivalent face value.