Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 1 December 2015 00:21 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market continued to remain bullish yesterday as yields were seen dipping for a second consecutive day.

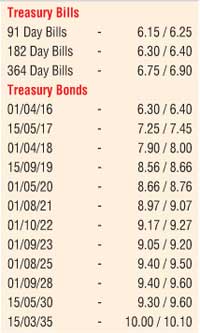

Buying interest across the yield curve saw yields on the 15 September 2019, 1 May 2020, 1 August 2021 and 1 October 2022 dip to intraday lows of 8.62%, 8.70%, 8.95% and 9.20% respectively while on the long end of the curve the 15 March 2035 was seen dipping to an low of 10.05%.

intraday lows of 8.62%, 8.70%, 8.95% and 9.20% respectively while on the long end of the curve the 15 March 2035 was seen dipping to an low of 10.05%.

Meanwhile, the Open Market Operations (OMO) department of Central Bank was seen mopping up liquidity by way of outright sales of Treasury bills for the first time in seven months yesterday. The auctions consisting of three maturities drained out in total an amount of Rs. 15 billion at yields of 5.85% for 45 days, 6.11% for 52 days and 6.16% for 59 days.

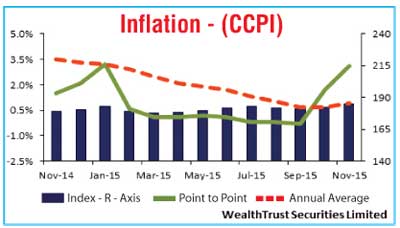

The overnight call money and repo rates remained low to average 6.30% and 5.43% respectively as surplus liquidity stood at Rs. 134.39 billion. Furthermore, inflation for the month of November saw its point to point increase for a second consecutive month to 3.10% while its annualised average reflected an increase for the first time in thirty two months to record 0.90% in comparison to its previous month numbers of 1.70% and 0.70% respectively.

Rupee dips further

The rupee on spot contracts dipped further yesterday to close the day at Rs.143.25/35 on the back of importer demand. The total USD/LKR traded volume for 27 November was $ 46.92 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 143.60/70; three months – 144.45/60; and six months – 145.75/90.