Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 1 December 2015 00:23 - - {{hitsCtrl.values.hits}}

Moody’s has said that Sri Lankan banks will benefit from 2016 Budget-initiated curbs on pawning and consumer finance loans.

Following is the full text of Moody’s update on Sri Lankan banks following the presentation of 2016 Budget by the Government.

On 20 November, Sri Lanka Finance Minister Ravi Karunanayake proposed introducing limitations on

pawning6 loans and consumer finance loans for the country’s commercial banks. The proposal is credit

positive for Sri Lankan banks because it will limit their exposure to these higher-risk loans. Two of our rated entities, Bank of Ceylon (BOC, B2/B1 stable, b17) and Hatton National Bank Ltd. (HNB, B2 stable, b1), are among the banks that will benefit from these tighter rules.

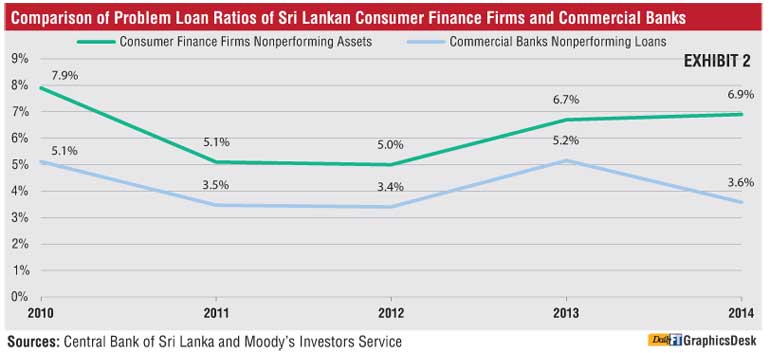

Mr. Karunanayake proposed limiting pawning loans to 5% of a bank’s loan book. The quality of these loans is directly linked to volatile gold prices, which makes them risky for banks. As Exhibit 1 shows, problem loans for Sri Lanka’s commercial banks increased materially in 2013 following a 27% decrease in gold prices that year. The asset quality of Sri Lankan banks has stabilized as banks shrank their pawning loan books to 5.2% of gross loans as of the end of June 2015, from 14.4% at the end of 2012. The proposed 5% cap will further decrease banks’ exposure to these loans and will prevent excessive growth in this segment if gold prices increase.

The second proposal mandates that banks cease consumer finance lending starting 1 June 2016. Such loans are provided to individuals and are typically higher risk and unsecured. As of the end of June 2015, consumer finance loans composed around 5% of gross loans for the five largest banks engaged in consumer lending.8

For those banks, the growth in this segment has been rapid, averaging a compounded annual growth rate of 44% over the past four years, compared with 24% growth in gross loans excluding consumer finance.

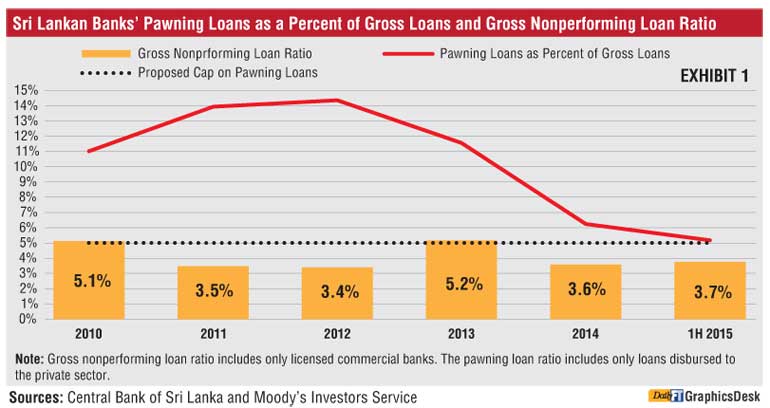

Consumer finance lending has historically had poor asset quality relative to secured banking loans, reflected by the weaker asset quality of specialized Sri Lankan consumer finance firms. As shown in Exhibit 2, consumer finance firms had a 6.9% problem-loan ratio at the end of 2014, versus 3.6% for the commercial banks.

We expect that the Central Bank of Sri Lanka will likely implement the proposed limitations on pawning and consumer finance loans because the authorities want to limit the banks’ exposures to risky sectors, while simultaneously promoting credit growth to other sectors of the economy, such as agriculture, small and midsize enterprises, the young and women.

Footnotes

6 Pawning loans are typically short-term loans extended by banks to retail and small and midsize enterprise borrowers using gold as collateral.

7 The bank ratings shown in this report are the bank’s deposit rating, senior unsecured debt rating (where available) and baseline credit assessment.

8 Bank of Ceylon, Hatton National Bank, People’s Bank, Sampath Bank, and Commercial Bank of Ceylon are the five largest commercial banks that engage in consumer financing. These banks composed 62% of total banking system assets as of the end of June 2015.