Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 30 October 2024 00:02 - - {{hitsCtrl.values.hits}}

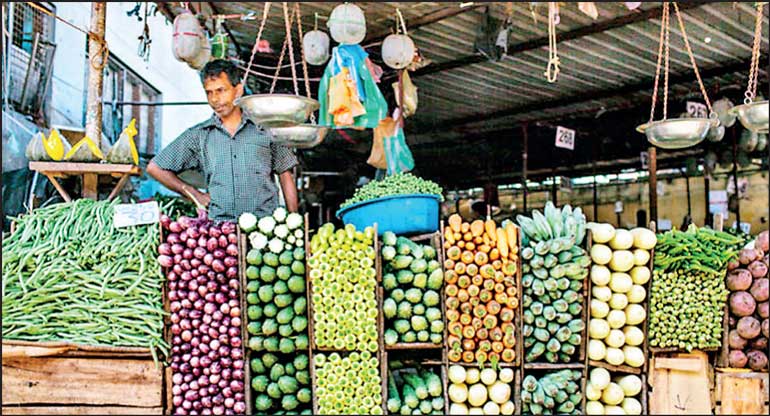

Tax policy must be reflective of real market conditions for consumers and the public

By Kumar Ranaweera

Sri Lanka’s new Government and executive brings with it a new dimension of thinking to policy and governance. Therein lies significant opportunity, albeit laden with challenges, to change the way Sri Lanka does business and how we are perceived by the world.

In this post-crisis milieu, Government has a difficult balancing act to ensure a positive trade balance, manage its primary account considering IMF expectations, all whilst providing relief to a burdened public in the run up to 2028, when debt payments must resume. Reform should encompass better governance – combat corruption, drive exports and investment, stop wastage and a review of tax and industrial policy to strengthen returns. The Government led by the new President must adopt a fact-based approach towards policy, as opposed to strategy and actions that were often driven by political whims and favouritism.

The country offers numerous examples for failed politicised tax policy decisions. The sugar tax scam from 2020 presents ample evidence where Government lost over Rs. 16 billion in revenue. The sugar tax scam saw taxes cut to 25 cents from Rs. 50 per kilogram overnight that year. Consumers had to bear a shock of up to Rs. 70 a kilogram as a result.

The lack of fact-based policy also hurts excise earnings. The latest IMF reports indicate that excise from items such as fat contained productions lime and cement, sugar and sugar confectionary and mechanical appliances increased by 59.1% in the first eight months of the year. However, owing to excessive increases, it has been recorded that government revenue from tobacco has fallen over 10.8% to just Rs. 71.6 billion in the first eight months of this year. Revenue was over Rs. 80 billion at this stage last year. This is the result of dwindling sales of legal cigarettes by much as 21.8% to just 1.22 billion sticks. This comes on the back of a 14% tax hike in January this year, when cigarettes in Sri Lanka are already priced excessively. Furthermore, despite the drop in legal cigarette sales the country’s smoking incidence remains high due to the prevalence of a flourishing illegal market.

In the recent past, the alcohol and tobacco excise tax hike has skyrocketed with 44% in 2023 and an additional 14% in 2024. In addition to this, in 2024, the increase in VAT by 3% further pushed prices up of legal alcohol and tobacco. Whilst inflation-based pricing formulas are popular theory, such price increase on any product during a high-inflationary regime impacts affordability and eventually government revenue. The tobacco trade in Sri Lanka offers ample example, as government revenue fell and smoking incidence remains high, which then presents a public health and law and order question. Sri Lanka’s strategy with tobacco has focused almost entirely on pricing-based controls. This strategy requires overhauling akin to our political systems. A strategy that disregards socio-market trends fails to deliver any tangible benefits or value to a public or government.

Importantly, tax policy must be reflective of real market conditions for consumers and the public. As published by the Institute of Policy Studies recently, past increases to VAT and related exemptions hurt the poorest segments more, who spent 10% of their income on VAT, compared to 6% of higher-income groups. At the same time, PAYE tax at 36% for high income brackets and a tax threshold beginning at Rs. 100,000 significantly hurt the working class, which was reflected in political outcome at the last election. Taxes must be reflective of public expenditure, and the Government must demonstrate adequate public investment for what is paid. Taxes must be seen put to work.

Accordingly, it is envisaged the new President and his Government will give adequate attention towards corrective tax policy that is market reflective, better targeted and diverted towards the benefit and welfare of the public. Policy shapes the development prospects of the people and country. Sri Lanka has got it wrong all along, and under a new regime there is renewed hope for change.

(The writer is a Senior Research and Market Analyst attached to a leading audit firm in Colombo.)