Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 18 October 2021 00:00 - - {{hitsCtrl.values.hits}}

Since its inception in 1944, the Ceylon Association of Shipping Agents (CASA) has played a vital role in developing the local maritime industry and has contributed towards positioning Sri Lanka as a transhipment hub in the region.

Leading on policy and strategy CASA also works on multiple day-to-day issues in the smooth movement of goods and handling maritime operations. Through regular dialogue with stakeholders, Government institutions, regulatory bodies and other Government and private sector agencies, CASA seeks to effect an interchange of ideas and information, represent and advocate the views of the association in all official fora and shape the future of the industry by investing in education and training for its members and working with maritime training academies to train seafarers.

CASA too echoes the Government’s aspirations towards making Sri Lanka a maritime hub, leveraging on its strategic positioning. However, there are several key initiatives that will need to be prioritised to reach this goal.

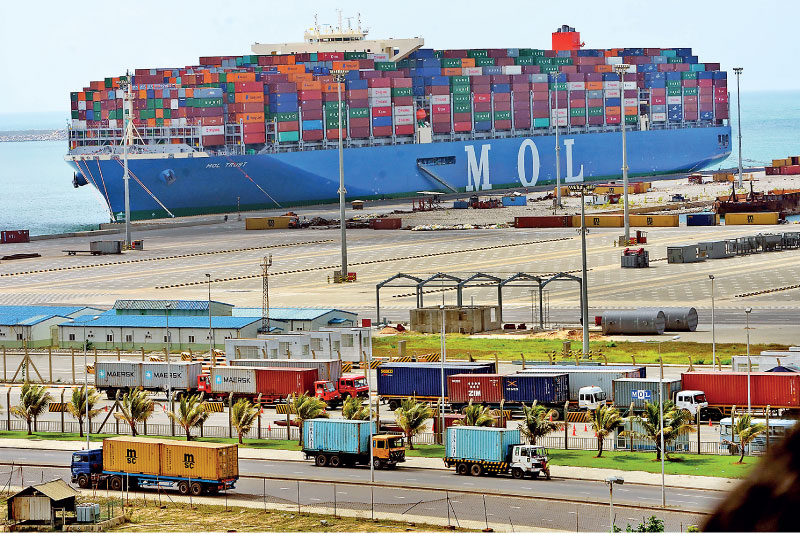

Sri Lanka is strategically located, where the busy East-West shipping route passes just six to 10 nautical miles south of the island. More than 70,000 ships ply this route annually, carrying two-thirds of the world’s oil and half of all container shipments. It is no secret that Asia is bound to emerge as the economic powerhouse of the world, if the current trends of development continue for the next couple of decades.

Many have expressed views on what is required to make this transformation including the need to liberalise the industry, which is misleading and also misses out on the fundamentals of what is required to develop and build efficiency in the maritime sector Sri Lanka needs to invest in basic infrastructure and improve the ease of doing business. In any case the shipping industry is fully liberalised contrary to views expressed.

Shipping agents have significantly contributed to the GDP and the Balance of Payment of Sri Lanka, amidst turbulence and has demonstrated a positive trend in the generation of foreign exchange, over the years despite the global financial crisis, the tsunami, the Easter bomb attacks and COVID-19.

The sea transport income in 2019 had been $ 1,555 m, which was 4.4% of the current and capital account balance. Agents have expanded their service offering to the principals through ancillary services and promoting Port of Colombo and convincing them to divert additional business to Colombo. Shipping agencies have reinvested their income on other related logistics and transportation related businesses (which would have otherwise been repatriated out of the country) thus creating employment opportunities for Sri Lankans.

Direct employment in the transportation and storage sector is over 6% of the Sri Lankan labour force. It is also important to remember that there are other indirect contributions to other sectors such as boat operators, bunker traders, vendors for ship supplies, hotels/villa operators, sludge removers, etc., which also has to be considered when calculating the economic contribution of the agents.

It is inevitable that Sri Lanka should capitalise on the location specific advantages and position itself as a hub. Therefore it is important to probe what constitutes a maritime hub and what are the immediate investments required to get there. This article mainly highlights few of those crucial investments requiring urgent attention.

Fast-tracking the development of port-related infrastructure

Developing maritime ancillary services

For Sri Lanka to realise its vision of being a maritime hub, it is important to focus on the development of support services or ancillary services. We need to ensure that we have the full range of services at competitive prices to be perceived as an attractive destination for main lines, feeders, causal callers and passenger vessels. These ancillary services include bunkering, marine lubricants, freshwater supply, off shore supplies, ship chandelling, slop disposal facility, salvage and towage, ship repairs, ship building, ship layup, maritime security and other services. Some of the areas that need to be developed are highlighted below:

Opportunities in maritime security industry and as a crew change hub

Sri Lanka has been a central point for the embarkation and disembarkation of sea marshals and ship crew for private maritime security companies and crewing companies. All the logistics for the transfer of these guards and crew are arranged for by shipping agents including airport transfers, liaising with service providers and the Sri Lanka Navy for the storage of the weapons and equipment in the Naval Armoury, arranging accommodation, subsequent repatriation for foreign seafarers/sea marshals, etc.

If Sri Lanka wishes to maintain its position as a crew exchange hub the country needs to align the health ministry quarantine regulations for sea farers in line with that for tourists and also enable them to travel on commercial airlines in order to attract more numbers of ship owners and managers to perform their crew exchanges using ports of Galle/Colombo and thereby increasing the volume and foreign exchange revenue to the Country as well. Further relaxation of isolation and quarantine regulations in line with those offered to tourists will send a clear message to ship owners and help the country earn more foreign exchange at this crucial time.

With regard to OBST operations it is vital that the rates offered to sea marshal companies by the armoury are competitive and in line with the competing floating armouries in the Red Sea, in order to maintain volumes and also encourage Sri Lankan sea marshals to be employed.

Developing legal infrastructure

There is a need to review and develop the laws and judicial practices according to the industry needs. This includes specialised legal services covering the marine and logistics sector as well as laws and regulations recognising the modern developments in the maritime supply chain that are required to reach a hub status. Further if the legal systems are enhanced, Sri Lanka can become a favourable location for ship arrests, arbitration, etc. It also is necessary to develop the dispute resolution process so that decisions can be expedited. Special admiralty courts need to be developed to have fast resolution of maritime matters.

Further a system of clearing the abandoned and detained containers at the Port of Colombo needs to be implemented. Currently over 1,100 containers are lying in terminals for many years. Speedy action needs to be taken for destruction or auction these containers and release the containers to the trade, especially at the time there is a shortage of equipment in the market. Local prohibitive legislation for shipping lines to recover logistics costs has also contributed to the short allocation of containers for Colombo cargo.

Development of national merchant shipping fleet and Sri Lanka flag

The Government should encourage organisations towards ship ownership, ship operation and ship management under the Sri Lanka flag. This requires fiscal incentives and measures to make such investments attractive. It also requires a smooth and easy process for ship owning, operations and management.

Therefore it is important to have framework and a central unit which is dedicated for the purpose of promoting ship owning and flagging. Attracting ship owners to register their fleet using the Sri Lanka flag is a direct method of earning foreign exchange revenue.

Capacity and talent building

Investment in capacity building of people will be of paramount importance to the growth of the industry. A key area of development is vocational training. To develop the skills required it would be important to encourage partnerships between foreign and local universities to provide world class education in logistics and supply chain management.

It will also be important to introduce workshops and trainings for specialised roles within the supply chain. Further, the importance and opportunities in shipping and logistics can be incorporated at a much earlier age to students at the secondary education level.

Improving ease of business and digitalisation

Finally, if we want to realise our maritime hub aspirations, the Government needs to create an encouraging climate for investors by improving ease of doing business. This includes; streamlining process, providing incentives and non-bureaucratic regulatory infrastructure for these services to be offered at world class standards and regionally competitive rates.

One of the biggest barriers has been integration of information between different authorities and lack of transparency. Sri Lanka is ranked 99th in the Ease of Doing Business Index compared to Singapore which has a ranking of 2nd. This shows that there is a long way to go and one way of getting there is adopting digitalisation. Many countries are implementing initiatives such as; automation, paper less trade, electronic data interchange, artificial intelligence and block chain to develop greater efficiency in operations.

Currently the shipping process involves a myriad of manual documents, physical interactions and paper submissions to multiple government authorities leading to delays and increased ultimate costs for the consumer. There is an urgent need to fast-track the digitalisation drive starting with port community systems, customs systems and also 24 approvals process in all ports and affiliated authorities.

CASA, the voice of the shipping industry, has been supporting the initiatives to develop the Single Window Blueprint facilitated by the National Trade Facilitation Committee and Port Community System Project spearheaded by the Sri Lanka Ports Authority. As a stakeholder and an industry body representing shipping lines in Sri Lanka, CASA firmly believes that the National Single Window and the National Trade Information Portal will put us in the right direction to achieve the maritime hub aspirations of Sri Lanka.

CASA is also in consultation with Government authorities such as the Sri Lanka Ports Authority, Sri Lanka Customs, Department of Immigration and Emigration to streamline processes and to improve Ease of Doing Business which will eventually facilitate trade in Sri Lanka. During the pandemic, CASA played an active role in coordinating the implementation of Electronic Delivery Orders (EDO) which significantly reduced the physical interaction and can be considered a key step towards digitalisation. Yet the port community urgently awaits an integrated system that makes supply chain seamless.

Conclusion

The policymakers need to engage with stakeholders and the private sector to ensure these initiatives and plans are implemented systematically. The aspects highlighted in this article are critical success factors in our pursuits towards sustainable competitive advantages, a superior business proposition to the global shipping community, which will in turn will be instrumental in realising our aspirations to become a maritime hub. It is imperative that these issues are addressed urgently, with due priority, rather than non-issues such as liberalisation.

Real progress can only be made when we first focus on having the right resources in place, at the opportune time, increasing efficiency and driving cost effectiveness. Once this is in place, the rest will follow. This should be the key focus area of policymakers.