Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 9 July 2021 00:00 - - {{hitsCtrl.values.hits}}

Even though the Sri Lankan solar industry has matured since its inception, up to now it has primarily been a passive one

By Eng. Lanka Perera and Eng. Rohan Seneviratne

Sri Lanka, being an island situated near the equator, is blessed with a significant amount of solar radiation or sunlight, to be put in plain terms, throughout the country, year around. Looking at this fact and the rapid developments in solar technology, many individuals claim that solar power generation would be Sri Lanka’s best option in achieving its goals in low carbon electricity generation and providing low-cost electricity to the people, in light of the pressing need to meet the growing demand.

And there has always been an uproar regarding relevant authorities and professionals either turning a blind eye towards this solar potential lying in front of us or purposefully trying to add friction to an otherwise smooth journey of popularising this green energy source, delivered free at our doorstep. In particular Ceylon Electricity Board (CEB) being the major electricity utility in Sri Lanka is blamed time and time again for posing a hindrance for the progression of the solar industry in Sri Lanka.

Whether these accusations are based on facts or mere misconceptions, needs to be explored further. In this context it is worthwhile looking through the path of progression of the solar industry within Sri Lanka and especially CEB’s contribution in this sector to-date and what holds in store for its future.

Up to year 1999 more than 50% of the electricity generation of the country was fulfilled by renewable energy resources, which mainly consisted of large hydropower generation. In the meantime, in year 1996, embedded generators were interconnected to the CEB’s distribution network, under Power Purchase Agreements. Grid interconnection of Non-Conventional Renewable Energy (NCRE) generation plants of up to 10 MW was initiated this year. Under the NCRE umbrella, renewable energy sources like mini-hydro, solar, bio-mass (community waste, dendro) and wind are considered. As a progressive step in this process, in the year 1997 CEB introduced the grid interconnection standards and procedures for embedded generators. Owing to technical constraints at that time, CEB did not allow connections of renewable energy facilities to the low voltage system.

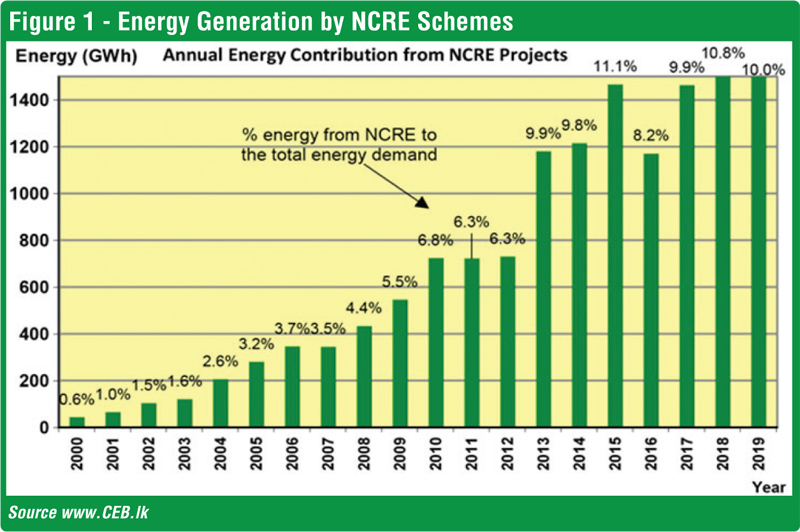

Another favourable step to the NCRE developers including solar projects, of the country was the introduction of a cost-based, technology-specific and three-tier tariff with effect from year 2007. This allowed a project developer to cover its operation and maintenance and capital costs and also it ensured an assured return on capital. From the inception in 1996 the NCRE sector in Sri Lanka has gradually evolved and the annual energy contribution by NCRE was continually on the rise (as shown in Figure 1).

The year 2008 marked another milestone in the path of the renewable energy sector in Sri Lanka as the Cabinet approval was granted for the net metering concept. This opened the doors for the utilities’ bulk and ordinary customers alike, to connect a renewable energy source to the low voltage network. In order to allow for implementation of the net energy metering scheme, the ‘Grid Interconnection Standards for Net Metering of On Grid Renewable Energy Based Generating Facility’ was formulated and published in year 2010, in which CEB was a pioneering party.

The same year CEB formulated and published the ‘Net Energy Metering Manual’. The allowable size of a facility started with 42 kW and was then enhanced to 10 MW and later on reduced to 1,000 kW. The scheme came in to effect from July 2010.

In this scheme no payment was made to the customer. The energy consumption (import) and the energy fed (export) to the network were set off against each other. Any excess generation was carried forward up to 10 years and any excess usage was billed at the normal tariff applicable to the customer.

Even though this scheme was not limited to solar and any renewable source could be connected, the customer base predominantly consisted of solar facilities. With the passing years the solar market constantly evolved. By 2016 the net metered solar customer base of CEB had grown to 4,690 and that of Lanka Electricity Company Ltd. (LECO) had reached 1,795. Capacity-wise 32 MW had been added to the system via net metered solar generation by 2016. The average size of a connected solar installation was approximately 5 kW (Refer to Figure 2).

The country’s solar market was gaining momentum when in 2016 another progressive step in the net metering scheme was introduced. The new additions to the scheme were introduced specifically for solar connections. The expanded concept consisted of three schemes, namely Net-Metering, Net Accounting and Net Plus.

The Net Metering scheme was retained as it was, with option for existing customers to shift to another scheme if required. Net Accounting and Net Plus Schemes were allowed for power producers using solar energy and installations necessarily had to be on actual functional roofs and not on ground or structures erected for the purpose of adding more solar capacity.

These schemes also included payments for the energy fed to the network by the customer, unlike in the initial scheme. Under the Net Accounting scheme, the customers’ consumption and solar generation was set off against each other and a payment was made for the excess generation at the introduced export tariff, of Rs. 22.0 per unit during the first seven years and from the eighth year up to 20th year, Rs. 15.50 per unit. The contract period was extended to 20 years.

Net Plus scheme accounted for energy consumption and generation separately. The generation from the solar PV plant was directly exported to the network and the customer was paid as per the introduced export tariff same as in Net Accounting. The customers’ total consumption was billed at the normally applicable tariff. The export tariff is Rs. 22.0 per unit during the first seven years and from the eighth year up to the 20th year, Rs. 15.50 per unit.

The contract period was extended to 20 years. The capacity of the solar installation was extended to the contract demand of the roof owner. The above prices were so attractive to the solar developers and less favourable to the CEB as CEB average selling price to the customers is about Rs. 16.50.

CEB spearheaded in establishing standards and procedures

The favourable export tariff for customers, added to the growth of the rooftop solar industry, while the utility incurred additional expenditure in implementing these schemes. Despite this fact the CEB spearheaded in establishing standards and procedures related to provision of these schemes and proactively took actions to promote these schemes by enlightening customers, fast tracking the service providing procedures and effecting payments to customers.

In 2016 itself, almost immediate to the introduction of the Net Plus schemes, the Ministry of Power and Energy, launched a project called ‘Soorya Bala Sangramaya’ in collaboration with the CEB, Sustainable Energy Authority (SLSEA) and LECO to promote rooftop solar plants. Then target was to add 200 MW by solar generation to the national grid by 2020 and 1,000 MW by 2025. With the relentless work of CEB and the contributions of all stakeholders in the rooftop solar industry, by 2017, within one year of launching the project, total solar capacity of the country reached from 30 MW to 100 MW.

Further in 2017 CEB developed the procedure for absorbing HT Metering customers under Net Plus scheme, with capacities of 1 MVA or above. In this the procedure and technical requirement for connection of High-Tension metering consumers under Net Plus Scheme, Procedure on commissioning and testing of solar installations connected to low voltage feeders and recommendation for tariff for the HT metering solar installations were formulated.

As at end of April 2021, Sri Lanka has 32,411 roof solar installations with total capacity of 367 MW. Out of the above, 16,472 installations (121MW) operate as Net Metering scheme, 14,392 installations (113.5 MW) operate on Net Accounting scheme and another 1,547 installations (132 MW) operate on Net Plus scheme.

Over voltage issues at low voltage network at day time is becoming quite a common problem in the urban areas, where the locations have a higher amount of rooftop Solar PVs installed. Electricity flows from higher voltage to lower voltage. The inverter has to be running at a higher voltage than the grid, so it can push power out. On a sunny day, when a household’s generation exceeds its consumption, the solar inverter pushes electricity into the grid and this lifts the network voltage a slight amount depending upon the distance from the transformer.

The problem occurs when a large number of solar PV installations are connected in to the same low voltage line and every solar installation is pushing power into the system. This lifts the network voltage above the regulatory limits. This can cause damages to sensitive electrical equipment connected to the network. Voltage rise amount caused by Solar PV is getting increased when the distance from the distribution transformer gets increased.

It is nearly impossible to connect Solar PV systems which are to be connected at far-end locations from the distribution transformers without violating voltage limits. Thereby it is quite obvious that there is an upper cap of domestic solar PV systems which can be absorbed to low voltage networks.

From year 2017 onwards CEB initiated tenders to procure energy from ground-mounted solar PV power plants. The initiated ground-mounted solar PV power plant tenders are in the form of 1MW x 60 plants, 10MW x 2 plants, 1MW x 90 plants, 10MW solar PV power plant with agriculture farming and 150MW solar PV power plants in (1-10) MW capacity and the total expected capacity of those initiated tenders are about 330MW.

At present 33 solar PV power plants amounting to 33MW capacity had been connected to the national grid and about 59 solar PV power plants amounting to 77MW capacity having signed the Power Purchase Agreement with CEB are in construction stage and it is expected to commission within the next (12-15) month period.

The balance capacity is expected to be connected to the national grid in the next two years. Further CEB is expecting to initiate another 90MW ground mounted solar PV power plant tender in (1-10) MW capacity and 60MW ground mounted solar PV power plant tender in 10MW capacity during the upcoming months to further bolster the renewable energy integration to the national grid. At present the installed capacity of ground based solar installations in Sri Lanka is 84 MW.

During the years while the rooftop solar energy generation has continually grown CEB diversified its solar arena in 2020 by launching a project to implement 7,000 Nos of 75 kW ground based solar PV generating systems, under Built Own Operate (BOT), near distribution transformers in rural areas, under national competitive bidding. The distribution transformers where the solar facilities are to be connected have been identified by CEB, after a technical study. The solar facility implementers are to be selected via competitive bidding process, for which the bid has already been published.

The project is expected to add 525 MW of solar power to the national grid and contribute 1,000 GWh of electrical energy per year to the country, once completed. Further CEB will financially benefit since the tariff for the solar energy will be decided via competitive bidding (approximately Rs. 16 per unit) and also this will contribute to CEB’s goal to achieve 70% electricity generation via clean energy sources by 2030.

In this course of progression, CEB has constantly evolved in establishing standards, developing technical specifications, testing procedures and in human capacity building in the solar sector. Also, in parallel, the other industry stakeholders have grown, with time. More and more solar PV vendors have come in to the market and with the ever-growing competition vendors have improved their technical know-how in this field. Further the standards of equipment such as solar panels, inverters, battery banks and other associated equipment, the workmanship and the value-added services provided such as online energy monitoring systems have improved.

Not to mention the existing and prospective solar customers have become more knowledgeable and keener on this area. Utilities, private solar vendors and customers all alike have become more vigilant to the varying solar market conditions in the technical as well as in the financial sense.

Regardless of these continuous improvements and contribution by CEB for the promotion of renewable energy, the critics have always pointed that Sri Lanka is on a slow drive and CEB is an impediment for the promotion of solar and Sri Lanka should meet major percentage of increasing electricity demand by renewable energy resources. Yet, despite the abundance of resources like wind and solar the actual possibility of a 100% renewable fed system needs to be analysed giving due respect to technical and financial constraints.

Sri Lanka has so far tapped the full potential of major hydro schemes and is left with only NCRE resources like mini-hydro, wind, solar, bio mass for any new renewable additions. Resources like wind and solar are inherently intermittent and their output fluctuates according to the real time availability of wind and sunlight. This adversely affects balancing the supply and demand of the power system and also the stability of the system.

Also, it in turn requires either adequate reliable generation reserve from other resources or enough energy storage connected to the system to compensate for the fluctuating supply and to maintain system stability. Additional financial burden has to be borne in order to upgrade the existing transmission and distribution networks to smart grids to support for the high penetration of renewable sources like wind and solar.

As per the CEB least Cost Generation Plan it is envisaged to generate 70% of electrical energy requirement of the country through clean energy sources by the year 2030 out of which 50% is to be generated from renewable energy sources. To achieve this target CEB is planning to integrate 2338 MW of solar and 765 MW of wind power to the national grid in addition to what is existing by the year 2030. This is a challenging task and at the same time creates many business opportunities to the private sector to invest in solar and wind power projects.

It is paramount to meet the country’s low carbon goals, just as it is essential to provide reliable and low-cost energy to support the economic growth of the country. Hence it is important for a developing country like Sri Lanka to adopt a gradual process of phasing out of fossil fuels, based on a scientific approach, rather than rebelling for an overnight green change, based on sentiments. Sri Lanka seems to be exactly progressing on that path by promoting renewable energy and introducing liquid natural gas as gap fuel with contributions of all stakeholders in the sector.

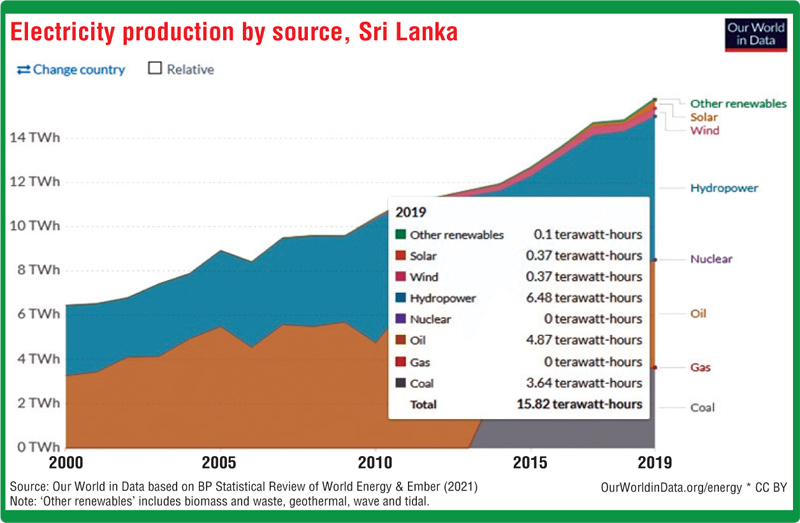

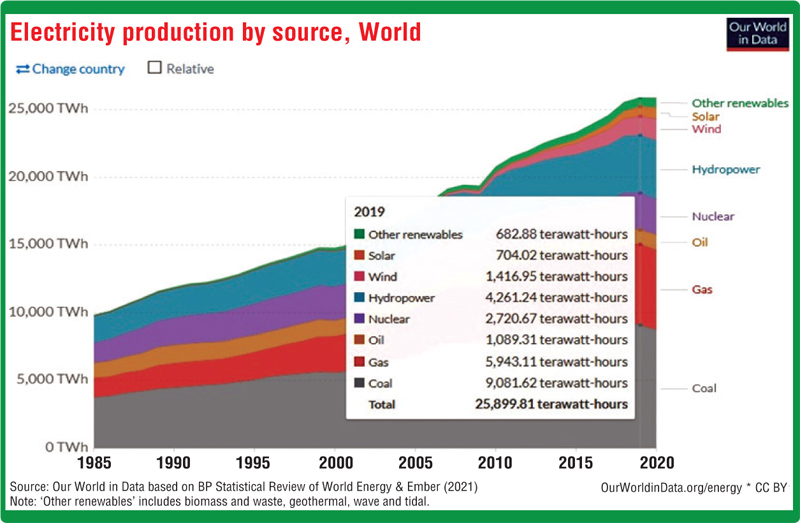

So, with all these progressions how far have we come in the solar industry as a country? How far behind are we as a country in the global solar power generation arena? As per the BP statistical Review of World Energy (2021) data the solar electricity generation of the world is 2.7% of the total generation and that of Sri Lanka is around 2.3% and is growing. This is a sign that Sri Lanka is on the path to a greener future. But what more opportunities lie ahead of us as a country?

Even though the Sri Lankan solar industry has matured since its inception, up to now it has primarily been a passive one, where technology-wise local value addition was minimal. All major equipment such as solar PV panels and inverters are imported and utilised locally which is approximately 80% of the project cost. It is important that investments are made in areas like major component assembling or manufacturing to enlarge the scope of local value addition.

On the other hand, Sri Lanka has so far explored only in mini scale solar power generation, with specific attention to rooftop solar and small-scale ground based solar. Large-scale solar power generation facilities are not yet implemented. The feasibility of adding large-scale solar power plants to the national grids has to be studied further and new projects should be created. Furthermore, if we envision a country with high renewable penetration, steps have to be taken to upgrade our transmission networks to smart grids to suit for such scenario.

Apart from human technical capacity building Sri Lanka has to explore into new business models and investment options in order to make such large-scale solar power plants a reality in Sri Lanka.

The Government, a utility, any authority, the private sector, or a citizen alone will not be able to make the future of the solar industry of Sri Lanka brighter. It would only be a reality if all parties come forward and collaborate to do their part in setting strategic goals, research, capacity building, investments, utility perspectives, and so forth. We are hopeful of such a brighter future.