Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 28 March 2020 00:05 - - {{hitsCtrl.values.hits}}

Realistically, the current WHO advice of good hygiene and social distance would have to be the cornerstones of the fight against the coronavirus in the coming months. It is important to prepare for the worst and hope for the best

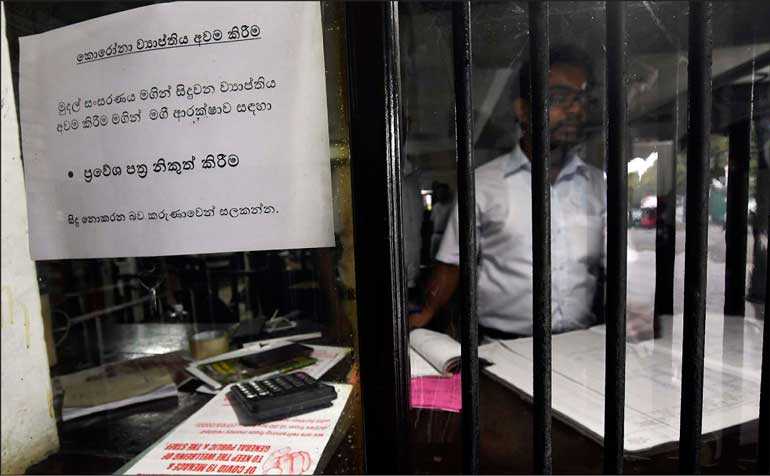

– Pic by Shehan Gunasekara

COVID-19 has wide-ranging implications on two fronts: healthcare provision and economic activities. The impact is being transmitted at the global, sectoral and individual levels. The severe impact of the COVID-19 pandemic is being compounded in global financial markets by the tension in the oil market arising from Russia’s effort to undermine the US shale sector leading to a split between Russia and Saudi Arabia.

The severity of the impact of COVID-19 pandemic is being amplified by the difficulties healthcare services, first in China and then in Europe and the US have had in containing the health emergency. The economic shock is being intensified by a combination of supply disruption and demand destruction.

Health emergency

COVID-19 is a highly-contagious and rapidly-spreading influenza-like virus. It has spread to 197 countries infecting 416,686 people and causing 18,5987 deaths. In today’s highly globalised and interconnected world, it is relatively easy for an epidemic in one country to become a global pandemic very quickly. Extensive human mobility for business, employment and leisure creates conditions which are conducive for the emergence of global pandemics. The authorities in several countries are experiencing severe strains on their healthcare systems and disaster risk management.

Lessons from the successes of China, Hong Kong, Singapore, and Taiwan in containing the spread of the diseases highlight the following formula: identify those affected through testing, trace all contacts with those affected very aggressively; and isolate/quarantine all who have come into contact with the disease. It is interesting that Hong Kong, Singapore and Taiwan which are in close proximity to China, where the disease originated have been most successful in containing the disease. These jurisdictions have drawn important lessons from combating SARS (2003) in terms of developing systems and modalities for rapid and decisive response.

These countries provide the template which can be followed by countries like Sri Lanka. It is difficult to predict when a vaccine will be ready. In the normal course of things, the full cycle of development, testing and regulatory approval can take 10-15 years. Given the global health emergency, there are teams around the world that are working on reducing the time lag. It is said that there are at least two vaccines which are being tested. There also seems to have been some progress in re-purposing existing drugs to combat the Coronavirus. However, more testing is been done. The rule-book is being thrown out of the window and efforts are being made to mobilise money to countries manufacturing even as the testing is being conducted.

Realistically, the current WHO advice of good hygiene and social distance would have to be the cornerstones of the fight against the coronavirus in the coming months. It is important to prepare for the worst and hope for the best. Japan has made good progress on the basis of this twin-pronged approach.

Economic shock

There are both demand and supply shocks that are buffeting the global economy.

Demand shocks include the following;

It is noteworthy that the world’s four largest markets have all been severely affected: China, Europe, US and to a lesser extent Japan.

Supply side shocks;

“The pandemic is also likely to catalyse longer-term compulsions which will have a fundamental impact on the pattern of global production and distribution. Firms are likely to undertake reviews to reduce risks associated with their supply chains as the occurrence of “black swan” events is likely to increase with the rise in the frequency and intensity of climate related natural disasters and health pandemics. There is likely to be pressure to domesticate their supply chains. The technological advances associated with the 4th industrial revolution are likely to provide a tailwind to this process.”

“The pandemic is also likely to catalyse longer-term compulsions which will have a fundamental impact on the pattern of global production and distribution. Firms are likely to undertake reviews to reduce risks associated with their supply chains as the occurrence of “black swan” events is likely to increase with the rise in the frequency and intensity of climate related natural disasters and health pandemics. There is likely to be pressure to domesticate their supply chains. The technological advances associated with the 4th industrial revolution are likely to provide a tailwind to this process.”

Response of government activities in major countries

Government and central banks have responded very aggressively to the prospects of a global recession (less than 2.5% growth). The collapse of output in China in the first quarter of 2020 and expected decline in the US and Europe in the second quarter of 2020 has even prompted talk of a global depression – the first since the great Depression in the 1930s.

The global financial crisis (2008) triggered the last major economic slowdown. The causal factors are qualitatively different. On that occasion the crisis stemmed from the banking system, particularly the “too-large to fail” banks. This time around the banking system, particularly in the US which was the source of the instability last time, is in much better shape, with both capital adequacy and liquidity ratios in stronger positions. This time the crisis is rooted in the real economy and has not been transmitted to the banking system as yet.

The scale of the shock has prompted unprecedented large responses from the major governments and central banks. The authorities in emerging markets including Sri Lanka, have followed suit. Governments are implementing large-scale fiscal stimulus programmes to both large and small businesses as well as measures to shore up household incomes.

“Helicopter money” a term coined by Ben Bernanke, is being issued in the form of income transfers. Australia has done it, The US is contemplating it and the UK is considering a Universal Basic Income. The priorities have been to support otherwise viable businesses, both large and SMEs, which have run into cash-flow difficulties, due to the effects of COVID-19; and to supplement the incomes of families who have experienced losses due to lay-offs. Governments are recognising the need to stand-by their people and businesses in the wake of this unprecedented shock. Business confidence, consumer behaviour and the pattern of family life have all been disrupted materially.

Central banks have also played their role by cutting policy rates, reducing SRR, ramping up asset purchase programmes and taking regulatory action to boost cash-flows of firms by reducing their debt servicing temporarily. As for asset purchases, direct acquisition of corporate bonds has the most direct and effective impact. The ECB has announced such a programme. The US Fed requires a change in the law to permit it. Instead, it is activating the Term Assistance Loans Facility (TALF) used during the response to the Great Financial Crisis. The Chinese government and PBOC have led an aggressive counter response. The fiscal and monetary measures announced (and others in the pipeline) represent a concerted effort to contain the downside and support a strong recovery. More than one government has said it will ‘do what it takes.’

Prof. Ricardo Hausman (Harvard University) has recommended that EM governments should borrow as much as they can to provide sufficient liquidity to firms and income support to households. The focus should be on borrowing from domestic sources and mobilising external financing from official sources. A multilateral debt relief initiative organised by the IMF/World Bank for vulnerable countries should also be on the cards. Access to international capital markets is severely constrained as a result of the spike in yield of high risk assets as result of “flight to quality” as reflected in a strengthening of the USD.

While increased Government borrowing is inevitable and necessary some caution should be exercised because of Sri Lanka’s adverse debt dynamics. Debt to GDP is about 85% while its rating peers record a mean of 55%.

Prospects of recovery

The optimistic scenario for recovery anticipates the COVID-19 induced shock receding by mid-May/June. Some commentators foresee a robust V-shaped recovery. The reasons given are that unlike in the case of a natural disaster, such as an earthquake or storm, the infrastructure, factories with plant and machinery, commercial real estate, etc., will be unscathed and economic activity can recommence as soon as workers can resume their normal working practices. It is noteworthy that there is already a strong bounce-back in China.

If the crisis persists for much longer and firms have to let go large parts of their workforce, then ramping up activity could take longer and the recovery is likely to be more U-shaped. The human costs of the pandemic are already high and will be much higher.

Impact on Sri Lanka

Sri Lanka has launched a strong public health emergency response.

Sri Lanka’s growth which was projected to increase to 4% in 2020 by the CBSL is likely to come under pressure. Output in all sectors would be impacted by the disruption to people attending to their work. Tourism and travel will be most exposed.

The Government had already taken measures to boost economic activity even before the COVID-19 outbreak, in the wake of drastically low growth in recent years. The recessionary pressures affected by the COVID-19 imperative will reduce the danger of overheating in the economy. The authorities would need to calibrate their response to boost growth; as well as protect employment and incomes without undermining macroeconomic stability.

As in the past, the multilateral financial institutions are offering exceptional financing by way of counter cyclical liquidity. The IMF is also likely to attach lighter conditionality with a greater focus on growth in its country programmes. This gives the Sri Lankan authorities the opportunity to negotiate growth friendly programmes after the elections. This would send a positive signal which would enhance sentiment and confidence at home and abroad while enhancing Sri Lankan creditworthiness.

Crises can offer opportunities. Priority should be attached to effecting reforms that strengthen the framework to facilitate growth on a sustained basis. Reforms should focus on improving the factor markets; business climate; trade policy and facilitation to increase competitiveness and access markets; education, training and skills development; mainstreaming sustainability to planning and budget processes; strengthening tax administration; improve Doing Business Index ranking; special attention should be paid to reforming the large loss-making public enterprises which undermine fiscal sustainability and the balance sheets of state banks.

The Pathfinder Foundation proposes that the Government as a matter of urgency sets up a fully-empowered ‘Economic Recovery Task Force’ that should be mandated to very quickly develop a comprehensive short, medium and long term blueprint for Sri Lanka’s economic recovery once the situation stabilises. This task force should be composed of the best minds the country has to offer.

This group should be instructed to think outside traditional paradigms and look for practical ‘beyond the box’ solutions and pursue measures designed to take advantage of opportunities created in the short-term by the bounce-back; and measures which anticipate the arc of paradigm shifts in the longer-term in terms of how production of goods and services will change. It is important for us to understand that the post-corona global environment will look very different to the world we knew before this pandemic engulfed us.

(This is a Pathfinder Alert of the Pathfinder Foundation. Readers’ comments are welcome at www.pathfinderfoundation.org)