Saturday Feb 21, 2026

Saturday Feb 21, 2026

Saturday, 8 September 2018 00:10 - - {{hitsCtrl.values.hits}}

Perpetual Treasuries seems to be treating the gain as a capital gain. My view on the matter is set out below.

1. It is clear that the fiscal concession conferred in respect of interest received by section 32 (2) of the Inland Revenue Act, No 10 of 2006 (as amended), is confined to a “primary dealer” alone (within the contemplation of the definition of the relevant term phrase as set out in section 217 of the Act) who is engaged in a primary market transaction.

2. The question that arises for consideration is whether a primary dealer who purchases a relevant security, treasury bond or treasury bill issued under the relevant empowering statutes in a primary market transaction and retains such security or instrument until maturity or for more than one day comes within the scope of the tax concession conferred by section 32 (2).

3. The statutory provision makes it explicit that the fiscal concession is confined to a primary dealer engaged in a primary market transaction who holds the relevant security or instrument for no more than one day. It is trite law that a transaction cannot be both a primary market transaction and a secondary market transaction at the same time. It is possible for a transaction to have that status on a consecutive basis but the status cannot be concurrent.

4. The general rule of interpretation is that a statute is to be construed, if possible, so as to give sense and meaning to every part. The maxim expressio unius est exclusion alterius (which means the express mention of one thing implies the exclusion of another) was never more applicable than when applied to the interpretation of this statute.

5. Francis Bennion in his well-known work Bennion on Statutory Interpretation [London: Lexis Nexis, 5th edn., 2008], at p. 1259, commenting on the operation of the principle in specific statutory contexts, states as follows:

Uncertainty in one part of a proposition may be resoved by implication from what is said in another part, even though that other part is not directly referring to the first part. Accordingly, account is to be taken of a meaning of one provision in an Act that logically if obliquely arises from what is said elsewhere in the Act. Equally, an express statement in an enactment may carry oblique implications respecting the legal meaning of other Acts, or of unenacted rules of law.

6. P. St. J. Langan (ed) in Maxwell on The Interpretation of Statutes [London: Sweet & Maxwell, 12th edn., 1969], at p. 293, states as follows:

[W]here a statute uses two words or expressions, one of which generally includes the other, the more general term is taken in a sense excluding the less general one; otherwise there would have been little point in using the latter as well as the former.

7. A related linguistic canon of statutory construction is the noscitur a sociis principle. This means that a word or phrase is not to be construed as if it stood alone but in the light of its surroundings. This means in effect that a statutory term is recognised by its associated words.

8. In Bourne v Norwich Crematorium Ltd, [1967] 1 WLR 691, at p. 696, Stamp J expressed the applicable principle in the following manner:

English words derive colour from those which surround them. Sentences are not mere collections of words to be taken out of the sentence, defined separately by reference to the dictionary or decided cases, and then put back into the sentence with the meaning which you have assigned to them as separate words...

9. This principle can be illustrated by the manner in which the Financial Services Act 1986 was interpreted in City Index Ltd v Leslie, [1992] QB 98. Schedule 1 paragraph 9 of the Act referred to a contract the purpose of which “is to secure a profit or avoid a loss”. The question arose whether “secure a profit” meant obtain a profit or arrange security for a profit. The court decided the point by reference to a note included in paragraph 9 which disapplied the paragraph “where the profit is to be obtained in a specified manner”.

10. In the instant case what is relevant is the fact that the holding of any relevant security or instrument for a period longer than one day from the date of acquisition by a primary dealer who has acquired such security or other instruments is treated as a secondary market transaction by operation of law.

11. A primary market transaction arises by implication where the relevant instrument or security is held for less than one day because any period in excess of one day would be treated as a secondary market transaction. The inclusion of a situation where a relevant instrument or security is held by a primary dealer for more than one day within the definition of a secondary market transaction by necessary implication excludes this from the scope of a primary market transaction.

12. Where a person is engaged in buying and selling securities and making a profit by way of trade it cannot be argued that the gain constitutes a capital gain (where the test is different). Therefore, an income tax liability will kick in. Furthermore, there is most likely to be a liability for Financial VAT, dividend tax and deemed dividend tax.

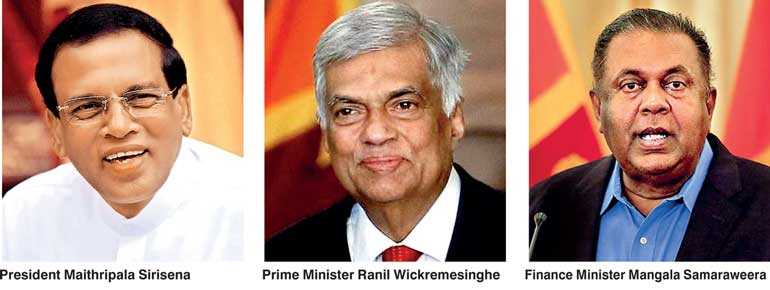

I hope this sufficiently clarifies the legal position.Dear Prime Minister,

In pursuit of your commitments to the Parliament please take additional steps re: Treasury bond case and ensure upholding the rule of law, justice and promotion of

anti-corruption actions

The citizens have noted with great satisfaction; and remain hopeful of seeing the realisation of the commitments you made in the Parliament, in response to the question raised by the Chief Opposition Whip regards the Treasury Bond Scam. By your response, you committed that:

1. The Government had sought the Attorney General’s advice, as to whether it can take over the Rs. 11 billion lying to the credit of the Perpetual Treasuries Group in frozen accounts, without waiting till the conclusion of the on-going case in the Colombo High Court; which is purportedly more than the loss incurred due to the questionable Treasury Bond issuance

2. The Attorney General and the Police are free to initiate action in the High Court upon the conclusion of the investigation

3. You will ask the Attorney General’s Department and the Bribery Commission to expedite and complete the investigations early;

4. All legal steps have been taken in bring the former Governor back to the Country; and

5. To inform you of anything else that needs to be done:

In pursuit of the above commitments especially 5 above, on 6 September 2018, the day You as the leader of the United National Party celebrate its 72nd Anniversary of the Party, under the theme ‘Weda Karana – Weda Keruna 72,’ I appeal that in fulfilment of the “Yahapalanaya Promises of 2014/15” that you personally take due Transparent and Committed Executive Action, under your personal directions and oversight, to ensure that the following action steps are initiated without delay:

1. Instruct the Commissioner General of Inland Revenue, to initiate a process to assess and recover the following taxes due, along with applicable penalties due thereon, in the event it is determined that any member of the Perpetual Treasuries Group of Companies have wilfully avoided and/or failed to return and settle the dues, arising from engaging in business activities and “Acting As a Primary Dealers and or Trading in Government Securities, Bonds, etc.,” and in respect of profits made there from:

a. Income Tax

b. Financial VAT

c. Deemed Dividend Tax

(Opinions of two leading Tax Experts in above connection is annexed)

2. Insist that the Auditor General or a Competent Auditor selected by the Auditor General, conducts a Forensic Audit and Transfer Pricing Audit on the operations of any member of the Perpetual Treasuries Group of Companies, which engaged in business activities as Primary Dealers, and or Trading in Government Securities, Bonds, etc. during the financial years 2015 and 2016, and the findings are transparently published and provided to the Attorney Generals Department and the Bribery Commission.

3. Arrange for the Securities and Exchange Commission of Sri Lanka(SEC), as well as any of the Professional Accountancy Bodies who are members of IFAC (including CA Sri Lanka, CIMA Sri Lanka and ACCA Sri Lanka),the Chartered Financial Analysts Sri Lanka, the Bar Association of Sri Lanka, the Directors Institute and any Chambers of Commerce to assess whether any entity or any Director, Officer or Manager or Employee of the Perpetual Treasuries Group of Companies were also concurrently members of the respective Professional bodies/associations and Chambers; and were bound by Codes of Governance, or Professional Codes of Conduct and Ethics; and if so require such Associations, professional bodies and Chambers to carry out a review whether any of their members who were in employment or acted in a professional capacity as Accountants, Mangers, Lawyers, Investment Managers, Auditors, Consultants or Tax Practitioners have violated the binding Professional Codes of Conduct and Ethics and / or any Commitments arising from :

a. Non-compliance with Laws and Regulations (NOCLAR) or

b. Any provisions of the Prevention of Money Laundering Act

and if so to compel them to institute relevant disciplinary hearings and impose required sanctions where in default of applicable codes.

I look forward to your personal leadership action in initiating the proceedings as set out above in pursuit of your commitment to the Parliament.

In pursuit of your commitments to the Parliament please take additional steps re: Treasury bond case and ensure upholding the rule of law, justice and promotion of

anti-corruption actions

Chandra J on Perpetual Treasuries