Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 18 October 2023 01:09 - - {{hitsCtrl.values.hits}}

1. Introduction

Committee on Public Accounts

Committee on Public Accounts of Sri Lanka is one of the oldest Parliamentary financial oversight committees where the Westminster model of Parliamentary System has been practicing. This is the oldest and the most significant financial oversight Committee in Parliament of Sri Lanka. As an Oversight Committee, the Committee on Public Accounts plays a pivotal role in assisting the respective Parliaments to ensure the accountability to the public finance as people’s representatives. It is tasked with overseeing the use of public funds for executing public policies.

2. History of the committee

The Public Accounts Committee was set up in response to the motion placed before the Legislative Council by E.R. Thambimuttu on 5 October 1921.

The motion moved

“Since the Council has no means of ascertaining that the grants of the Council for each financial year, including supplementary grants, have been applied to the objects which the Legislative Council presented and also in view of the fact that any balances have been left unexpended at the end of the year are not made available to meet the following years expenditure.” I move that a Standing Committee of Public Accounts be appointed for the ensuing financial year, namely 1921 – 22.” (Ceylon Sessional Papers, 1922)

A Standing Committee on Public Accounts was accordingly appointed on 5 September 1923. Its first meeting was held on 17 October 1923. That Committee consisted of the following members.

Chair – E.J. Hayward

E.R. Tambimuttu

F.R. Dias

A.C.G. Wijekoon

It dealt with the Colonial Auditor’s report for the year 1921-22. This situation persisted until the introduction of the Donoughmore Constitution in 1931 and it functioned with some limitations. However, at the request of the Committee the Colonial Auditor was present at all meetings. The Constitution of 1931 did not give much attention to the role of audit or Public Accounts Committee. However, they recommended far-reaching changes regarding the responsibility of audit. Accordingly, for the first time the Auditor General was made responsible directly to the Legislature.

The Committee was thereafter appointed by a resolution of the State Council on 21 June 1932 and the rules and orders of the State Council were amended to provide for a Standing Committee on Public Accounts.

It was suggested and agreed to carry out the recommendations of the Public Accounts Committee with the concurrence of the Treasury by the Financial Secretary. At the request of the Committee, the Auditor General and a representative of the Treasury were also attended to the Committee meetings.

Another important matter, which came up during this period was, the fact that the State Council should consider the report of the Committee on Public Accounts in the House.

An important fact raised here was that within the Soulbury administrative system, financial control should not be concluded at the approval of estimates in the parliament and, the importance of including the scrutiny of proper utilisation of provisions approved for a service by the enforcement of the appropriation bill, to the scope of the Auditor General.

After the grant of independence to Sri Lanka in 1947, due to the growth of public revenues and expenditure, it was needed to be scrutinized more carefully to achieve proper accountability.

A full-fledged Committee on Public Accounts was set up under Standing Order No. 125 of Parliament when independent Sri Lanka was born in 1948.

As years went by, the increasing workload on CoPA necessitated the separation of public finance policy issues relating to Public Enterprises. Standing Order No.126 was enacted by Parliament on the 23 March 1979 for establishing a separate Committee on Public Enterprises. After 43 years, Standing order No. 119 of the new Standing Orders of Parliament approved and adopted by Parliament that include the revisions approved by Parliament on 05 October 2022 and 23 November 2022 which are effective from 23 November 2022 provides for the establishment, powers and functions of the Committee on Public Accounts.

The Committee on Public Accounts is enforced by the Parliament Standing Order 119 and Standing Order 134 and 135 provide for the matters connected to the proper functioning of the Committee.

3. Constitutional provisions relating to the public finance

Constitutional provisions

In Sri Lanka, Parliament is vested with full powers over public finance. Article 148 of the Constitution of Sri Lanka provides as under;

“Parliament shall have full control over public finance. No tax, rate of any other levy shall be imposed by any local authority or any other public authority except by or under the authority of a law passed by Parliament or of any existing law”

Articles 149 and 150 related to the Consolidated Fund and Article 151 related to Contingencies Fund also indicate the exclusive control of Parliament over public finance.

4. Main duties of Parliament over public finance

Parliament exercises its control over public finance in three stages.

The above functions are executed by Parliament at two levels

Through the level of the Committees:

At this level, Parliament is privileged to examine in-depth through its Committees.

Accordingly, the Committee on Public Accounts performs the financial oversight duty by assisting the control of public finance.

The contribution of these Oversight Committees is very crucial in Parliamentary control over public finance.

5. Committee on Public Accounts (COPA)

Duty of COPA

Duty of COPA

It shall be the duty of the Committee on Public Accounts to examine the accounts showing the appropriation of the sums granted by Parliament to meet the public expenditure and such other accounts laid before Parliament as the Committee may think fit, with the assistance of the Auditor-General. - [SO 119 (2)]

The Committee on Public Accounts shall, every three months, report to Parliament on the accounts examined, the finances, financial procedures, performance and management generally of any department, local authority and on any matter arising therefrom. The report shall include observations on matters that require remedial action, and recommendations to ensure the proper usage of public finance. - [SO 119 (3)]

The following Hon. Members of Parliament had chaired the Committee on Public Accounts during the period of years 1923 to 1947.

The following Hon. Members of Parliament had chaired the Committee on Public Accounts during the period of years 1923 to 1947.

The following Hon. Members of Parliament had chaired the Committee on Public Accounts from 1947 until now.

The following Hon. Members of Parliament had chaired the Committee on Public Accounts from 1947 until now.

Composition of COPA

Composition of COPA

[SO 119 (1)] - There shall be a Committee to be designated the Committee on

Public Accounts consisting of sixteen Members, who are not members of the

Cabinet of Ministers nominated by the Committee of Selection.

The Members are appointed by the Committee of selection according to the party ratio and announced by the Hon. Speaker of the Parliament at the commencement of each Session of Parliament.

This Number varies from session to session according to the decisions taken by the Committee of Selection on the request of party leaders.

Composition of COPA in the 4th Session of the 9th Parliament

The Committee on Public Accounts currently consists of 31 members that are listed below.

Lasantha Alagiyawanna, M.P. (Chair)

Mohan Priyadarshana De Silva, Attorney at Law, M.P.,

Prasanna Ranaweera, M.P.,

K. Kader Masthan, M.P.,

(Dr.) Suren Raghavan, M.P.,

(Mrs.) Diana Gamage, M.P.,

Chamara Sampath Dasanayake, M.P.

S.B. Dissanayake, M.P.,

Tissa Attanayake, M.P.,

Wajira Abeywardana, M.P.

A.L.M. Athaullah, M.P.

Kabir Hashim, M.P.,

Mano Ganesan, M.P.

(Dr.) Sarath Weerasekera, M.P.,

Wimalaweera Dissanayake, M.P.,

Niroshan Perera, M.P.,

J.C. Alawathuwala, M.P.,

Vadivel Suresh, M.P.,

Ashok Abeysinghe, M.P.,

Buddhika Pathirana, M.P.,

Jayantha Ketagoda, M.P.,

Sivagnanam Shritharan, M.P.

Hector Appuhamy, M.P.,

(Dr.) Major Pradeep Undugoda, M.P.,

Isuru Dodangoda, M.P.,

Muditha Prishanthi, M.P.

M.W.D. Sahan Pradeep Withana, M.P.,

D. Weerasingha, M.P.,

Weerasumana Weerasingha, M.P.,

Manjula Dissanayake, M.P.

(Dr.) Harini Amarasuriya, M.P.,

6. Auditor General and COPA

6. Auditor General and COPA

Article 153 of the Constitution of Sri Lanka provides for the appointment of the Auditor-General.

Article 154 of the Constitution of Sri Lanka enumerates the following duties and functions of the Auditor-General.

The National Audit Act No.19 of 2018 states that the Auditor General should assist the duties of the Committee on Public Accounts.

The Auditor General submits his reports to the parliament that are prepared on the accounts of the Government Institutions within 10 months of the closure of each financial year and as and when he deems it necessary.

The Reports of the Auditor-General form the foundation for further work by COPA. Nothing however forbids the Committee to examine matters involving public finance, which has not been reported upon by the Auditor-General.

By scrutinising the reports submitted by the Auditor-General, the COPA observed that the matters referred by the Auditor-General as deficiencies on the part of the public institutions falls in to following broader categories.

1. Non-compliances with Appropriation Laws, Financial Regulations and other Regulations, Treasury circulars and Departmental standing orders, etc.

2. Non-performances and under performances in relation to the resources consumed.

3. Not performing of the objectives and main functions entrusted to the entities at the establishment of such institutions.

4. Losses to the Government, Uneconomical Transactions, Misappropriation of Government Assets and frauds.

7. Fundamentals to be established by COPA

There are three fundamentals, which the Public Accounts Committee, in its functions, should have to establish:

1. To ensure that money is spent as Parliament intended.

2. To ensure the due exercise of economy

3. To maintain high standard of public morality in Financial Matters.

The Committee is expected to ascertain whether the money has been spent adhering to the rules, regulations and practices laid down by Parliament.

The investigations of the Committee on Public Accounts focus on the following main areas:

8. Institutions under the supervision of COPA

8. Institutions under the supervision of COPA

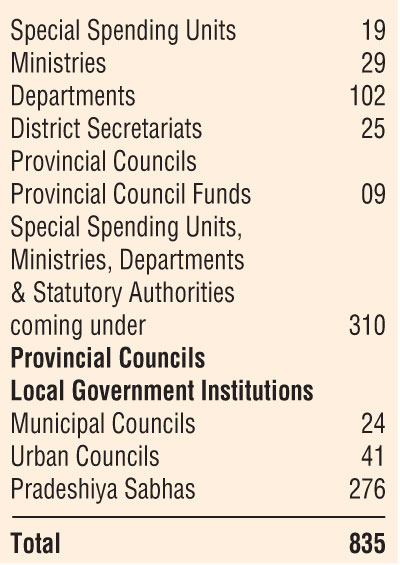

There are approximately 835 institutions coming under the supervision of this Committee (according to the 2023 Estimate)

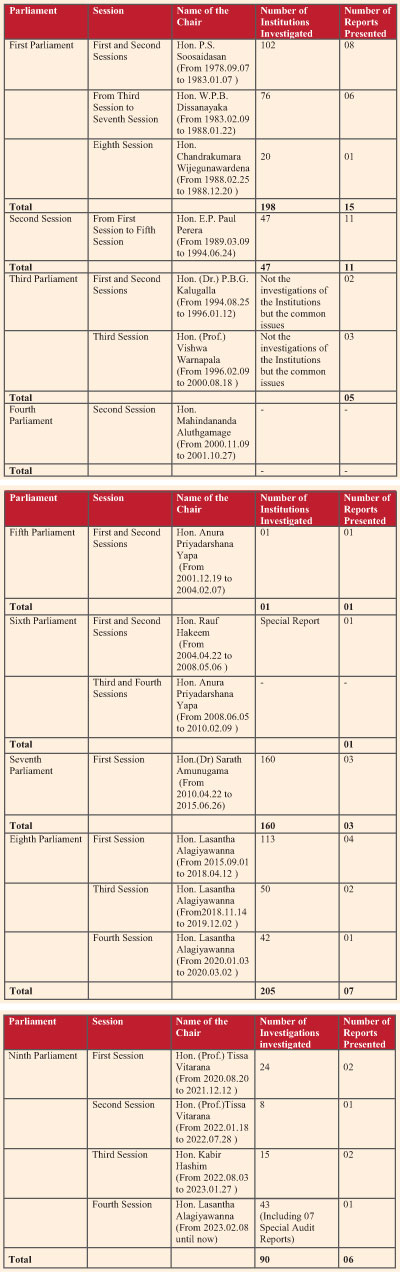

The reports presented to the Parliament and the institutions investigated by CoPA from the 1st Parliament to date are as follows:

Committee on Public Accounts – Examinations of the Institutions and Table the Committee Reports (1978 – 2023)

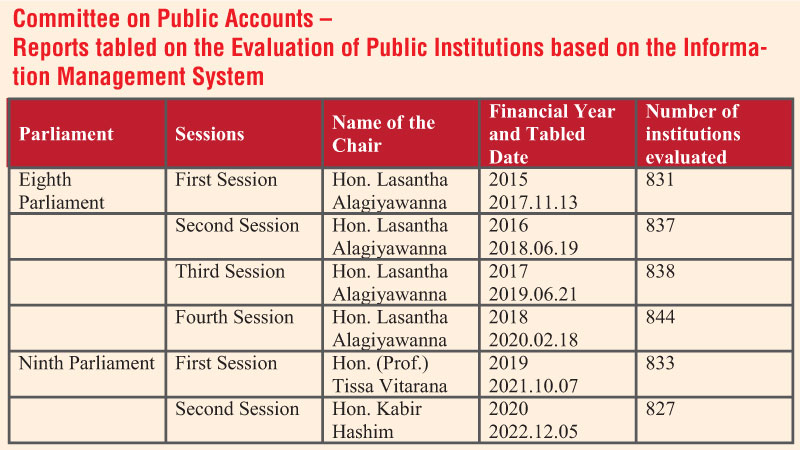

Since it was difficult to call around 835 institutes before the Committee, the Eighth Parliament COPA initiated a Web Based Evaluation System involving all the state institutions from the financial year 2015 to evaluate their financial discipline, adherence to financial rules and regulations and also to performance guidelines, with the intention of overcoming these challenges to some extent (in addition to the prevailing Committee system).

This online questionnaire was presented to evaluate those institutes to an extent.

9. CoPA Management Information System (CoPA MIS)

With the escalation of the number of public institutions, the Committee on Public Accounts of the Eighth Parliament had identified the following key areas as the immediate challenges that have to be overcome focusing special attention on the Committee.

Strategies adopted by the CoPA in implementing the online evaluation system

All the state institutions have been categorized into eight groups considering their accounting and administrative systems and procedures, nature of the reporting systems applicable for them and the amount of budget allocation.

All the state institutions have been categorized into eight groups considering their accounting and administrative systems and procedures, nature of the reporting systems applicable for them and the amount of budget allocation.

A communication path had been developed among all stakeholders and link with the subject officers who handle the programme, Accounting officers, Chief Accounting Officers, Auditor-General and the Parliament has been developed.

A communication path had been developed among all stakeholders and link with the subject officers who handle the programme, Accounting officers, Chief Accounting Officers, Auditor-General and the Parliament has been developed.

Six online formats of questionnaires have been prepared for each category of institution and uploaded to the COPA Management Information System (MIS) to enable all the state institutions to download and complete the questionnaire online.

Six online formats of questionnaires have been prepared for each category of institution and uploaded to the COPA Management Information System (MIS) to enable all the state institutions to download and complete the questionnaire online.

The Questionnaire consists of two parts and was framed to perform evaluations along the following directions.-

The Questionnaire consists of two parts and was framed to perform evaluations along the following directions.-

Part I – Financial Compliance

i. Performance and preparation of Financial Statements

ii. Measures taken by institutions for Financial Control

iii. Asset Management

iv. Maintenance of Records and submission of financial reports

v. Revenue Management (Collection and accounting of revenue)

vi. Expenditure Control (Adhering to limits fixed by the Parliament, maximum utilising of provisions and Interest limits)

vii. Other Financial Activities (Advance Account, Commercial activities and Deposit Accounts )

viii. Maintaining of Records (main primary books of the entity)

ix. Timely Submission of Reports (Eight main Accounts )

x. Responses to Audit (Audit Queries and Internal Audit Queries)

xi. Reporting to Parliament (Submission of Performance Reports)

Part II – Operational Performance

i) Implementing the provisions of the Right to Information Act

ii) Reaching Sustainable Development Goals for the Millennium Development

iii) Implementing provisions of the Citizens’ Charter

iv) Implementing a good Human Development Plan

v) Reaching a clear audit opinion according to the new Audit Act

vi) Proper responding to audit disclosures reported to Parliament

vii) Reaching performance goals according to identified objectives and functions of each institution

10. Significant achievements and activities of COPA in between the Eighth Parliament and now

e.g.: The percentage of improvement of overall financial control and compliance with performance guidelines of all the government institutions examined through COPA MIS are as follows:

Accounting year 2015 - 64%

Accounting year 2016 - 71%

Accounting year 2017 - 80%

Accounting year 2018 - 78%

Accounting year 2019 - 82%

Accounting year 2020 - 80%

Special observations on achievements

In 2015, out of around 840 government institutions, 111 institutions have scored low marks or less than 50 marks where it was able to bring the number to just one institution in 2021.

In 2015 it was limited only to 58 institutions or 7% of the total institutions to obtain more than 90% marks in the evaluation whereas the figures have increased to 329 institutions or 37.1% in 2021.

Performance evaluation on a different basis was started later, from 2018, has shown a considerable encouraging signs of giving more weightage for performance evaluation by 191 institutions or 18.3% obtaining more than 90% in 2021 evaluation.

A fundamental technical committee consisting of 13 relevant institutions that is chaired by the Secretary to the Prime Minister had been appointed to enforce the recommendations of this Sub Committee which is performing successfully. Presidential Secretariat, Ministry of Finance, Economical Stabilization and National Policies, Ministry of Technology and the Information and Communication Technology Agency of Sri Lanka are the other members of this Sub Committee.

A number of meeting sessions and a series of zoom meetings were held to review the online questionnaires and submit proposals to bring timely amendments. A questionnaire that had been updated accordingly was presented for the year 2022.

Implementation of the directives given by CoPA has been strengthened by the amended Standing Order 119(4) of Parliament.

Standing Order 119(4) - “A report of the Committee on Public Accounts, once tabled in Parliament shall be referred to the Minister in charge of the subject of Finance and the Ministers in charge of the institutions and the respective Minister shall submit the observations and actions taken in that regard to Parliament within eight weeks.

If the Minister is of the view that particular recommendations may not be fulfilled, the Minister shall explain the reasons in writing and indicate alternative actions, the Minister proposes to take to ensure the proper usage of public finance.

If the Committee requires, the committee may invite the relevant Minister to explain the position in person, and to answer the questions that arise as to such matters within eight weeks.

When Parliament so decides, the report concerned may be referred to the Attorney- General for his observations and necessary action.”

In the Eighth Parliament, the Chairman of the Committee on Public Accounts and the Chairman of the Committee on Public Enterprises submitted a joint proposal to the Honorable Speaker of the Parliament to facilitate live broadcasting of the committee meetings. Accordingly, Standing Order No. 14 of the Parliament has made provision for that.