Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 2 November 2021 01:46 - - {{hitsCtrl.values.hits}}

Apparel, ceramic, porcelain, crafts, gem and jewellery are some products which lost market grip as a result of the withdrawal of GSP+ in 2010 – Pic by Shehan Gunasekara

By Economic Intelligence Unit, Ceylon Chamber of Commerce

Key insights

What is EU GSP?

The Generalised System of Preference schemes of the European Union (EU GSP scheme) is a unilateral trade arrangement implemented by the EU where developing countries are allowed to pay less or no duties on their exports to the EU. EU GSP has been in operation for over 50 years since its introduction in 1971 (born out of the UN Conference on Trade and Development (UNCTAD)’s request for developed countries to help developing countries integrate into the world economy). There are three main variants (arrangements) of the EU GSP scheme;

Standard (General) GSP: for low and lower-middle income countries. This means a partial or full removal of customs duties on two third of tariff lines.

Special Incentive Arrangement for Sustainable Development and Good Governance, GSP Plus (GSP+): It slashes these same tariffs to 0% for vulnerable low and lower-middle income countries that implement 27 international conventions related to human rights, labour rights, protection of the environment and good governance.

Everything but Arms (EBA): The special arrangement for least developed countries (LDCs), providing them with duty-free, quota-free access for all products except arms and ammunition.

GSP Plus therefore offers incentives in the form of duty reductions on exports as a reward to developing countries for their commitment to upholding the 27 core international conventions on human and labour rights, sustainable development and good governance. In addition, the country must also be considered ‘vulnerable’ under two conditions;

the country is not competitive in the EU market (the import-share ratio is less than 6.5% of EU’s total GSP imports) and

the country does not have a diversified export base (seven products account for over 75% of that country’s total GSP imports to EU).

Eligible country exports to EU under the EU GSP scheme must also be compliant with the Rules of Origin (RoO) criteria (as set out in the GSP scheme) in order to be eligible for the tariff reduction. There are currently eight GSP Plus beneficiaries in the EU GSP scheme- Sri Lanka, Armenia, Bolivia, Cape Verde, Kyrgyzstan, Mongolia, Pakistan, and the Philippines.

Why is GSP+ scheme important for Sri Lanka?

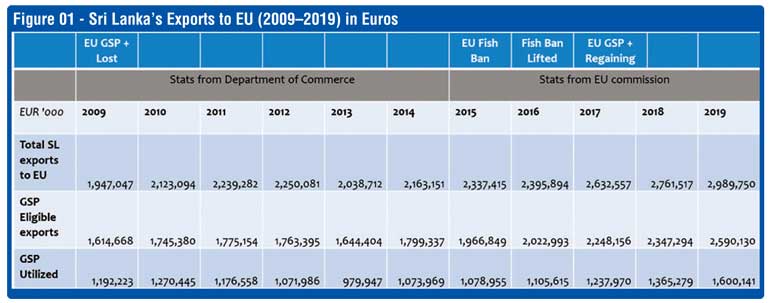

EU is Sri Lanka’s largest export market accounting for $ 3.1 b and a share of 31.6% of total exports. EU is also the largest market for Sri Lanka’s leading export product, apparel, accounting for 42% of Sri Lanka’s apparel exports (two-year average: 2019 and 2020.)1. Sri Lanka’s export trade with the EU improved significantly from $ 1.76 b in 2004 to a peak of $ 3.56 b in 2011.

Export performance since then has been below the $ 3.45 b mark struggling to reach the level attained in 2011 due to withdrawal of the GSP+ facility in 2010 and ban on fisheries exports in 2015. In the first eight months of 2021, export to EU including UK has increased by 26% compared to the same period in 2020 in line with the overall export growth of 23%.

Sri Lanka’s GSP+ benefits were temporarily withdrawn in August 2010 due to non-effective implementation of certain human rights conventions. As a result, Sri Lanka operated under the GSP scheme for little over a six-year period, until the GSP+ facility was regained in May 2017.

Regaining GSP+ was an important victory for the country, as at that time Sri Lankan exports have been performing poorly. During 2015 and 2016, exports declined year-on-year for 17 months straight (March 2015 to July 2016). The additional tariff advantage greatly strengthened Sri Lankan exports’ relative competitive position in the EU.

Sectors like apparels, processed food products, seafood, toy products, porcelain and ceramic ware, are some of the main sectors that benefited under GSP Plus. The additional tariff concession gained by these sectors varied; in many apparel categories duties are cut from 9.6% to zero, in the seafood sector from 18.5% to zero, in the fresh and processed fruits and vegetable sector from 12.5% to zero, in the porcelain and ceramic ware sector from 8.4% to zero, and in the toy products sector from 1.2% to zero.

While it is difficult to provide a full analysis of what was lost due to withdrawal of GSP+ in 2010, looking at how Sri Lanka’s competitors fared in the EU market, provides a perspective on how Sri Lanka lost out to Asian apparel exporters.

According to the International Trade Centre, Vietnam, Pakistan and Cambodia all trailed Sri Lanka in 2009, with EU exports at $ 2.1 billion, $ 1.5 billion and $ 1.09 billion respectively, against Sri Lanka’s $ 2.3 billion. By 2015, however, Vietnam’s apparel exports to the EU had risen to $ 3.9 billion, Pakistan’s to $ 2.9 billion and Cambodia’s to $ 3.7 billion, with Sri Lanka trailing at $ 2.4 billion. Apparel, ceramic, porcelain, crafts, gem and jewellery are some products which lost market grip as a result of the withdrawal of GSP+ in 2010.

Further the EU GSP also provides an opportunity to engage in regional cumulation2 to gain advantage of Rules of Origin. Regional cumulation encourages regional co-operation amongst those countries which are both GSP beneficiaries and members of a regional grouping recognised by the EU. Inputs from other countries are considered as originating in the exporting country. There are two main types of regional cumulation that can benefit Sri Lanka:

SAARC was recognised by EU with effect from 31st October 2000 as a regional grouping to enjoy the benefits of regional cumulation of origin. For example, fabric imported from a SAARC country doesn’t have to go through the double transformation process.’

Source material from any ASEAN county and export to EU under GSP subject to a condition that the two cumulating countries produce a joint statement to the EU that they agree to comply to EUs reporting requirements under ROO criteria which will then be accepted and gazetted by the EU. For e.g. Source unprocessed tobacco from Indonesia and manufacture cigarette products to be exported to the EU member countries. The normal duty rates applicable for this product category is about 29% and can be brought down to about 8%-9% by making use of these facilities. Non-compliance with ROOs will be dealt with seriously as the EU follows a strict monitoring procedure on compliance to prevent anti-dumping3. There has been an instance where bicycles imported from China has been re-assembled in Sri Lanka and re-exported to EU under GSP scheme to avoid 48.5% anti-dumping duty applicable.

Although Sri Lanka has applied for Regional cumulation with countries such as South Korea and Indonesia, there has not been much progress achieved.

The European Parliament Resolution:

The European Parliament Resolution on the situation in Sri Lanka, in particular the arrests under the Prevention of Terrorism Act (2021/2748 (RSP) [Based on details published in the European Parliament website]:

Way forward

Based on consultation with key stakeholders, the following key recommendations are made in terms of way forward:

Footnotes

1USD Mn 2153 and USD 1748 Mn in 2019 and 2020. This figure includes exports to UK

2 Regional cumulation is a form of diagonal cumulation, which only exists under the Generalised System of Preferences (GSP) and operates between members of a regional group of beneficiary countries. http://ec.europa.eu/taxation_customs/customs/customs_duties/rules_origin/preferential/article_774_en.htm#regional_cumulation

3 A company is dumping if it is exporting a product to the EU at prices lower than the normal value of the product (the domestic prices of the product or the cost of production) on its own domestic market. http://ec.europa.eu/trade/policy/accessing-markets/trade-defence/actions-against-imports-into-the-eu/anti-dumping/index_en.htm