Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 15 February 2021 02:30 - - {{hitsCtrl.values.hits}}

Despite Governor Lakshman’s assertion that the Government has the economy well in hand, the emerging economic indicators record a ‘doomy and gloomy’ picture day by day

Dismissing the critics of the current economic policy

Dismissing the critics of the current economic policy

Central Bank Governor Deshamanya Professor W.D. Lakshman, in a press conference last week, is reported to have blamed the critics for failing to understand the economic policy measures being pursued by the Government. He has branded the critics as “purveyors of ‘doom and gloom’” and added that they have not understood the alternative economic strategy being pursued by the Government. According to him, “The Government has the economy well in hand and will ensure all debt repayments.” (Available at: http://www.ft.lk/front-page/Govt-managing-economy-using-alternative-measures-CB-Chief/44-713143).

Both local and foreign critics taken to the task

The critics he has referred to include both foreign agencies like multilateral lenders and rating agencies and the local writers who have recently expressed their views on the conduct of the budget and monetary policy. Two such local critics have been ex-central bankers, former Assistant Governor Anila Dias Bandaranaike, and former Director Professor Sirimevan Colombage.

Bandaranaike, constructively criticising the Budget 2021, had questioned the validity of budget numbers, and opined that its realisation was doubtful. She had referred it to an instance of an ostrich sinking its head in the sand or the emperor walking in the street in his new clothes (Available at: http://www.ft.lk/columns/Budget-2021-Playing-ostrich-or-parading-in-the-Emperor-s-new-clothes/4-711788).

Colombage had written several articles questioning the soundness of the Central Bank’s monetary policy, especially its adherence to what is known as ‘Modern Monetary Theory’ or MMT. He had argued that money printing by the government to repay debt worshipping MMT is likely to magnify the macroeconomic imbalance (Available at: http://www.ft.lk/columns/Money-printing-to-repay-Govt-debt-worshipping-MMT-is-likely-to-magnify-economic-instability/4-710612).

Both Bandaranaike and Colombage had held, among others, the post of the Director of Statistics in the Central Bank and had had hands-on experience in estimating the country’s Gross Domestic Product, compiling the Central Bank’s internal price indices, and conducting island-wide consumer finance and socio-economic surveys.

Governor Lakshman had not personally referred to them when he challenged his critics, but he had been extremely polite when doing so. This is a departure from the previous practice of the Bank in which such critics were referred to as mere ‘retired central bank officers’ implying that they were not fit to express their opinion on the economy.

Economy is indeed in doom and gloom

Despite Governor Lakshman’s assertion that the Government has the economy well in hand, the emerging economic indicators record a ‘doomy and gloomy’ picture day by day. This has been the trend which the country has been experiencing since 2013. There were signs of major macroeconomic imbalances that needed immediate attention by policymakers. Economic growth had been slowing after the three boost years following the end of the ethnic war in 2009. Accordingly, during 2010 to 2012, the real economic growth rate on average was above 8%.

But because of the domestic economy-based economic strategy pursued by the Government ignoring the need for integrating to the global economy, growth rate started to fall year after year since 2013. The Yahapalana Government which came to power in 2015 failed to arrest this declining trend. As a result, 2019 ended up with a meagre growth rate of 2.3%, well below the post-independence average of 4.5%. This was continued to 2020 and it was reflected as a negative growth of 1.6% in the first quarter of the year. The situation became worse after the country was hit by the COVID-19 pandemic. Though the Government had expected a V-shaped quick recovery, with the onset of the second wave in November 2020, it now appears that it will be a prolonged recovery. The country should now get ready for this elongated economic recovery.

External sector and fiscal sector imbalances

Apart from the slowing economic growth, both the external sector and the fiscal sector too had been ailing from a major macroeconomic imbalance during this period. The country’s balance of payments was under stress, foreign reserves built up by borrowing from abroad was dwindling, the exchange rate needed periodical adjustments by way of mega depreciation and the foreign debt accumulation with resultant debt servicing ate up the country’s meagre foreign earnings.

On the fiscal side, the declining Government revenue as a percent of GDP in a background of rising government expenditure had made the whole fiscal sector unstable. On top of this, the present Government had offered a highly attractive income and VAT concessions to taxpayers. This was justified by the Government policy advisors as a supply side stimulus to reawaken the ailing economy. But it seriously dented the Government’s revenue base making the fiscal sector further vulnerable. During the first 10 months of 2020, the total tax revenue loss, compared to the achievement in 2019, amounted to Rs. 441 billion. This is a significant loss and when prorated, it will amount to a loss of about Rs. 520 billion.

Denial is not a strategy

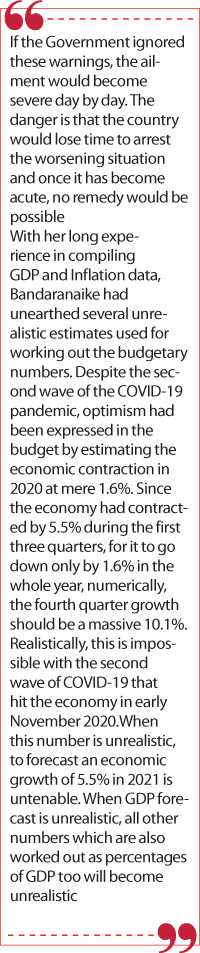

This is what the critics had pointed out in their criticisms. If the Government ignored these warnings, the ailment would become severe day by day. The danger is that the country would lose time to arrest the worsening situation and once it has become acute, no remedy would be possible. This was put cogently by the Citibank Research in its Sri Lanka country update released recently. It warned the Government in a hard-hitting title that ‘Denial is not a Strategy’. Now by calling the critics that they are purveyors of doom and gloom and questioning their level of understanding of the alternative policies being pursued, the Government appears to be continuing with the denial strategy.

Mismatched priorities

Bandaranaike in her article had questioned, among others, the mismatch in the priorities of the Government and the paltry budgetary allocations for the high priority areas. According to her, there are two immediate priorities to be addressed. They are the pandemic related health crisis and the looming economic and debt crisis. In the long run, the priority should be to reverse certain adverse trends in the economy. They are the curtailing the loss of skilled workers due to mass-scale migration, protection of environment and the maintenance of the investment ratio at least at 30% of GDP. According to her, Budget 2021 has ignored both these priorities.

Unrealistic growth numbers

With her long experience in compiling GDP and Inflation data, Bandaranaike had unearthed several unrealistic estimates used for working out the budgetary numbers. Despite the second wave of the COVID-19 pandemic, optimism had been expressed in the budget by estimating the economic contraction in 2020 at mere 1.6%. Since the economy had contracted by 5.5% during the first three quarters, for it to go down only by 1.6% in the whole year, numerically, the fourth quarter growth should be a massive 10.1%. Realistically, this is impossible with the second wave of COVID-19 that hit the economy in early November 2020.When this number is unrealistic, to forecast an economic growth of 5.5% in 2021 is untenable. When GDP forecast is unrealistic, all other numbers which are also worked out as percentages of GDP too will become unrealistic.

Inflation will raise its ugly head

About the Government’s mild inflation target, this is what Bandaranaike has said: “The estimates for inflation and private sector credit expansion were inconsistent. The State Minister (Ajith Nivard Cabraal) stated that there will be no IMF bailout, while the budget speech stated that bilateral loans and domestic borrowing would meet the deficit. This conveys that government will borrow from captive sources like state banks, EPF and ETF. Till now, with low private credit demand, interest rates have remained low. The estimated optimistic rise in private sector credit by 14.7% (6% in 2020), together with high Government borrowing and low interest rates cannot all three be reconciled. Alternatively, printing money will raise inflation to well over the 5% estimate.”

She had also questioned the validity of the import substitution policy being marketed as its main economic strategy. “The unrealistic economic strategies proposed for import substitution and export and investment promotion, respectively, were tried and failed in the Bandaranaike Government of ‘70-77 and the Jayawardena Government of ‘77-’90. Can old rhetoric promoting failed ideas succeed 30-50 years later?” says Bandaranaike.

‘Alternate reality is a farce’

‘Alternate reality is a farce’

Bandaranaike’s conclusion has been revealing. “In conclusion, this budget is a farce set in an alternate reality. I cannot understand whether those who prepared it and who supported it are entirely devoid of thinking capacity or callously devoid of any regard for our people and our environment. Are they playing ostrich to fool themselves or making the emperor parade in his new clothes to fool himself and others? Either way, during 2021 and beyond, Sri Lanka will remain a country of vast potential and lost opportunities,” she says.

Unsound MMT

Colombage had questioned the soundness of printing money for paying debt by the Government, a proposition presented by a minority group of economists who call themselves Modern Monetary Theorists. Having worked in senior positions in the Economic Research Department in this area for many years, he is competent to opine on the subject both technically and practically.

This is what he has said: “On similar lines mentioned above, Central Bank Governor Prof. W.D. Lakshman is reported to have stated at a recent economic forum that domestic currency debt in a country with sovereign powers of money printing is not a huge problem, as the modern monetary theorists would argue. Since rupee-denominated bonds are within the ‘sovereign powers’, money could be printed to repay them as indicated by MMT, he argues. While recognising the difficulties in repaying Government debt in the face of the pandemic-related economic setback and the country’s already heightened debt burden, it would be rather inappropriate to simply use money printing to finance fiscal deficits in Sri Lanka following the MMT, which is used as a means to boost aggregate demand in advanced countries.”

Liquidity injections without structural reforms

The Central Bank has been concentrating on liquidity injection to the economy by way of increasing money and credit levels to revive the economy badly hit by the COVID-19 pandemic. There is no objection to this strategy if it is introduced only as an immediate priority. But if the Bank continues to rely on it in the short to medium run, the increased liquidity should overheat the economy and when imports have been curtailed, it would certainly lead to price inflation. Hence, Colombage has argued that without introducing structural reforms, these policies would not work.

Case against MMT

Colombage has presented cogently the case against adopting MMT by Sri Lanka. He has said, “According to them, the most important conclusion reached by MMT is that the issuer of a currency faces no financial constraints. Put simply, a country that issues its own currency can never run out of money and can never become insolvent in its own currency. It can make all payments as they come due. As a result, for most governments, there is no default risk on government debt, according to MMT advocates.”

Sri Lanka rupee is not a reserve currency

He further says: “MMT works well in advanced countries such as the US or Japan which run debt levels far exceeding their GDP. Such countries can afford to print money continuously, as the hierarchical nature of the international monetary system enables their currencies to perform the fundamental functions of money (i.e. means of payment, unit of account and store of value) on an international scale. Hence, such currencies are known as reserve money, which means that they are acceptable for international transactions. On the contrary, developing countries such as Sri Lanka are placed at the bottom of the hierarchical structure, as their currencies are unable to perform the functions at international level. In other words, developing countries lack international monetary sovereignty.”

The unseen dangers of MMT

Colombage’s final conclusion is as follows: “The recent monetary expansion points to imminent dangers in adopting MMT-style monetary policy in a country like Sri Lanka, though such policy stance might be unavoidable amidst the unprecedented economic setback caused by the COVID-19 pandemic. MMT completely ignores the critical importance of ensuring macroeconomic balances which is the very foundation of mainstream macroeconomics developed by leading economists over decades. MMT rests on the assumption that a government can simply finance its budget gap by printing money using the sovereign power, unlike an individual borrower who does not have such divine power.

“Given the risks of exchange rate depreciation, weakening export competitiveness and capital outflows, MMT policies are bound to put developing countries like Sri Lanka in extremely vulnerable positions. High inflation emanating from the rising money supply weakens export competitiveness and encourages imports further widening the balance of payments deficit, unless the exchange rate depreciates adequately to compensate for inflation. Hence, prudent monetary management linked with disciplined fiscal policy needs to be planned for the medium and long-run, phasing out the current expansionary monetary policy stance. Structural adjustments are crucial in this process though they seem to be neglected in current policy discussions.”

Thus, instead of dismissing the critics as purveyors of doom and gloom, it serves well for the Central Bank to sit back and listen to them.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)