Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 9 November 2020 00:00 - - {{hitsCtrl.values.hits}}

By Research Intelligence Unit (RIU), London

At the current juncture in Sri Lanka’s journey of economic development, it is imperative the Treasury succeeds in increasing Government revenue from its main instruments of taxation and industries that make the lion’s share of contributions to the Government.

At the current juncture in Sri Lanka’s journey of economic development, it is imperative the Treasury succeeds in increasing Government revenue from its main instruments of taxation and industries that make the lion’s share of contributions to the Government.

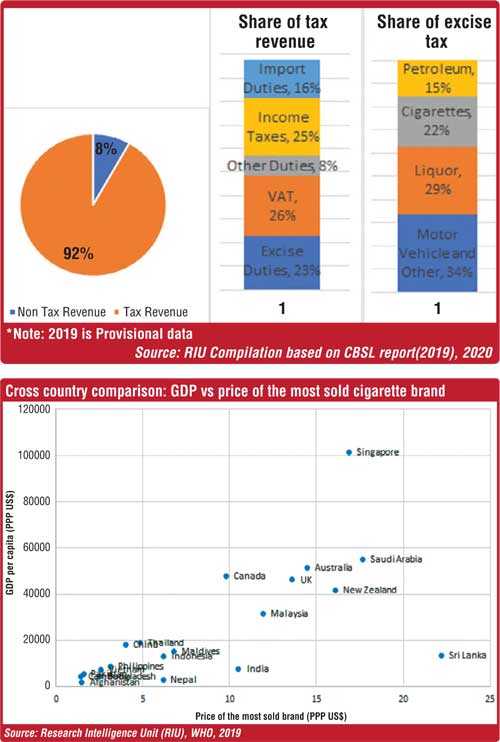

Tobacco taxation in Sri Lanka has in recent years been characterised by politicisation and myopia that resulted in sub-optimal achievement of fiscal and health objectives. Nevertheless, tobacco remains a vital contributor to the Treasury and it is critical that policymakers get it right. The major tobacco producer, Ceylon Tobacco Company, contributed nearly Rs. 110 billion in excise and sales taxes annually, which constituted 97% of the total industry contribution.

Ill-advised tax increases are a one-dimensional approach to the problem resulting in lower efficiency of excise tax over the past four years. It is imperative the Government adopts a pragmatic and comprehensive tobacco policy to maximise revenue and achieve national health objectives, plus, and curb the growth of illicit markets.

Intellectual independence

As an independent and progressive research agency with its Asian head office in Colombo since 2003, the Research Intelligence Unit (RIU) has published a series of reports that highlights the need for emerging economies like Sri Lanka to maximise Government revenue by addressing the large and highly nefarious illicit markets that co-exist with legitimate products, especially in the Asian region. Illicit markets result in direct revenue leakage for governments, intellectual property theft and revenue loss for legitimate suppliers of products to the market. They also undermine health, safety, security and law and order objectives of countries.

In Sri Lanka, we have a unique and complex tobacco consumption environment that cannot adopt a one-size-fits all approach dictated by international development agents such as the World Health Organization (WHO). Even if such international institutions have the best interest of consumers at heart, they are not entirely aware of ground realities.

Keeping an ear to the ground

Most recently, the RIU is concerned with local media in Sri Lanka publishing findings of a new report ‘Elasticity-Estimates-for-Cigarettes-in-Sri-Lanka’ by the Institute of Policy Studies (IPS) which, whilst claiming to calculate optimal tax levels for the industry, has chosen to promote their own version of the WHO narrative where it completely ignore the presence of beedi and smuggled products in the market.

The IPS report released in October 2020 is compiled on the basis that the only option available to smokers in Sri Lanka are legal cigarettes. It has intentionally ignored the substitution effect of cheaper alternatives freely available in the market in the form of smuggled products and beedi.

According to the latest data, total tobacco prevalence in Sri Lanka currently sits at 22.5% (WHO, 2020). The prevalence levels for tobacco products for men was recorded at 44.4% whilst for women it was 2.8% in Sri Lanka in 2018 (WHO, 2020).

However, legal cigarettes only make up 31% of the tobacco industry and is the only category that falls within the excise net. Whilst implementing a theoretical model that is distant from ground realities, as proposed, could potentially result in the reduction of consumption in legal cigarettes, Government revenue from the industry will also decline. This will put smugglers and the undertaxed beedi industry at advantage. Beedi is currently priced at around Rs. 5 and smuggled cigarettes are priced between Rs. 30-45, while the most popular legal product is Rs. 65.

Between 2014 and 2016, Government revenue from the tobacco industry grew at a CAGR of 18%. However, post excise hike in 2016 the growth rate of Government revenue declined significantly and for the first time in recent history, in 2019, Government revenue from the tobacco industry declined – a clear indication that the revenue model has broken and consumer affordability had reached a tipping point.

Consequently, recent years have been characterised by leakages in tax revenue due to the emergence of a thriving illicit market. Various studies have concluded the presence of smuggled cigarettes to account for much as 15.57% (Wickramasinghe) or 23% (Pepper Cube) of market share. According to RIU’s own primary research (Macro Economic Policy Series: Achieving Objectives with Tobacco Taxation 2019) the share of illicit cigarettes grew from 10% in 2015 to 21% by 2019. This trend was triggered by unprecedented rise in taxes in 2016, which resulted in a 52% rise in the price of a legal cigarette. In addition to triggering a flourishing smugglers market, we have also witnessed a 132% rise in beedi consumption whilst legal industry sales declined 28%.

Why is Sri Lanka on the map?

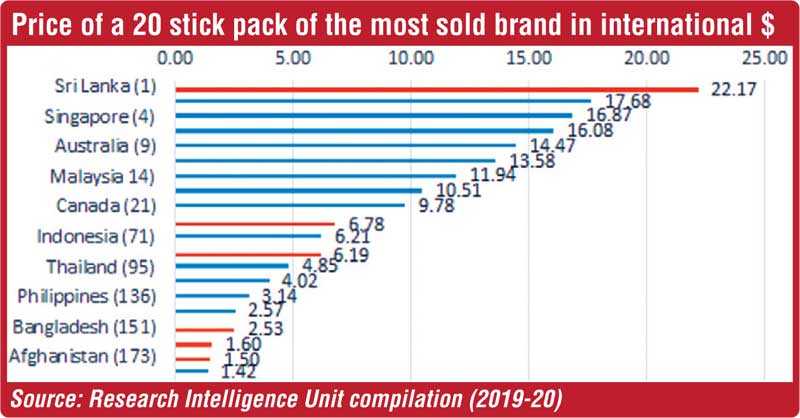

A major concern with the IPS report is that it completely fails to acknowledge the presence of an illicit market for cigarettes as well as the substitution impact of beedi. As illustrated in in Figure 2, ad-hoc tax increases over the past five years have resulted in Sri Lanka having the most expensive cigarette in the world (on purchasing power parity basis) a fact that is even acknowledged by the WHO in its Report on the Global Tobacco Epidemic, 2019. Consequently, the island is on course to join the ranks of countries where smugglers dominate the tobacco market (Malaysia, Brazil, Ecuador, Panama, Pakistan).

WHO do we believe?

Apart from this fundamental flaw in failing to properly assess ground realities in Sri Lanka, the published report also conveniently ignores the most recent data and continues to make a forecast up to 2021. In effect the report blatantly disregards real-life data for 2019 and 2020 where the proposed tax rates have already been implemented, and any further increases in tax will in fact exceed even IPS’ own recommended rates. The reality can be clearly observed in 2019 when higher taxes resulted in a fall in Government revenue, a rise in illicit cigarette consumption of 45% from 2018, whilst total tobacco consumption increased. Beedi is priced at Rs. 5 per stick and accounts for 61% of the total market.

The IPS report alludes to the WHO’s recommended methods on taxation, whilst ignoring the fact that even the WHO recognises the challenges posed by cheaper substitutes in the market.

The report also seeks to make recommendations on taxing the different tiers of the legal cigarette despite previous attempts to collapse the tiers of excise tax resulting in failure. This was evidenced by the fact that in July 2019 the Government equated excise tax rates applicable to cigarettes exceeding 67 mm but not exceeding 72 mm in length to that of cigarettes exceeding 72 mm, but not exceeding 83 mm in length. This proved to be extremely ineffective as consumers immediately switched to illicit products that once again led to revenue leakage for Government.

Realising the market response, the Government reverted back to excise rate on cigarettes that are 67 mm to 72 mm back in October 2019. As mentioned above, the IPS report conveniently ignores the development that took place in 2019 as it doesn’t support their narrative.

Why do illicit markets matter?

Illicit tobacco consumption is constantly rising and remains a global concern. Many countries adopt strict taxation laws to reduce consumption of tobacco products but this in turn encourages the growth of illicit tobacco. A study conducted in Europe showed that 74% of smokers who had used illicit cigarettes in the past, did so because illicit smokes are cheaper (European Commission, 2016).

Illicit cigarettes can result in serious consequences to users. Some of these products contained five times as much cadmium, nearly six times as much lead and high levels of arsenic. They also contained 160% more TAR, 80% more nicotine and 133% more carbon monoxide (Coventry Telegraph, 2015). Pesticides and even rat poison have been found in counterfeits according to The Tobacco Retailers’ Alliance, which represents independent stores that sell tobacco in the UK (Independent, 2018).

Cigarettes are one of the most smuggled ‘legal’ products in the world, and cigarette smuggling is considered a form of transnational organised crime. This activity poses significant and increasing threats to national security and public safety. A perception study on the illicit market found that in all European countries, a third of respondents or less think that black market cigarettes is one of the most important sources of revenue for organised crime (European Commission, 2016). According to the Italian Minister of Healthcare, the value of the illicit trade of tobacco products in Italy gives organised crime double the revenue it generates from selling cocaine and heroin.

Evidence shows many high-profile terrorist organisations such as Al-Qaeda and ISIS operate smuggling rings due to higher profit margins and relatively lower risk. According to Dr. Louise Shelley, University Professor at George Mason and Ronald K. Noble, the INTERPOL Secretary General, “Paramilitary groups and organised crime rely on counterfeiting – especially of cigarettes – to reap huge profits and even to fund terrorist activities.” This issue was also raised during the visit by the US Secretary of State, Mike Pompeo to Sri Lanka when one of the issues discussed was support and technical assistance with border security to combat trafficking. Sri Lanka is geographically vulnerable to all kinds of trafficking and its exposure to terrorism in recent history needs no further mention.

Conclusions

Our ongoing research shows that high price differentials between legal and illicit cigarettes caused by poorly thought out rash taxation policies have contributed to significant market distortions and growth in smuggling. Ill-advised tax increases are a one-dimensional approach to the problem, resulting in lower efficiency of excise tax over the past four years. Cross country experiences explored in our work also establishes the connection of high taxes and illicit growth. Therefore, it is imperative the Government adopts a pragmatic and comprehensive tobacco policy to maximise revenue, achieve national health objectives and curb the growth of illicit tobacco.

Policy-makers have to get taxation right to reduce economic loss to the country as well as health impacts the illicit market is causing. If comprehensive and effective measures, are adopted to successfully control and minimise the illicit market share, then tax increases should be considered for optimum national health and fiscal outcomes. In the current environment however, especially with the Government being severely pressed to manage COVID-19 and maintain tax revenue from the most critical industries, it becomes vital it gets the tobacco tax policy right.

Whilst arguably this current environment now creates the need to consider moderate tax adjustments to ensure sustainable revenues for the Government in 2021, merely resorting to knee jerk, ad-hoc excessive tax increases on the recommendation of incomplete research proposals is the furthest thing from the solution to this globally significant issue. Moreover, when local policy research agencies are motivated by the dictates of large international NGO’s and their agendas, this takes them further away from the ground realities of Sri Lanka.

(www.riunit.com [email protected])