Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 12 February 2021 00:00 - - {{hitsCtrl.values.hits}}

The findings of the study have important implications for diverse users to formulate their future policy decisions for the development of the stock market and the economy

By Dewundara Liyanage Prasath Manjula Rathnasingha and Nayomi Weerasinghe

4. Analysis and discussion

4. Analysis and discussion

‘Do sell side security analysts act as prophets?’ has to be carefully examined through understanding the relationship between the information contained in consensus return (RCP) and realised stock return (Rit). Then the researcher attempts to explain the findings of the study from a different perspective giving novel insights to the existing literature. The research question outlined, guide the researcher throughout starting with descriptive analysis concerning the variables of the study. Then aims to ensure statistical assumptions underlying in the estimation model through a test of validity and reliability. Finally, the results of hypothesis testing through multiple regression models discuss to achieve the research objectives.

4.1. Descriptive statistics

The descriptive analysis aims to provide an overview of the variables under the study based on the sample data to make a general conclusion. Accordingly, Table 1 shows the average value of stock return, consensus return and risk factors together with their standard deviation values and t statistics. The information evidence that the mean value of the Rit is 1% per month and the average value of RCP is 1.1% per month. The average value of Rit is significant and different from zero at a 10% significance level, whereas RCP is significant at a 5% level.

4.2. Inferential statistics

The test of the hypothesis is the main focus under inferential analysis. Based on the hypotheses establish, statistical test conduct for their acceptance or rejection and facilitate the achievement of the research objectives and ultimately address the research problem of the study.

4.2.1. The relationship between stock return and consensus return

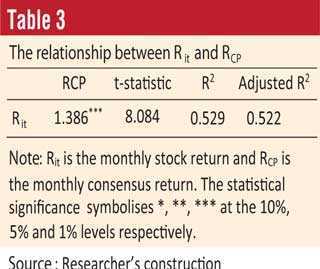

The empirical studies have evidence that there is a direct relationship between stock return and consensus return. Hence, hypothesis 1 developed by the researcher to test the relationship postulate in the present study. The descriptive statistics relevant to the regression analysis represented in Table 3.

The regression output in terms of the relationship between Rit and RCP shows that there is a positive significant relationship between two variables. The adjusted R squared value 52.17 percent shows the overall model suitability in terms of the dependent and independent variables. It is required to observe the relative strength and statistical significance of the co-efficient of RCP (independent variable) on the Rit (dependent variable). However, the researcher unable to find any evidence in the empirical studies to the best of available knowledge to grasp the direct relationship between Rit and RCP. The consensus price defines in the literature as the average target price forecast by all the SSSA in the market for a given stock (Nasdaq, 2018;). Thus, the researcher’s effort is to find evidence in terms of SSSA recommendations and target price forecasts and incorporate consensus price to the existing literature to recognise the relationship with stock return.

There is evidence in the literature that SSSA forecasts once they publish affect share prices. Specifically, Brav and Lehavy (2003) state that approximately 54% of SSSA target prices realise in the actual market. In terms of SSSA recommendations, Womack (1996) finds that buy recommendations lead to a +2.4% change in share price in a short term, whereas sell recommendations lead to a -9.1% change in share price in long run. The evidence reveals that there is a relationship between SSSA forecasts and returns of securities. Thus, the researcher can reliably assume that there is a direct relationship between return Rit and RCP.

5. Findings of the study

Efficient functioning of a share market is critical for economic development since it gives companies the ability to quickly access capital it needed for investments through stock markets. Financial security analysts are an important element of financial decision making in the Stock Exchanges throughout the world. Accordingly, SSSA act as middlemen between investors and the stock market by reducing the information bridge. The empirical studies evidence that SSSA use all the available information in their equity research such as past price information, publicly available information and notably the private information in deriving at the consensus prices to deliver a fair estimate about future share prices ensuring market efficiency (Jagadeesh et al., 2001).

Thus, investment banks, brokerage houses and pension funds, spend large amounts of capital to obtain the service of SSSA to generate forecasts (stock recommendations, target prices and consensus prices) for their investors. However, though SSSA use all the available information in deriving at consensus prices, actual prices might deviate harshly from the consensus prices. The ambiguous performances identify in above creates an excitement in the researcher to conduct the present study to solve the research problem, Do Sell Side Security Analysts (SSSA) act as Prophets?

To address the research problem, twenty two listed companies selected for the period from 1 October 2012 to 30 September 2017. The number of companies qualifying for the study bounds by the sample selection criteria to limit the analysis to a realistic level. Further, in the study of the direct relationship between share price and consensus price, the researcher deliberately transforms the unit of measurement from price to return. The investigation reveals that there is a statistically significant positive relationship of 1.386 (t = 8.084) between Rit and RCP. The incorporation of RCP into asset pricing models continue the association nevertheless in a lesser magnitude. The RCP decrease from 1.386 (t = 8.084) to 0.342 (t = 1.938) in CAPM and Further, diminishes to 0.265 (t = 1.518) in FF5 model with the introduction of risk factors MRP, SMB, HML, WML, RMW and CMA in each assets pricing model.

The SSSA are more interest in declaring favorable predictions on growth (high B/M) firms with high market risk and less favorable predictions about value (low B/M) firms with low market risk (Barber et al., 2001; Brav & Lehavy, 2003). SSSA predictions (recommendations, target price revisions and consensus prices) already reflect in the MRP and incorporation of RCP into the asset pricing model modify the magnitude of the coefficient of MRP without any change to the factor significance. However, asset pricing model significance measured in terms of adjusted R2, enhance from 79.6% (in CAPM) to 83.7% (in FF5) with the incorporation of RCP to the basic asset pricing model.

The inclusion of a new factor into an asset pricing model is problematic for the reason that the average return describes by the new factor reflects from the existing factors and vice versa as recognise in the Fama and French (2015). Thus, in the following phase researcher’s effort is to recognise the impact of RCP on other risks factors in the asset pricing models, thus there is a significant difference in HML factor (Δ0.009 in FF3, Δ0.011 in C4F and Δ0.007 in FF5) WML factor (Δ 0.007) and RMW factor (Δ -0.014) after incorporating RCP into the basic asset pricing models. However, the researcher notifies that MRP, SMB and CMA factors are static concerning the introduction of RCP, where factor significance remains the same irrespective of the changes in coefficient values. The reason justifies in the empirical study of Barber et al. (2001) consistent with the conventional wisdom that SSSA interest in issuing forecasts for larger firms. Hence, the study sample comprises of the highest capitalisation firms in the CSE, thus MRP and SMB factors are insensitive to the SSSA forecasts concerning big firms in a portfolio (Barber et al., 2001; Brav & Lehavy, 2003). Similar reasoning is generalised into the CMA factor as well.

Fama (1998) states: “The long-term return anomalies are fragile. They tend to disappear with reasonable changes in the way they are measured” (p. 304) known as the "bad model problem". In that the researcher’s effort in using prominent asset pricing models CAPM, FF3, C4F and FF5 are to test the methodological illusion in the asset pricing models use in estimation of long-term abnormal returns. The analysis reveals that it is unlikely the results generate is attributable to a poor asset pricing model. Where all the models reveal that RCP absorbs an equal portion of the unexplained abnormal return. The researcher notifies a difference (Δ) in the abnormal return of 0.009 in the CAPM model with RCP. The difference (Δ) in abnormal return is 0.006 for the rest of the asset pricing models (FF3, C4F and FF) after incorporating the new variable RCP. Thus, the researcher presumes that the argument raises by Fama (1998), “long run return anomalies to market efficiency tend to disappear with a reasonable change in the asset pricing model use” is unreciprocated. Thus, based on the findings of the study, the researcher exemplifies that there is no significant difference in the estimation of long-term abnormal returns using different asset pricing models.

In the present study, the researcher’s exertion is to examine the relationship between RCP and Rit. Further, the researcher employs the knowledge gathered from the examination to test the abnormal return predictability, the measure by the magnitude and significance of the regression intercept. The aforementioned discussion evidence that new variable RCP absorbs an unexplained portion of the abnormal return pertains to the basic asset pricing models. Hence, the parameter estimates of the multiple regression models for the portfolio consider in the study and the time series regression analysis shows that RCP has predictive power in explaining the cross section of average returns. Consequently, the coefficient of alpha diminishes in each asset pricing model after integrating the RCP by the researcher.

Thus, the researcher précises the findings of the study as follows; There is a statistically significant relationship that exists between the RCP and Rit. The measurement of return predictability in asset pricing models reveals that the relationship between RCP and Rit further exists in lesser magnitude even after the introduction of risk factors i.e. MRP, SMB, HML, WML, RMW and CMA in each asset pricing model. However, a fragment of the relationship in RCP and Rit represents through HML, WML and RMW factors however, MRP, SMB and CMA factors are insensitive to RCP. Based on the analysis and discussion, the researcher exemplifies that there is no significant difference in the estimation of long-term abnormal returns using different asset pricing models i.e., CAPM, FF3, C4F, and FF5. All the asset pricing models used in the study reveals that RCP absorbs an equal portion of the unexplained abnormal return.

The sole interest of the present study is the ‘abnormal return’ measure by the magnitude and significance of the regression intercept (Fama, 1998; Brav & Lehavy, 2003; Kothari & Warner, 2007; Fama & French, 2015). The new variable, RCP absorbs an unexplained portion of the abnormal return pertains to the basic asset pricing models. Thus, the researcher believes it is more likely that analysis evidence of a market that is informationally inefficient. Accordingly, the researcher reserves the right to define ‘consensus return’ as a potential anomaly to market efficiency.

The conclusion is drawn as to the ‘informationally inefficient market’ cannot be generalised to the CSE as the sampling frame consists of forty-four companies with consensus information. Further, “the test of private information’ is a test whether individual investors or groups have monopolistic access to private information that is not fully reflected in the market price. As emphasise by Fama (1970), “We would not, of course, expect this efficiency model to be an exact description of reality” (p. 409). Accordingly, the researcher can conclude that sell side security analysts act as prophets in the Sri Lankan context.

5.1. Implications of the study

In a globalised world, the role of academic inquiry to discover new knowledge is significant to have a knowledge driven community. In that the implications of the present study discussed from the perspective of academics, investors, public listed companies itself, SEC and Government of Sri Lanka as follows; The consensus price is probably the next level of security analysts’ forecast, the most notable output of the financial analysis where limited attention receives from the academics, teachers of finance and students.

Specifically, the results generated from the study contributes to the theory that it is possible to earn abnormal returns by using sentiments based on SSSA consensus price, especially by constructing portfolios using the methodology followed in the study. Thus, the findings of the study benefit the academics and students by fetching the finance practice into theory.

Moreover, the study has important implications for both local and foreign investors. The information publishes online on financial service companies like Bloomberg, Thomson Reuters and FactSet, directly impact on the trustworthiness of the local and foreign investors in formulating their investing strategies. Additionally, both private and institutional investors can get insights based on SSSA consensus price to construct portfolios that consistently beat the market and earn abnormal returns. The government plays an important role in this regard, as evidenced in the study of Antônio et al. (2017) find that the greater the government effectiveness, the greater the forecast accuracy of target price estimates and consensus prices issue by the SSSA.

The findings are valuable from the perspective of companies listed in the CSE to formulate suitable policy decisions. The accuracy of favourable consensus price forecasts enhances the reliability of the investment. Thus, investors inspire to trade based on the SSSA consensus price and it increases the liquidity of the stock, improves the firm valuation and reduces the cost of equity of the company. Contrarily, unfavourable consensus price forecasts give signals to the company about their near future, thus the management can plan future uncertainties and better evaluate its operational and financial restructuring alternatives.

Further, there is an increasing trend between investors to invest in emerging stock markets due to higher risk and return and exploit profit through market inefficiencies. Additionally, the inefficiency of CSE provides an insight to market participants to create innovative financial products (e.g., short selling) which improve investors' active market participation and develop the CSE. Also, SSSA consensus price directly affects future share prices. Superfluous price escalation gives insight to the SEC and Government of Sri Lanka on many market ills such as excess market volatility, the possibility emerging bubbles in fast-moving companies, emerging market meltdown and recent financial crisis. Thus, the findings of the study have important implications for diverse users to formulate their future policy decisions for the development of the stock market and the economy.

(Dewundara Liyanage Prasath Manjula Rathnasingha is attached to the Department of Finance, and Nayomi Weerasinghe is attached to the Post Graduate and Mid-career development unit, Faculty of Management and Finance, University of Colombo, Colombo, Sri Lanka. Email: [email protected])