Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 28 January 2020 00:01 - - {{hitsCtrl.values.hits}}

By The Retired Banker

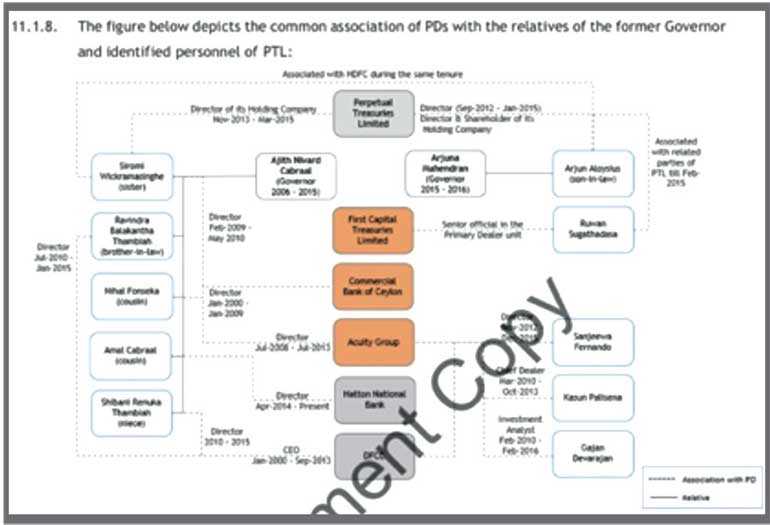

Every morning I read the FT online. I must say I simply have no fondness for any of the political parties for what they have done to our country. All are self-centred people who come to power to only look after their families. Ajith Nivard Cabral and Arjuna Mahendran did just that for 15 long years. The forensic bond report is an open shut case of these malpractices.

The EPF (workers’ money) lost Rs. 8.7 billion between 2008 and 2015 on bond transactions. Lost Rs 7.7 billion by investing in six listed companies and Rs. 4.5 billion on unlisted companies. Can workers’ money be invested in unlisted companies? What do the trade unions have to say? Why are they silent? Why aren’t they asking for an independent investigation into the affairs of Nivard Cabral’s and Arjuna Mahendran’s relatives who have amassed wealth via the stock market and unscrupulous bond trading?

Like State funds and State institutions, even the private banking sector has been a victim of these financial scandals and abuse. The Central Bank officials responsible for executing the bonds and buying dud stocks should be investigated thoroughly – like the IGP (first time in history) is languishing in jail for negligence. The CBSL officials responsible should be investigated, their assets should be investigated and if found guilty should be jailed and ill-gotten gains should be confiscated.

Banking sector

The capital growth of the Sri Lankan banking sector has been satisfactory despite of many bottlenecks and unfavourable business climates. The banking sector provides bulk of the much needed capital for the growth of the private sector. The banking sector consisted of 25 Licensed Commercial Banks (LCBs), and seven Licensed Specialised Banks (LSBs).

The total asset base of the banking sector increased by 14.6% over the past year from Rs. 10.3 t in 2017 to Rs. 11.8 t by the end of 2018. Domestic Systemically Important Banks held 62% of total sector assets as at the end of 2018. The Government controls the huge two State banks, they control 50% of the banking sector.

There are four big private sector commercial banks that have some Government shareholding indirectly, but essentially owned by the private sector and managed by them. But occasionally the State has attempted to intervene to give jobs to their girls and boys, forgetting that the majority of the capital is put by the private sector investors and the deposits are owned by the public. That too the Government has attempted to intervene using the money of the workers (EPF and ETF) or depositors’ money or life funds (Insurance Corporation or NSB or BOC).

Central Bank of Sri Lanka

The Central Bank of Sri Lanka (CBSL) serves as the country’s central bank and exercises supervisory powers over its financial system. It is responsible for the conduct of monetary policy and oversight of banks in Sri Lanka. We have had periods where the Central Bank instead of focusing on its declared mandate has intervened in the affairs of the private sector banks in appointments and directed lending to specific institutions. During the leadership of the former Governor Dr. Coomaraswamy and the Monetary Board members, it is said collectively they put a stop to the political interference in financial institutions and helped to bring back dignity to the office of the CB Governor. The forensic report clearly highlights the gross abuse of the Governors in office from 2005-2017. It is now hoped the ageing Oxford educated economist now Governor would do the same. If not, the financial sector will be further downgraded, encouraging foreign funds to bail out and increase their cost of borrowings.

Interference

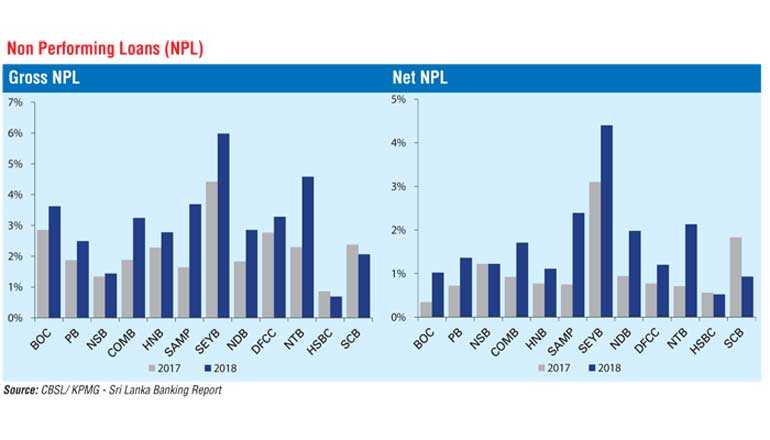

Moody’s Investor Service’s outlook for the Sri Lankan banking system remains negative, as both asset quality and profitability remain under huge pressure.

Sri Lanka adopted International Financial Reporting Standards (IFRS) in January 2012 by issuing Sri Lanka Financial Reporting Standards and Sri Lanka Accounting Standards. Commercial banks are now required to comply with these accounting standards and Central Bank guidelines.

In January 2018, Sri Lanka adopted New IFRS9 standards set out by the International Accounting Standards Board, which require banks to set aside provisions for future losses, and introduced a new basis for financial asset classification. This classification that is still to be adopted in markets like India and US has put enormous pressure on banking assets. The non-performing loans have hit over Rs. 250 billion. The Easter Sunday attacks only amplified these problems. The Government at least now must learn from the mismanagement of the previous eras and do what is good for the country. The EPF should not be managed at the whims of the Central Bank Governor and his stooges. The trade unions should stand up and be heard before the workers’ money is vandalised further.

They should file a criminal case against the CBSL officials for squandering their money. The private banks should not be stuffed with unqualified and inexperienced people supporting the Government. It is private capital and private deposits that are at stake.

Take Commercial Bank, the largest private bank. The Government’s only claim is because the EPF has a 10% stake (workers’ money) has got invested in the shares of the bank, the largest private shareholder is Indra de Silva, foreign funds own over 30% and World Bank has a stake.

DFCC Bank, the one-time development bank, the Government through BOC, Insurance Life Fund and EPF have close to 30%, the largest private shareholder Yassen has 9%. The Government in this instance should use its influence to get DFCC to do long-term lending. NDB Bank, the Government has 30% through EPF and the life fund. The largest private shareholder is Dr. Yaddehige with 5%. Sampath Bank, the largest shareholder Dammika Perera has 15% and the EPF has 10%. Hatton National Bank, the largest shareholder is the Harry Jayawardena-led group that has close to 18% and indirectly more, the Captain family has 10% of HNB, foreign funds around 28%, State Insurance Life Fund has 13.2% and EPF 9.75%. Nations Trust Bank – JKH 20%. The resurrected Seylan Bank has the largest private shareholder and is the only bank in which the Government has a stake of 5%. The largest private shareholder is Ishara Nanayakkara’s Brown and Company with 10%.

Collectively these private banks control 50% of the banking assets and employ over 50,000 people directly and indirectly. Why destroy them? Let free enterprise thrive within globally-accepted norms.

My plea therefore to President Gotabaya who has promised professionalism should:

a)Not allow the EPF and ETF to be vandalised by CB officials anymore

b)Not give representation to EPF to look after their own investments without putting stooges

c)Investigate those who have squandered the EPF and punish them fully

d)Support private capital to grow and flourish without interference in their stability and progress like in the past

e)Life funds should be represented by professionals on the life fund boards

f)Spend some time reading the forensic report to understand the abuse that took place

g)Ask the trigger-happy AG to prosecute the rogues. You will be remembered forever.

Now with a seasoned administrator like Dr. P.B. Jayasundera back in the saddle who understands how private capital is critical for nation building, it is expected he will guide the new leadership to work within the accepted norms of good corporate governance practices without going back once again to the dark days of the CBSL. We are fortunate we have a professional paper like the FT to address these issues openly.