Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 14 August 2024 00:00 - - {{hitsCtrl.values.hits}}

Session - 1

Session - 2

Session - 3

Session - 3

By Michelle Therese Alles

Held under the theme ‘Sustainable Pathways to a Brighter Future’, the recent ESG Summit, inaugurated by President Ranil Wickremesinghe, marked a significant step forward for Sri Lanka’s commitment to sustainability. The summit was organised by the Daily FT in collaboration with the Colombo University MBA Alumni Association. The full-day event featured 15 experts sharing transformative insights and innovative solutions in the realms of Environmental, Social, and Governance (ESG) practices.

In his welcome address, University of Colombo MBA Alumni Association President Suraj Radampola expressed a profound commitment to advancing ESG principles within Sri Lanka’s business community. He emphasised the Association’s role in raising awareness about the importance of optimal resource use and protection for future generations.

Radampola highlighted the historical context of ESG, noting that the term first gained prominence in 2004 under the UN’s Kofi Annan, who sought to integrate ESG fundamentals into capital markets. He pointed out that this led to the incorporation of ESG factors into financial reporting to enhance sustainability and performance, asserting that organisations embracing these principles are likely to boost shareholder value and mitigate environmental risks.

He further outlined the key areas of ESG that were to be explored during the summit, detailing how companies must address environmental stewardship, human rights, and governance transparency, and highlighted the role of financial reporting in uniting these factors.

Acknowledging HSBC’s contributions in this domain, Radampola expressed anticipation for the expert insights to be shared throughout the day. He concluded by encouraging ongoing engagement and collaboration, emphasising the association’s commitment to fostering innovative thinking and continuous learning in ESG practices.

University of Colombo Vice Chancellor Senior Professor H.D. Karunaratne highlighted the university’s prominent role as Sri Lanka’s leading educational institution, proudly noting that the Chief Guest, President Ranil Wickremesinghe is an alumnus. With approximately 43,000 students across 19 faculties, the University has taken significant steps toward sustainability. In 2022, it adopted ESG goals and implemented a pioneering digital tree inventory, marking the first time in Sri Lankan history that each tree on campus has been managed with a QR code.

Professor Karunaratne also praised the MBA Alumni Association for its continuous innovation and alignment with ESG principles. He emphasised the importance of the summit’s discussions and thanked all participants for their contributions, which he believes will drive meaningful progress in sustainability efforts.

In his address, President Ranil Wickremesinghe reflected on the University’s evolution since his own time as a student, and expressed pride in the progress made since 1977. “I am proud of how far we have come, yet we must strive for greater global recognition to ensure our universities can compete on the world stage,” the President stated.

President Wickremesinghe praised the University’s continued emphasis on ESG practices over the past three years. He recognised the private sector’s dedication to these principles but noted that global geopolitical tensions and the ongoing impact of the pandemic had hindered progress. “Although our dedication to Environmental, Social, and Governance matters is notable, we encounter substantial challenges due to geopolitical tensions and the pandemic’s enduring effects, which have slowed global advancements,” he remarked.

The President noted the difficulty in achieving the Sustainable Development Goals amid the current global economic climate and funding shortages. He highlighted the recent policy reversals in the UK under Rishi Sunak, which had further complicated global commitment to these goals.

In his remarks on Sri Lanka’s own initiatives, the President delineated the country’s commitment to sustainable development and its goal of reaching net zero emissions by 2040. He emphasised the need for significant investment in renewable energy, with a focus on producing gigawatts of energy to supply markets such as India.

President Wickremesinghe also stressed the importance of modernising agriculture, improving water management, and preparing for the impacts of climate change. He outlined plans for the International Climate Change University and a tropical belt initiative aimed at carbon absorption.

In conclusion, President Wickremesinghe emphasised the need for sustained local and international investment to bolster Sri Lanka’s social sector, alleviate poverty, and improve infrastructure. Drawing on historical examples, he urged a unified effort to achieve sustainable and equitable growth. “We must make substantial investments in renewable energy, modernise agriculture, and prepare for the impacts of climate change to ensure a prosperous future,” he asserted.

Guest of Honour and keynote speaker HSBC Sri Lanka and Maldives CEO Mark Surgenor emphasised the bank’s deep-rooted connection with the island nation for over 130 years, and underlined the urgent need to address climate change, describing it as a challenge that affects everyone. “As with any great challenge to humanity, we are committed to rising to the occasion and pushing forward,” he said.

Surgenor pointed out the real and pressing impacts of climate change on Sri Lanka, noting that 50% of the population lives in low-lying areas vulnerable to flooding. The country is also home to a significant portion of the world’s endemic species and biodiversity, many of which exist in delicate microclimates. Additionally, industries such as agriculture, tourism, and transport are highly susceptible to weather patterns.

Despite Sri Lanka contributing only 0.05% of global emissions, Surgenor stressed the importance of the country’s role in the broader context. He highlighted that Asia, which contributes 50% of global emissions, is critical to future sustainability efforts. Furthermore, as an export-driven economy, Sri Lanka must prepare for a global focus on sustainability throughout supply chains.

Globally, corporations are responding to the shift towards sustainability, with HSBC’s research showing that by 2030, 40-50% of corporate capital expenditure will focus on lower-carbon infrastructure. Between 2020 and 2022, HSBC invested over $ 200 billion in sustainable finance to support various industries’ transitions. The bank aims to align its customer and operational emissions with net zero by 2050, in accordance with the Paris Accord.

He concluded by encouraging active engagement during the Summit, which HSBC has partnered with since 2022. “Let’s be open, let’s engage, let’s listen, discuss, and challenge,” he urged, stressing the importance of collective action among policymakers, businesses, and finance providers to advance sustainability efforts.

Technical Session ‘E’

Keynote speaker for Session ‘E’, Advisor to the President of Sri Lanka (Environment, Climate Change & Green Finance) Dr Ananda Mallawatantri outlined a visionary path for Sri Lanka’s economic and environmental future. Dr Mallawatantri emphasised the country’s commitment to a significant economic transformation, focusing on boosting exports, enhancing regional cooperation, and advancing low-carbon growth.

He highlighted the strategic modernisation of Sri Lanka’s agriculture, fisheries, and aquaculture sectors, alongside innovative approaches in industry and tourism. Dr Mallawatantri noted that a crucial component of this transformation is transitioning the energy sector towards export-oriented strategies and expanding the nation’s Exclusive Economic Zone (EEZ).

Dr Mallawatantri underscored the importance of integrating environmental sustainability into these economic plans. He outlined Sri Lanka’s ambitious goal of achieving net-zero carbon emissions by implementing comprehensive land use and water management strategies. This effort includes a strong emphasis on blue-green conservation, aiming to balance economic development with environmental protection. “Our approach combines economic growth with a commitment to sustainability,” he asserted, stressing that these initiatives are crucial for ensuring a resilient and eco-friendly future for Sri Lanka.

Dr Mallawatantri also emphasised the importance of integrating sustainable practices and tools in Sri Lanka while advancing regional capacity building through global partnerships. He highlighted that a unified approach, involving renewable energy, ecosystem preservation, and disaster risk reduction, is essential for long-term benefits and inclusive growth. He outlined a vision for aligning Sri Lanka’s economic goals with environmental progress, aiming for a prosperous and sustainable future. He also addressed the challenges of coordinating extensive climate action efforts and the need for improved management through comprehensive dashboards. Noting that current efforts are hindered by ineffective tracking systems, he recommended forming dedicated teams to enhance coordination and monitoring, ensuring more seamless and efficient collaboration among stakeholders.

University of Peradeniya Faculty of Agriculture Senior Professor Buddhi Marambe delivered his opening statement to commence the panel discussion. Reflecting on the President’s address, Professor Marambe emphasised the urgency of the climate change issue. He noted that July 2023 was the warmest month ever recorded, and 2023 was the warmest year, with records surpassed again in July 2024. The global temperature recently reached 17.15 degrees Celsius, a significant increase from the pre-industrial average of 13.6 degrees Celsius. Professor Marambe stressed the need to transform challenges into opportunities to attract investment and achieve climate targets, emphasising that the private sector views environmental efforts as business opportunities rather than charity.

He emphasised the importance of robust private-public partnerships to advance environmental goals during his remarks. He commended Dr Ananda Mallawatantri’s presentation on the Nationally Determined Contributions (NDCs) and the NDC implementation plan, which outlines Sri Lanka’s commitment to reducing greenhouse gas emissions by 14.5% by 2030 from 2020 levels. Professor Marambe underscored the crucial roles of technology access, dissemination, and climate financing in achieving these objectives. He further highlighted the need for attention to various sectors and shared a successful example of private-public partnership in agriculture using spray drones.

MAS Holdings General Manager of Environmental Sustainability Dhanujie Jayapala, in response to a query from Moderator Daily FT Chief Editor Nisthar Cassim, expressed the importance of both public and private sector efforts in the crucial role of decarbonisation in addressing climate change. He pointed out that while governments have voluntary Nationally Determined Contributions (NDCs), the private sector’s involvement is equally vital. He noted that one significant initiative is the adoption of science-based targets by industries. With global emissions estimated at approximately 52 gigatons, half of which come from industrial sources, it’s essential for companies to take responsibility for reducing their carbon emissions. Science-based targets provide a scientific framework for industries to set and achieve these reductions, regardless of their growth.

Currently, 9,100 companies globally have committed to science-based targets, with over 5,800 having set approved targets. In Sri Lanka, around 20 companies are involved, with 4 having set approved targets. Jayapala emphasised the growing importance of decarbonisation, particularly for export-oriented industries, and the need for broader environmental considerations beyond just carbon emissions.

He cautioned against what he termed ‘carbon tunnel vision’, where the focus solely on carbon reduction may lead to neglect of other environmental impacts. For instance, industries like agriculture and textiles may face significant challenges related to water use and chemical management, respectively. Jayapala advocated for a ‘just transition’, ensuring that the shift to renewable energy and more sustainable practices does not leave workers, communities, or industries behind. He stressed the need for equitable access in public transportation and the inclusion of smallholder farmers in sustainable practices. In conclusion, Jayapala called for a holistic approach to decarbonisation, integrating social and environmental considerations into the transition process to ensure it is both justified and equitable.

Technical Session ‘S’

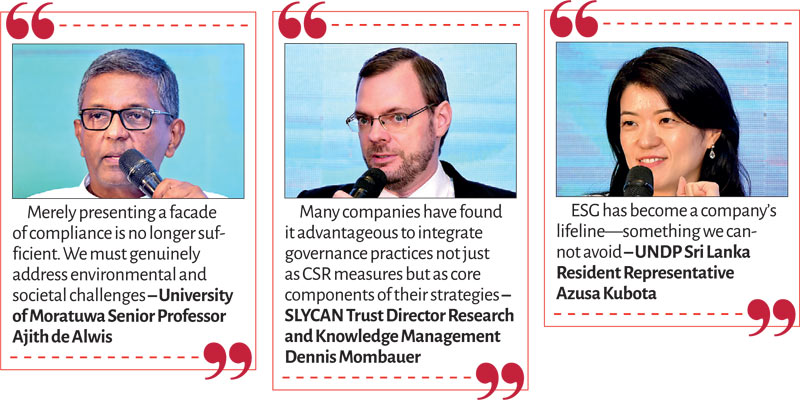

The ‘S’ Session keynote speaker UNDP Sri Lanka Resident Representative Azusa Kubota affirmed the growing importance of Environmental, Social, and Governance (ESG) practices for businesses, particularly in Sri Lanka. As investors and consumers increasingly demand responsible and sustainable business practices, ESG has become integral to corporate strategy. “ESG has become a company’s lifeline—something we cannot avoid,” she remarked. This sentiment reflects a global shift towards sustainability, driven by increasing consumer awareness and regulatory pressures.

Kubota highlighted the growing emphasis on ESG standards in Sri Lanka, noting that various incentives are being introduced to encourage companies to align with these practices. She stressed the crucial link between ESG and the Sustainable Development Goals (SDGs), underscoring the urgency of addressing both global and local challenges. The ongoing economic crisis and social upheaval in Sri Lanka have intensified vulnerabilities, making adherence to ESG standards even more critical for fostering resilience and sustainable development.

Globally, progress toward the Sustainable Development Goals (SDGs) is falling short, with only a 16% chance of achieving them by 2030 and an annual investment gap of $ 4 trillion. For Sri Lanka, emerging from economic crises, private sector investment is crucial to bridge this gap. Kubota highlighted critical financing needs in energy and water and stressed the importance of social ESG dimensions like fair labour practices and diversity. In Sri Lanka, over 55% of the population faces multidimensional vulnerabilities, exacerbated by recent crises. She called for inclusive workplaces and equitable interventions, especially for women and people with disabilities, and urged companies to adopt transformative ESG strategies that go beyond mere compliance to actively contribute to societal well-being.

Moderator Vidullanka PLC Director and Oceanpick Ltd. Chairman Rizvi Zaheed began the panel by asking Azusa Kubota to share her insights on how the social aspects of ESG (Environmental, Social, and Governance) could benefit Sri Lanka. The discussion covered a range of topics, including equity, diversity, inclusiveness, support for vulnerable groups, and the critical role of corporate leadership. Given the broad challenges facing Sri Lanka—such as the aftermath of the pandemic, economic difficulties, and climate impacts—the agenda was extensive.

Kubota emphasised that addressing ESG issues requires understanding their interconnectedness. She noted that it is not feasible to separate social aspects from environmental ones or to treat them as isolated pillars. Sustainable development involves a complex interplay of various goals, all of which are interdependent. Advancing one goal often drives progress in others. She advocated for using a Human Development Index, a composite measure that captures not only income but also the multifaceted interactions between various factors affecting individuals. She further explained that it is challenging to single out specific priorities due to the intertwined nature of these issues. She stressed the importance for companies to recognise the multi-dimensional effects of their actions, acknowledging that their decisions create ripple effects across multiple areas.

Brandix Managing Director Hasitha Premarathna observed that while ESG issues are fundamentally interconnected, the Social aspect, or ‘S,’ holds a special place as they are deeply connected to human values and emotions. The core of social initiatives revolves around people, making them inherently close to the heart. While frameworks and plans are important, true progress in this area should stem from a genuine commitment to the well-being of individuals.

He highlighted that value creation in organisations starts with internal practices. In the private sector, profitability is essential, but it should not come at the expense of the workforce. A productive workforce is crucial for profitability, and it’s important to ensure that gains from productivity are shared fairly with employees. He cited the apparel industry as an example, where a significant portion of the workforce is female. In this sector, enhancing productivity through automation and digitalisation is critical, but it must be balanced with fair reward systems and continuous improvement initiatives.

Addressing the broader impact, Premarathna stressed the importance of extending benefits beyond the organisation to the surrounding community. For companies involved in export markets, such as those in the apparel industry, demonstrating commitment to community welfare is crucial for building brand loyalty and market presence. He outlined how companies like Brandix connect with local communities, ensuring resources are shared equitably and supporting essential services like schools and water supply.

He concluded with the observation that by fostering a supportive relationship with the community, companies not only enhance their market access and customer loyalty but also contribute to overall brand growth. Additionally, engaging in these social initiatives can improve financing opportunities, as sustainability efforts are increasingly recognised and valued by investors.

Technical Session ‘G’

NSB Chairman Dr Harsha Cabral delivered a compelling keynote address to commence the ‘G’ Session, tracing the evolution of corporate responsibility from its origins to its current significance. He highlighted the historical neglect of Corporate Social Responsibility (CSR), noting that it was virtually nonexistent in earlier business practices. Reflecting on historical examples like the British introduction of tea plantations and early American presidents who owned slaves, Dr Cabral illustrated how businesses once ignored societal impacts. He emphasised that CSR has since become integral to modern business, with companies now expected to contribute positively beyond their core operations, citing initiatives such as Otara Gunewardene’s Embark project, which cares for stray dogs, as evidence of CSR’s expansion into diverse social and environmental efforts.

Dr Cabral introduced the core principles of CSR, known as the 3 P’s: People, Profit, and Planet. These principles advocate for a balance between profit-making and contributions to societal well-being and environmental protection. He explained that these principles form the foundation of ESG (Environmental, Social, and Governance) frameworks, which emphasise the importance of effective governance. He praised the progress made by companies in Sri Lanka, citing examples such as NSB’s comprehensive ESG statements. These reports cover a range of metrics, including carbon footprints, waste management, and employee diversity, showcasing the company’s commitment to responsible practices.

In his conclusion, Dr Cabral urged companies to adopt ESG principles not just to comply with regulations but to genuinely enhance their societal impact. Drawing on a quote from his father, a traditional schoolmaster, he reminded the audience that “It takes 30-40 years to build a good reputation, but only five minutes to lose it. This underscores the importance of consistent and sincere corporate practices,” he remarked.

Senior Professor Ajith de Alwis of the University of Moratuwa highlighted the crucial role of governance in today’s business landscape, accentuating a significant shift towards a broader stakeholder perspective. He underlined the complexity of aligning corporate practices with Environmental, Social, and Governance (ESG) standards, noting that merely presenting a facade of compliance is no longer sufficient. He pointed out that despite global promises, the trajectory to limit temperature rise to 1.5 degrees Celsius is in jeopardy, with current trends suggesting a rise of over 2 degrees. This situation calls for a serious commitment to ESG principles, moving beyond mere profit motives to genuinely address environmental and societal challenges.

Moderator Swisstek Aluminium Ltd. Director/CEO and MBA Alumni Association Treasurer Dr Tharindu Atapattu addressed SLYCAN Trust Director Research and Knowledge Management Dennis Mombauer, to highlight how companies, both large and small, have benefited from incorporating corporate governance into their business models. Mombauer noted that many medium and small-sized businesses have found it advantageous to integrate governance practices not just as CSR measures but as core components of their strategies.

He provided examples of companies in the fashion and garment sectors that have adopted sustainability measures, gaining a competitive edge in accessing export markets. He also pointed to opportunities in the tourism sector, where Sri Lanka’s rich natural resources can be leveraged for eco-friendly and sustainable tourism, which helps offset carbon emissions through natural ecosystems.

Mombauer emphasised the importance of leadership in implementing these practices, recommending that companies either include board members with expertise in sustainability or establish advisory boards to provide the necessary guidance. Furthermore, he stressed the value of collecting and utilising data related to sustainability and emissions, which can inform investment in technology and process optimisation, aligning business practices with broader environmental goals and market opportunities.

Sustainable Energy Authority Sri Lanka Chairman Eng. Ranjith Sepala asserted the importance of good corporate governance practices in promoting sustainable energy and improving performance. He highlighted that governance in the energy sector needs to be dynamic and adaptable to changing strategies, particularly as the goal shifts towards carbon neutrality.

Sepala outlined the key governance practices essential for achieving these goals, emphasising the need for a strategic approach to transitioning towards renewable energy. He noted that Sri Lanka aims to have 70% of its electricity generation from renewable sources by 2030. To achieve this, companies must adhere to governance principles that include transparency, cost-effectiveness, and flexibility.

He stressed that while cost efficiency is crucial, decisions must be made based on the context and conditions, such as opting for fixed prices or negotiating deals when necessary. The overarching goal is to provide low-cost, affordable, and sustainable energy while meeting carbon neutrality targets. Additionally, Sepala highlighted the importance of integrating various factors, such as fulfilling people’s requirements and ensuring energy security, into the governance framework to support these objectives effectively.

Sustainable Financing Panel

Commencing the Panel on Sustainable Financing, keynote speaker HSBC – Asia Pacific Head of Sustainability Sunil Veetil shared insights on the practicalities of executing and financing sustainability initiatives. The discussion, which had delved into theoretical concepts and frameworks, shifted focus to real-world applications and financial commitments. Operating in 17 to 19 countries across Asia Pacific, HSBC has pledged to invest between $ 750 billion and $ 1 trillion in sustainable projects by 2030, reflecting a global commitment to addressing climate challenges.

Veetil emphasised Asia Pacific’s major role in global emissions, accounting for 50% with projections rising to 55-57% in the next five to ten years. He pointed out that China’s strategy of ramping up emissions until 2030 before aiming for carbon neutrality by 2060 contributes significantly to this increase.

A key opportunity lies in transitioning the transportation sector, which requires $ 4-5 trillion over the next five years, alongside significant potential in the power sector and retrofitting buildings that account for 34% of global emissions. Financing these efforts demands collaboration between governments, banks, and other financial partners. The evolving regulatory landscape, including new sustainability reporting requirements starting in 2025, will further drive change, with European regulations also affecting Sri Lankan companies engaged with European stakeholders.

HSBC’s strategy for addressing emissions and sustainability focuses on three main areas: helping major emitters reduce their emissions by transitioning to renewable energy, enhancing supply chain sustainability with examples like Walmart’s initiative to cut one gigaton of carbon, and supporting emerging sectors such as renewables, hydrogen, and carbon capture through venture capital and infrastructure financing. He highlighted that Sri Lanka could benefit significantly from improvements in supply chain sustainability and new economic infrastructure, aligning with current government discussions.

In conclusion, Veetil emphasised the importance of collaboration, effective regulation, and viewing ESG strategies as a competitive edge. HSBC’s engagement with 1,500 major clients showed that sustainable practices are increasingly seen as a strategic advantage, offering potential for greater market share and profitability.

Moderator HSBC Sri Lanka and Maldives Head of Communications Tharanga Gunasekera opened the panel by addressing the importance of sustainable financing for each corporation and seeking their perspectives on the transition.

Colombo Stock Exchange CEO Rajeeva Bandaranaike, in response to the challenges surrounding capital flow for the transition, detailed how the CSE plans to manage these issues. He outlined the exchange’s efforts to support green financing and emphasised that the CSE aims to complement existing green financing initiatives rather than replace them. Recently, the exchange introduced frameworks and regulations for green, blue, and sustainability bonds.

To issue a green bond, companies must adhere to global standards such as those from the International Capital Markets Association, the European Green Bond Standard, or the Climate Bonds Initiative. They must also secure an independent verification statement to ensure transparency and credibility, and to prevent greenwashing. The CSE is actively working with prospective issuers and international agencies like the IFC and ADB, which have shown considerable interest. This positive engagement underscores the growing enthusiasm for green financing in Sri Lanka.

DIMO CFO/Executive Director Suresh Gooneratne emphasised the shift from voluntary to regulatory approaches in sustainability reporting, highlighting that new accounting standards, such as IFRS S1 and S2, now require companies to report and manage sustainability issues in relation to shareholder value. This transition demands a robust governance structure, integration of financial and non-financial indicators, and stringent oversight—challenges that are particularly daunting for smaller companies.

Gooneratne highlighted the need for significant organisational changes as companies shift from management systems to board-driven governance. He also pointed out the substantial funding required for climate mitigation, adaptation, and structural changes. While acknowledging the support from banks and financial institutions, he urged companies to independently weave sustainability into their core strategies and financial plans, stressing the importance of proactive planning and adaptation to meet regulatory requirements and achieve long-term sustainability goals.

Alliance Finance Company PLC Managing Director Romani De Silva stressed the challenges in the NBFI sector regarding sustainability. He noted that ESG principles often seem investor-driven rather than being internalised within organisations, which limits their effectiveness. He emphasised that true progress in sustainability comes from within institutions, citing past global efforts that failed due to lack of internal commitment.

Alliance Finance began its ESG journey with a people-focused approach in 1956 and formally adopted a triple bottom line strategy in 2012. After testing various frameworks, the company helped develop a holistic sustainability standard in 2017 that includes both environmental and social pillars. Mr De Silva called for a comprehensive triple bottom line taxonomy in Sri Lanka, integrating social aspects with environmental goals, and highlighted their achievement of planting 765,000 trees over the past five years. He stressed the need for policymakers and educators to embrace holistic sustainability for lasting impact.

Teejay Lanka PLC Chief Operating Officer Salman Nishtar shared insights into how the company is addressing ESG challenges. Teejay Lanka, which works with international clients, established an ESG committee to align with various customer requirements and strategic targets for 2030 and 2050. Initially, outcomes were limited, prompting the company to collaborate with consultants and refine its goals. The company adopted a three-year plan to allow for adjustments and focused on two main areas: energy consumption and emissions.

Teejay Lanka has implemented renewable energy solutions, including solar power, and is exploring biomass and hydrogen to achieve net-zero emissions by 2050. Efficiency improvements are a key focus, with IoT systems now monitoring energy and water consumption on machinery to enhance operational efficiency. The company’s commitment extends from top management and aligns with customer expectations, aiming for a 42% reduction in emissions by 2030 through sustainable and renewable energy initiatives.

Conclusion

The ESG Summit provided a vital platform for advancing Sri Lanka’s commitment to sustainable development. The discussions underscored the importance of integrating ESG principles into business strategies and highlighted the urgent need for collective action in addressing climate change and promoting social equity. With a clear focus on innovation and collaboration, the summit emphasised the crucial role of both the public and private sectors in achieving a sustainable future for Sri Lanka.

HSBC was the strategic partner of the Summit and Silver sponsors were A. Baur & Co. and LTL Holdings.