Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 14 November 2018 00:00 - - {{hitsCtrl.values.hits}}

By R. Ratnayeke, MBA

With the new jazzy goings-on with zero thought to the fundamental rights of the voter, and with us now in the midst of a colour-war carnival on the trading floor, it seems an appropriate time to pen a few words.

|

The economic understanding of the general public in our country leaves a lot to be desired – Pic by Shehan Gunasekara |

It began for me when I received a message via a WhatsApp group, by an excited friend. It read “just got the following from the news: prices of sugar, petrol, dhal etc. have been reduced by Rs. 5, all around. Taxes reduced on FDs and professional taxes reduced.” The excitement went viral.

Interestingly, the majority of folk in this WhatsApp thread were mostly non-professionals, who used small fuel-efficient cars to get around, and only few times a week at that. They had previously discussed not cooking Mysore dhal too often, and how they hardly ever encouraged sugar in their homes for the fear of ending up with diabetes, and through many a discussion it was also evident that the group seemed to have little or no real knowledge or awareness of financial investments. So what was it about these attention-grabbing rumours that made this specific segment of people so happy?

It made me reflect on something that happened a few weeks previously. I was with a group of friends enjoying a scrumptious buffet lunch at a south Colombo hotel, when we spotted the CBSL Governor at a table by himself quietly enjoying lunch. The poor man’s peaceful Sunday lunch was interrupted when we went over to speak with him briefly. Fortunately, he enjoyed the banter and didn’t seem to mind the barrage of questions coming his way.

Of everything he graciously spoke about, one thing he said stuck in my mind quite clearly. ‘Sri Lankans are not economically savvy,’ were those words. Sure, we aren’t the most scholarly of nations, but as adults aren’t we compelled to make economic decisions every single day of our lives. So how could these words reflect our people?

I decided to do some further research, as I read the ‘Hastily delivered midnight goodies which will derail budget’ article in the Daily FT, published a few days ago.

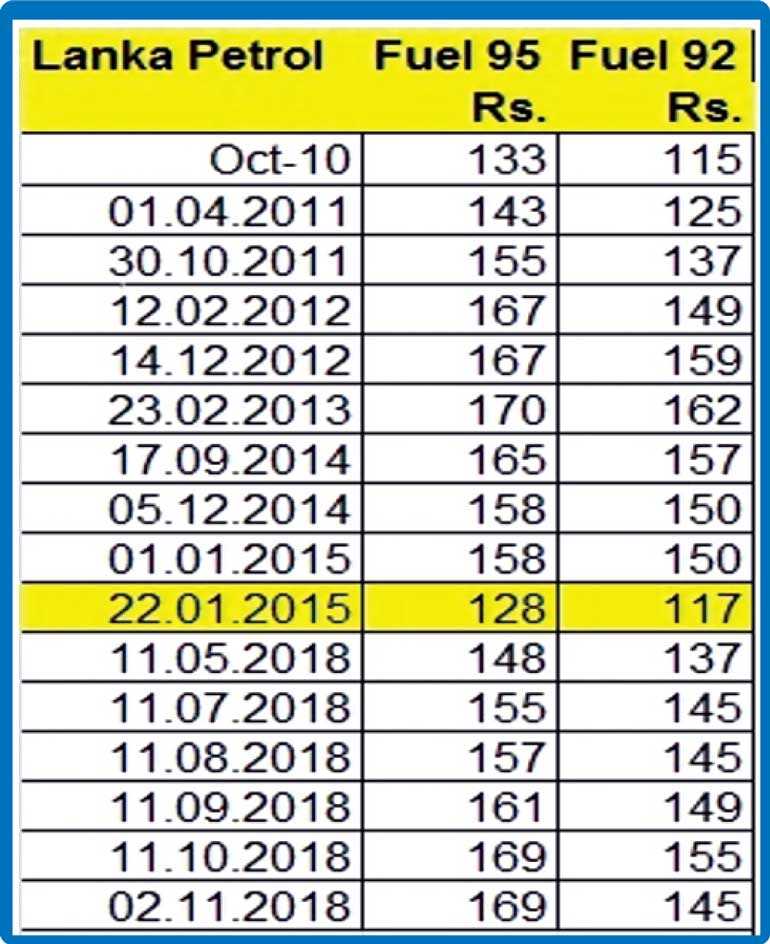

I discovered some very enlightening details about fuel fluctuation statistics, which I would like to recollect for you as we tend to forget. The chart shows eight years of petrol price changes we have seen and lived with. (http://ceypetco.gov.lk/historical-prices/)

The first column shows Petrol ‘95’ which is a popular choice that promises to give your vehicle quality and better performance. The second column shows fuel ‘92’ pricing, which is the preferred choice of three-wheeler owners, and those who struggle with pricing hikes they complained about in the last four years.

The chart actually depicts that if one person used 100 litres a month of ‘95’ fuel, they would have saved a minimum of Rs. 168k, compared to the previous four years. And a ‘92’ fuel user would have saved a minimum of Rs. 123k during the same time. Important to note, this saving is just on 100 litres a month. At most, noteworthy part is the low prices were held static for 39 months in the last four years. That is a record. But we didn’t realise.

The front page of the paper also shows further figures. Share market net outflow in four days last week was Rs. 4 billion, compared to Rs. 6 billion, 270 days up to September this year.

It also goes on to show the recovery of the Rs. 75 billion tax revenue loss. Or the yield of the $1 billion International Sovereign bond maturing that would spike due to risk association.

Now if this sounds like jargon to you, it might be unnerving to learn that certain authorities on life matters, if honest, will tell you that the economic understanding of the general public in our country leaves a lot to be desired.

But why do you need to worry, I hear you ask, when glamorised gossip reassures you that the public need not worry about any of this, as this week has seen the printing of new money to the value of $ 650 million, and that sounds much more comforting to you. Money printed to apparently pay for immediate losses. What timely and convenient planning it all seems to be. To break this down to you, that is an amount of almost a 250% increase from figures seen last year.

Are most of us familiar with the concepts and figures mentioned just above? If you are not, you are in the normal range of most Sri Lankan adults. The kind of adults who are quick to show excitement when we receive a social media forward of illusory price-cuts.

That is why it is that whilst we are aware of being manipulated when we shop and see price cuts everywhere at shopping malls and super markets, and find it unsettling to see the true extent of mind games being played on us through price cuts, which are essentially marketing tricks, manipulation and decoys, the population of this country don’t feel the same when it comes to gossip being fed about the economy of our own country.

Why aren’t we more economically savvy, Sri Lankans? Remember, it is easy to target masses of people who are gullible and ill-informed, and confuse them by simply making financial statements that most do not understand.

Everyone would be wise to learn more about economics. Every part of money management from the household, to small businesses, to the government is based upon economic models. Knowing economics would give us a much better ability to take in information and assess the facts. It should also motivate us to equip your children with that knowledge, so they too know the jazz from the waltz.

Bless our beautiful country.