Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 25 October 2021 00:00 - - {{hitsCtrl.values.hits}}

The landscape for the Port City has undergone notable changes since the initial assessment of its economic impact by PwC Sri Lanka in early 2020, the most significant of which is the enactment of the Colombo Port City Economic Commission Act, No. 11 of 2021 which recognises the Port City as a multi-services Special Economic Zone.

The landscape for the Port City has undergone notable changes since the initial assessment of its economic impact by PwC Sri Lanka in early 2020, the most significant of which is the enactment of the Colombo Port City Economic Commission Act, No. 11 of 2021 which recognises the Port City as a multi-services Special Economic Zone.

As such, a comprehensive update has been undertaken to incorporate the effects of the newly-enacted legislation as well CHEC Port City Colombo’s ‘Five-Year Plot Rollout Strategy’ and a revision of the Master Plan to 6.3 million sqm of Gross Floor Area (compared to 5.7 million sqm used previously).

The Act provides for a number of measures that bolster ease of doing business within the Area of Authority with regard to setting up a business, obtaining building permits and approvals, employing workers and enforcing contracts which are crucial to achieve the objective of being a home for exporters of modern services such as information communication technology, maritime services, offshore banking and financial services, professional services and regional headquarters.

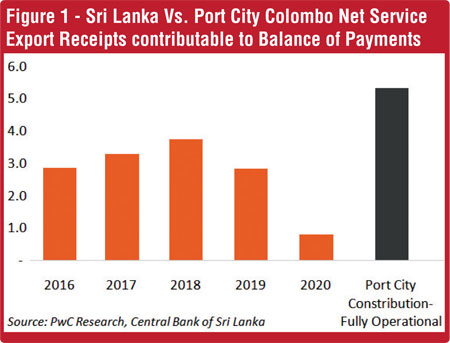

As per PwC estimates, these modern services could create up to $ 9 b of economic value addition to GDP and have a significant positive effect of $ 5.3 b to the Balance of Payments from service exports foreign earnings receipts annually, once the Port City reaches its full potential. The commercial sector is expected to create over 100,000 direct employment opportunities upon completion of the Port City Colombo.

As a lifestyle destination, Port City could rejuvenate Colombo’s appeal as a destination for city tourism similar to regional capitals such as Bangkok, Kuala Lumpur and Singapore by leveraging on attractions such as a luxury yacht marina, a world-class integrated resort, high-end retail malls and an international convention and exhibition centre to attract high value travellers.

Tourism, retail, and leisure activities are estimated to generate up to $ 1.8 b of direct economic value annually and provide 39,000 direct employment opportunities. Also noteworthy is the indirect contribution made by this sector that could amount to $ 850 m per annum via local supply chain.

The Special Economic Zone legislation also seeks to provide concessions to investors, with an expected $ 12.7 b to be attracted from the realization of value from land plots and construction activities that would be required to develop the 2.7 sqkm extension of the Central Business District of Colombo.

A clear beneficiary of this FDI would be the construction sector, where $ 8.7 b of investment is expected, leading to the creation of over 340,000 direct employment opportunities during the envisaged completion period of 20 years.

The analysis indicates that Sri Lanka stands to benefit by the Port City project, provided construction and operational stages proceed as planned and are well integrated with the local economy. A clear indication of this is that ~45-50% of the total value addition to the Sri Lankan economy is expected to accrue indirectly i.e. through procurement of construction material locally, expatriate and tourist spending across Sri Lanka and services rendered by local firms to occupiers of the Port City.

A detailed report that evaluates the economic impact of the Port City in light of CHEC Port City’s ‘Five Year Plot Rollout Strategy’ is due to be published shortly via PwC Sri Lanka’s website and social media platforms.