Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 21 August 2019 00:00 - - {{hitsCtrl.values.hits}}

US stocks plunge on fears of an economic downturn

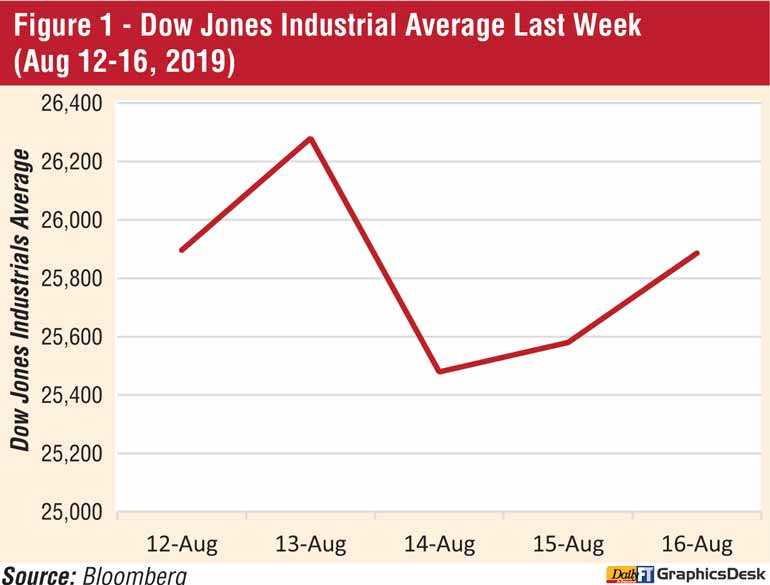

Last week’s turbulence in financial markets was a reaction to the fresh evidence of a possible recession in the US economy. The Dow Jones Industrials Average dropped a whopping 800 points or 3% last Wednesday, bringing the worst one-day decline this year (see Figure 1). By the end of the week, the US stock market had declined 1.7%.

Yield curve inversion signals a possible recession

What is behind this stock market decline? The essential information revealed last week was the inversion of the US Treasury yield curve, a tell-tale signal of oncoming recessions. A recession is defined as decline in GDP growth in two consecutive quarters.

To understand this recession signal from the bond market, it is important to know what bond yields and yield curves mean. Bond yield represents the expected rate of return to the investor from investing in a bond. The yield curve is a graph of bond yields at different maturities which typically range from one to 30 years. Under normal economic conditions, when the economy is expanding, long-term yields are higher than short-term yields demonstrated by an upward sloping curve. This higher yield for long-term bonds reflects the compensation investors receive for higher risk. On the other hand, if long-term yields are lower than short-term yields across maturities, the yield curve takes a downward sloping pattern. Such a pattern is described as an inverted yield curve.

Yields have declined across maturities

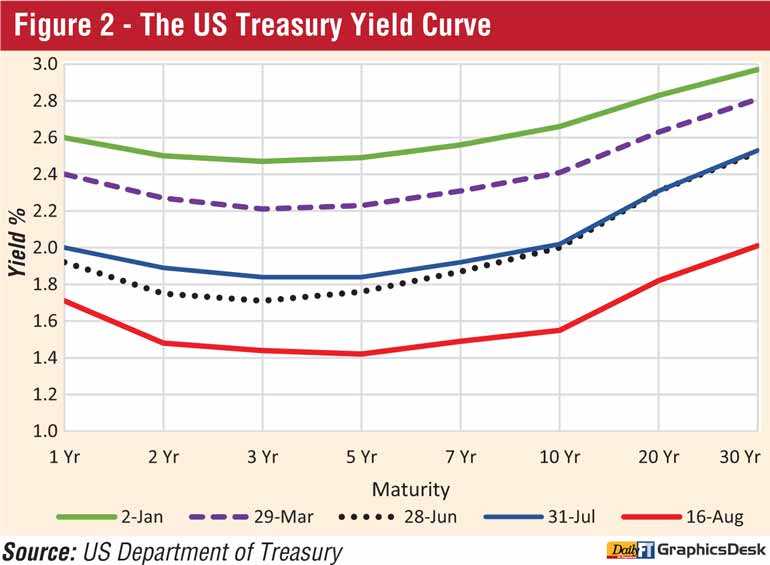

Let’s take a look at the yield curve for US Government bonds. Figure 2 plots the yield curve on bonds with one to 30-year maturities. Between January and August, the curve has progressively inverted. In January, the yield curve was inverted between one and three-year bonds. By August, the yield curve had inverted between one and five-year bonds. The turn of the yield curve between January and August traces a story of increasing pessimism of future economic conditions.

Further, the chart clearly shows that after the 0.25% interest rates cut by the Federal Reserve Bank on 31 July 2019, the interest rates on all maturities have declined in the range of 0.30% to 0.40%. These lower yields across the board show the expectations for lower inflation and lower growth in the US economy.

Long-term yield dropped below short-term yield

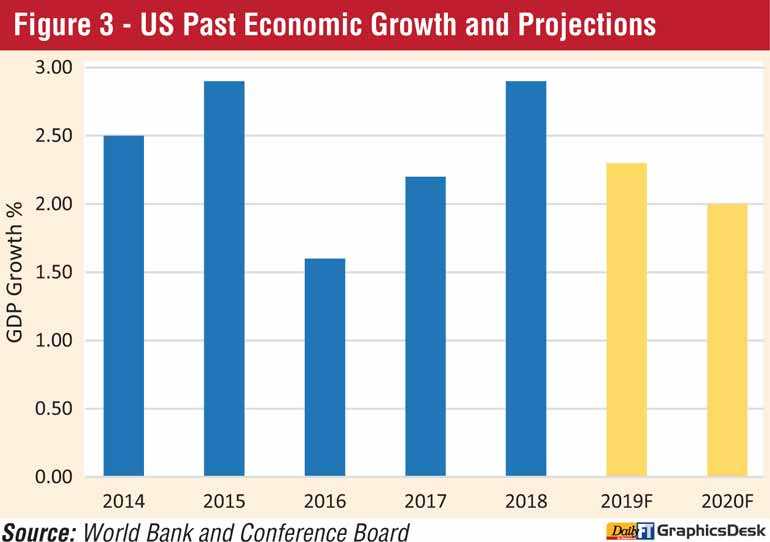

On the morning of 14 August, 2019 the yield on 10-year treasury bonds briefly dipped below the yield on two-year bonds. In more simple terms, the yield on two specific bond maturities inverted. In practice, this means that investors earn a higher return for lending money to the US for a period of two years than lending for 10 years. This is not normal and implies that investors are becoming pessimistic about future economic conditions. The US economy grew at 2.9% in 2018. According to Conference Board, the US growth is projected to decline to 2.3% in 2019 and 2.0% in 2020 (See Figure 3).

Since the markets have focused on the 10-year vs. 2-year yields, it is worth pointing out that on Aug 14, the 10-year yield ended at 1.59% vs. the 2-year yield of 1.58%. That means the 10-year was just 0.01% or one basis point above the 2-year yield. The 10-year Treasury bond is considered the benchmark for long-term interest rates in the US economy.

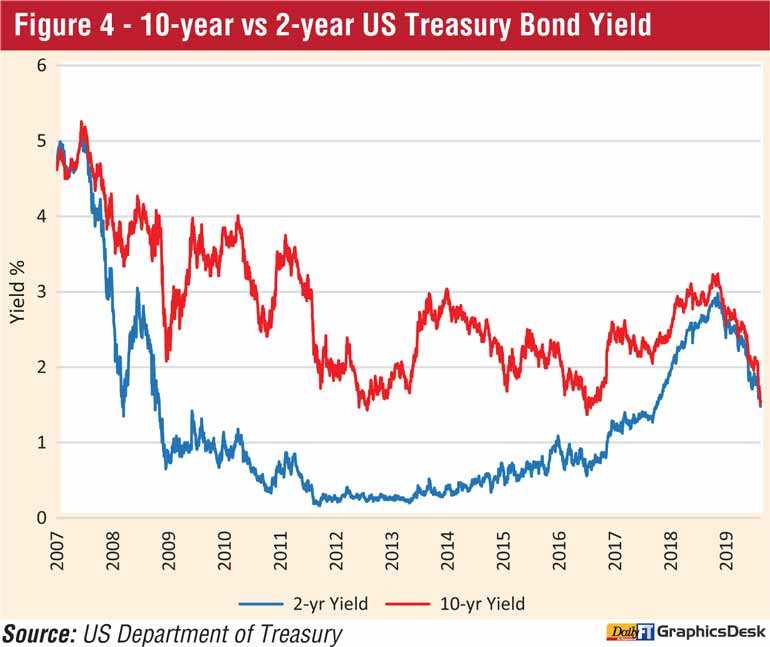

The yield between long-term and short-term bonds has been narrowing since the global recovery from the 2008 financial crisis. Figure 4 shows the spread between the 10-year and 2-year bond yields since 2007. First, it shows the collapse of bond yields during the 2008 financial crisis and the lower interest rates following the crisis in the past 10 years. Second, the spread between the two mantuaries started to narrow significantly since around mid-2018, indicating increased concerns about the economy over the past 12 months.

Bond yields essentially represent interest rates on bond investments. Since interest rates reflect expectations for future inflation and economic growth, signs of lower growth tend to push interest rates lower. Ultimately, longer-term rates could fall below shorter-term rates resulting in a downward sloping yield curve or an inverted yield curve. An inverted yield curve is often followed by an economic downturn or a recession with a time lag. On average, yield curves have inverted 16 months before the last five US recessions.

Why would investors settle for a lower return on long-term bonds?

This is because investors think they can earn a higher return by buying long-term bonds than short-term bonds. First, because of an impending recession, the Federal Reserve might cut short-term interest rates further lowering bond yields across all maturities. Therefore, the current long-term yields are seen as better than possibly lower long-term yields later. This forces higher demand for long-term bonds pushing up their prices. When prices rise yield falls.

Second, as the Fed lowers the short-term interest rate further, investors in short-term bonds will have to reinvest their maturing bonds into even lower yielding bonds. It would then make more sense to lock into the existing longer-dated bonds rather than having to rollover into lower yielding bonds in the future. As a result, the demand for short-term bonds falls, leading to lower prices and high yields. This causes the short-term yields to go up above the long-term yields thereby inverting the yield curve.

Yield inversions have predicted past recessions

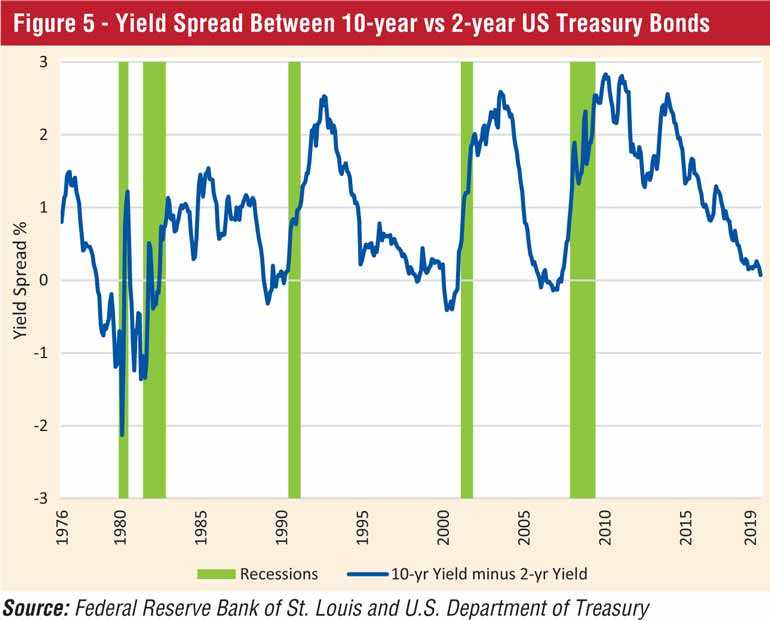

The yield curve has predicted the last five US recessions. The10-year vs. two-year yield inverted as early as December 2005 which was 23 months before the start of the recession in December 2007 and 32 months before the US financial crisis that began in September 2008. The recession lasted for 18 months from December 2007 to June 2009. In fact, the yield curve inverted before each of the last five US recessions in 1980, 1981, 1990, 2001 and 2007.

Figure 5 shows that the difference between the 10-year and two-year US Treasury bond yield and the periods of recessions. The yield difference or spread turned negative, meaning that the 10-year yield dropped below the two-year yield before each recession. However, such a recession does not happen right away. The yield inverted between 10 to 23 months before the last five recessions with an average 16 months between inversion and recession.

The market psychology seems to have turned negative

Yield inversion happened for a brief time last Wednesday, and the 10-year bond yield recovered to close above the two-year bond yield on that day. In fact, on a daily basis, the yield spread has not turned negative. Yet, investors reacted very negatively to the intra-day yield inversion.

This reaction amply demonstrates the investor concerns about the economic outlook. The US stock market has been in record territory and unemployment is historically low at 3.7%. The current economic expansion which began in July 2009 is now more than 10 years old. Consumer spending is strong. So how long will the good times last?

As stated earlier, the yield difference is so small that it can turn negative anytime catalysed by the next batch of bad news on the US or the world economy, the US-China trade dispute or geo-political developments. In such a scenario, investors worry that the stock market could decline further, weakening business investments, consumer sentiment and aggregate demand, ultimately leading to a contraction of the economy.

Possible implications for Sri Lanka

It is pertinent that monetary and fiscal policymakers analyse the potential economic consequences carried by a US recession and global slowdown. At a minimum, analysis of the experience during the 2008/2009 global financial crisis and the US recession will provide useful indications of potential economic impact for Sri Lanka. One should, however, keep in mind that the economic performance of 2009 was also influenced by the last stages of the Civil War, which ended in May 2009. Nevertheless, such an analysis will help design possible monetary and fiscal responses under alternative scenarios. Such a detailed analysis is not attempted here. Rather, the key areas of economic implications will be discussed briefly.

Sri Lanka is already facing a subdued growth environment. After recording a 3.2% GDP growth in 2018, growth is expected to slow down to 3% or below in 2019 largely due to the economic impact of the Easter Sunday bomb attacks. It is in this context, that one would have to assess the implications of a potential US recession and a global slowdown on the Sri Lankan economy.

An US recession combined with a worldwide economic downturn could cause a decline in demand for Sri Lanka’s exports. This will likely lower domestic economic activity which is already predicted to decline. Lower domestic economic activity could further dampen aggregate demand by reducing domestic demand, leading to reduced demand for imports as well. Thus, Sri Lanka’s export as well as import growth could slow leading to a narrower trade balance. As a point of reference, during the last US recession in 2009, Sri Lanka’s exports declined by 13%, imports fell by 28% and, as a result, the trade balance shrank by 48%.

Tourism is a key component of the balance of payments of Sri Lanka since it is the largest contributor to the services account. A global slowdown will likely cause people to be more cautious about discretionary spending on leisure leading to a decline in tourism earnings. Sri Lanka has already experienced a decline following the Easter Sunday attacks, with tourism earnings dropping by 19% in dollar terms the first seven months of 2019.

Workers’ remittances are the largest contributor to the income account of the balance of payments of Sri Lanka. A global economic slowdown could dampen the demand for foreign workers. Growth in workers’ remittances has exhibited a secular downturn and growth has already declined by about 10% in the first half of 2019. The growth in remittances slowed down in 2009 as well.

Lower economic activity could widen the budget deficit due to the fall in tax revenue. Any fiscal stimulus programs implemented by the government in order to mitigate the impact of a downturn will lead to higher government expenditure. As stated earlier, the expected lower domestic growth combined with a global slowdown could result in a 2019 budget deficit larger than the target of 4.4%.

In a global economic downturn, foreign investments abroad also tend to decline due to a decreased appetite for making new equity investments and lending funds to foreign enterprises. This means potential decline in new foreign direct investments (FDI) to Sri Lanka. Those investors who have already been approved and are committed may also postpone their investments until they see better global economic conditions or might face difficulties in obtaining the necessary capital. It is worth noting that FDI flows to Sri Lanka fell by 44% in 2009.

Foreign capital inflows to government securities could also accelerate if foreign portfolio investors see opportunities to pick up extra return by investing in emerging markets. Interest rates worldwide are likely to be lower as more and more central banks start cutting rates in order to mitigate against potential economic slowdown due to the slowdown in the US and world growth. This might result in further shrinking of interest rate differentials between emerging markets and the US. Despite narrowing interest rate differentials, however, some foreign portfolio investors will look for countries to earn a higher yield than what is available in the West.

If Sri Lanka maintains a higher inflation-adjusted return in dollar terms on government securities, then we might see more foreign capital flow into government securities. During the last US recession in 2009, Sri Lanka received a record level of 1,369 million dollars of net foreign inflows into government securities. In addition to attractive interest rates offered by government securities, this sharp increase of inflows was also influenced by the peaceful environment after the end of war in May 2009, the political stability and improvement of macro fundamentals.

However, the attractiveness of Sri Lankan Government securities to foreign investor is predicated on Sri Lanka maintaining a fairly stable political and macro environment. The upcoming election cycle and the expected slower growth due to the impact from Easter Sunday bomb attacks are factors that might increase the risk premium on Sri Lanka in the global financial markets.

Even in a US downturn scenario, the US stock markets might still be considered relatively attractive since stock markets in emerging markets are likely to be affected by slower growth in their economies. A significant correction and volatility in the US stock market will also cause declines in stock markets worldwide. If US stocks suffer a correction, they might be considered attractive from a valuation standpoint as well.

In such a situation, equity capital flows might in fact reverse from emerging markets. Sri Lanka’s stocks are already attractive in terms of valuation multiples, and its ability to attract more foreign flows will depend on the domestic political stability and better economic prospects. Net equity flows to the Colombo Stock Exchange declined by 32% during the last US recession in 2009.

The impact on the exchange rate critically depends on the behaviour of all the factors above. Sri Lankan rupee has appreciated by 3.2% against the US dollar so far this year. Due to lower interest rates and growth, the US dollar’s strength might dampen if not weaken. In the best-case scenario, increased capital flows into government securities and a narrow trade balance could mitigate against a possible drop in tourism earnings and remittances. This will support the stability of the Sri Lankan rupee. In the worst-case scenario, increased political and macroeconomic risks in the country will lead to further acceleration of net capital outflows and depreciation of the currency above the depreciation rate of 4.5% observed in the last 10 years.

A lower world interest rate environment will lower external borrowing costs for Sri Lanka. The country’s external debt service liabilities are estimated to be $ 6,071, 5,499 and 5,520 million in 2020, 2021 and 2022 respectively. The Government will need to borrow from abroad in order to service some of these foreign debts. However, the ability to lower borrowing costs will be influenced by the country risk premium demanded by lenders. Any deterioration of political and macroeconomic stability will likely increase the risk premium and negate any advantage brought by lower interest rates.

It is prudent to analyse potential economic and financial effects of a global slowdown for Sri Lanka and map out possible monetary and fiscal interventions ahead of time.

(Lalith Samarakoon is a Professor of Finance and Financial Economist. He serves as the Secretary-General and Chief Economist of the National Economic Council of Sri Lanka. Follow Perspective at www.lalithsamarakoon.com and Twitter @LSamarakoon. Email feedback and comments at [email protected].)